Public Employee Financial Protection Plan

Prudential Group Voluntary Term Life Insurance Program

NCPERS offers a supplementary survivor's benefit and insurance program to enhance the financial security of the members of its participating retirement systems. It has paid $105 million in benefits to members over the past 40+ years.

The plan is uniquely designed to augment your retirement system's survivor benefits to maximize the security when it is needed the most. While some members may not need the coverage those who do, may need it badly.

The plan is specially designed for retirement systems, to be offered to eligible members regardless of their health conditions, without any enrollment participation requirements (those active members that want it are assured of getting it), and they can carry this benefit into retirement. Most group life insurance benefits stop or are reduced at retirement. This plan may be continued for life at retirement.

This plan also offers a unique student loan benefit. For members age 45 and under, Prudential will reimburse the amount of Student Loans members owe up to a maximum of $50,000, should the member become totally disabled and have an outstanding student loan balance.

The plan is available to retirement systems with options for either payroll deduction or direct billing to the member's home. The plan is well designed and financially sound, with the plan reserves committed to maximize benefits to participants. Coverage is issued by The Prudential Insurance Company of America (Prudential).

Retirement Systems: Apply Here

For questions about the NCPERS Life Plan administration information including life insurance claims, coverage amounts, beneficiary issues and address changes, please contact the Plan's administrator Member Benefits, Inc. at 1-800-525-8056 or ncpers@memberbenefits.com.

For more information about offering this for your retirement plan or to receive a written proposal, please contact the Gallagher team at GBS.COAZ.NCPERS@ajg.com.

NCPERS offers a supplementary survivor's benefit and insurance program to enhance the financial security of the members of its participating retirement systems. It has paid $105 million in benefits to members over the past 40+ years.

Custom Designed

The plan is uniquely designed to augment your retirement system's survivor benefits to maximize the security when it is needed the most. While some members may not need the coverage those who do, may need it badly.

Voluntary

Retirement systems have found that it is better to offer voluntary supplemental benefits, than to increase the survivor benefits that apply to all members.

Benefits for Life

Most group life insurance benefits stop or are reduced at retirement. This plan may be continued for life at retirement.

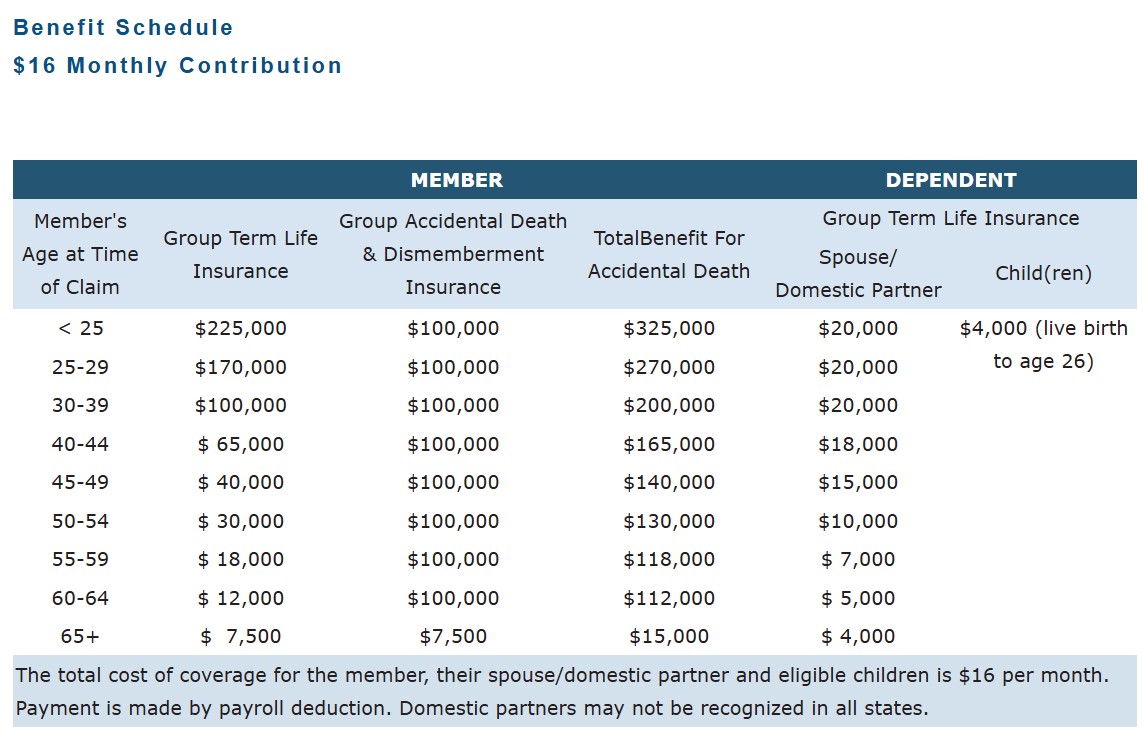

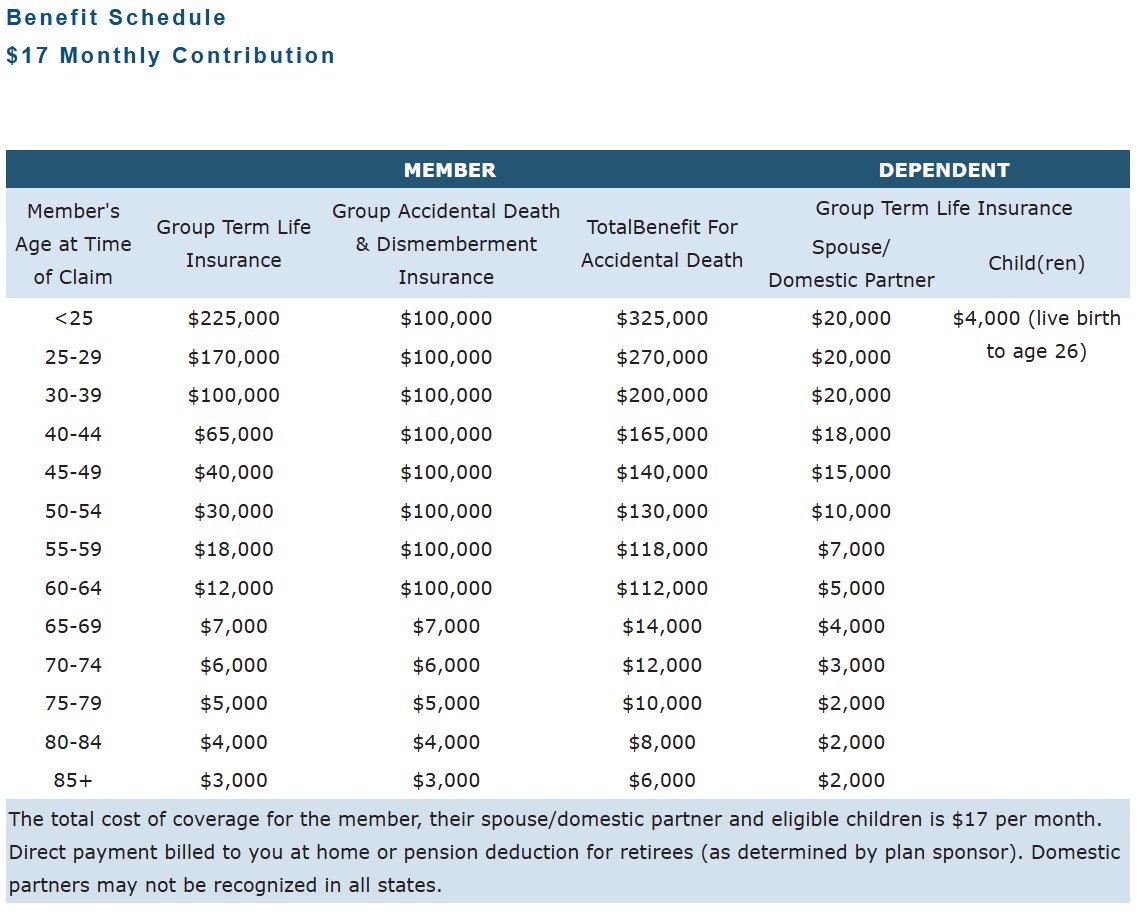

The NCPERS life insurance plan offers public sector employees and retirees an affordable and flexible way to protect their loved ones. With over 75,000 enrollees, this voluntary program provides coverage without requiring medical proof of insurability during initial eligibility periods. Members can opt-in within 90 days of hire or during open enrollment. The plan offers comprehensive benefits, including automatic coverage for spouses and dependent children, Accidental Death & Dismemberment (AD&D) protection, and even student loan repayment for members under 45 in case of total disability. Death benefits are payable through various settlement options, giving beneficiaries financial flexibility.

Sponsored by NCPERS and administered by Prudential, this plan ensures financial security for public employees and their families.

KEY FACTS

- The Plan is completely voluntary.

- There are currently more than 75,000 enrollees in the Plan.

- Eligible members may join within 90 days of hire (or effective date of membership with the retirement system) or at open enrollment, without medical proof of insurability.

- The Plan will pay its benefit in addition to other insurance plans.

- The member can terminate benefits at any time by stopping the monthly contributions.

- Subject to applicable state law, Prudential’s Alliance Account® is the standard settlement option for death benefits of $5,000 or more. 1 We will establish an interest-bearing account in the beneficiary’s name. Beneficiaries earn interest as long as the account remains open. They can withdraw the full amount immediately, write drafts 2 against the balance, or leave the funds in the account to collect interest. For death benefits of less than $5,000, claims will be settled via a lump sum check.

- The following settlement and payment options are available as an alternative to the Alliance Account:

- Lump Sum: The beneficiary may receive the full death benefit in a single lump sum check.

- Payment for a Fixed Period: The death benefit plus interest may be paid over a fixed number of years (1 to 25) either monthly, quarterly, semiannually, or annually. 3

- Payment in Installments for Life: The death benefit may provide monthly payments in installments for as long as the beneficiary lives.

- Payment of a Fixed Amount: The beneficiary may choose an income payment of a stated fixed amount either monthly, quarterly, semiannually, or annually.

- Interest Income: All or part of the proceeds may be left with Prudential to earn interest, which can be paid annually, semiannually, quarterly, or monthly. The minimum deposit is $1,000

- Coverage for spouse and eligible dependent children automatically included, as well as Accidental Death and Dismemberment (AD&D) for employee/ retiree.

- At no added cost, for members age 45 and under, Prudential will reimburse the amount of Student Loans members owe up to a maximum of $50,000, should you become totally disabled and have an outstanding student loan balance.

- The Plan is administered by Member Benefits, Inc.

- The NCPERS life insurance program is sponsored by NCPERS. The life insurance program is issued by The Prudential Insurance Company of America (“Prudential”), Newark, NJ. Membership in NCPERS is required for the Program. Prudential, and not NCPERS, is solely responsible for administering the benefits under the policy. The benefits under the policy are guaranteed by Prudential’s general account and are subject to Prudential’s claims paying ability.

If interested in knowing more about the plan for your retirement system contact the Gallagher Team at GBS.COAZ.NCPERS@ajg.com.

1 Beneficiaries may wish to consult a tax advisors regarding interest earned on the account.

There are fees for special services, such as stop payment requests. Prudential’s Alliance Account is a registered trademark of The Prudential Insurance Company of America.

2 Alliance Account drafts are considered checks under federal law for certain purposes.

3 Interest rates may change.

The Bank of New York Mellon is the Administrator of the Prudential Alliance Account Settlement Option, a contractual obligation of The Prudential Insurance Company of America, located at 751 Broad Street, Newark, NJ 07102-3777. Draft clearing and processing support is provided by The Bank of New York Mellon. The Bank of New York Mellon is not a Prudential Financial company. Alliance Account balances are not insured by the Federal Deposit Insurance Corporation (FDIC). All funds are held within Prudential's general account, which is not FDIC insured because is not a bank account or bank product.

Why should a retirement system offer an insurance program?

Public employers can have diverse needs for the security of their families that may not be fully met by the pension plan and other employment benefits.

The NCPERS Life Insurance Plan is uniquely and specially designed to fill in the gaps where traditional may be insufficient, and as such can be an extremely valuable asset to retirement plan participants. The Plan provides its maximum benefits when pension survivor benefits are lowest, and coverage continues into retirement when much or all of the member and dependent group life insurance disappears.

This unique Plan is available to participating employers of retirement systems that are members of NCPERS, and is not available elsewhere.

Are the rates competitive?

The rates are based on over 40 years of favorable claims experience, backed up by the mass purchasing power of a group of 75,000 employees/ retirees. We believe that comparable benefits are not available at this price from other sources.

Is the Plan financially sound?

Yes. The coverage is fully issued by The Prudential Insurance Company of America, one of the world's largest insurance companies*. The annual NCPERS premiums paid exceed $13 million per year**.

Would the retirement plan be at risk if they sponsored the program?

No. The benefits are fully insured by The Prudential Insurance Company of America, who is solely responsible for claims payment. Plan arranged and managed by Gallagher’s Benefits & HR Consulting Division. The plan is administered by Member Benefits, Inc.

Since most of our members have access to other insurance coverages, would this Plan be of interest to them?

The Plan benefits are payable in addition to other benefits, and the design of the Plan provides maximum protection when retirement benefits are smallest. The plan also appeals to higher risk occupations such as police and fire employees.

What if an employer, union or retirement system wants to provide this coverage for all its members?

This is allowable under the Plan. All the members/employees may be automatically enrolled in the Plan, and the sponsoring organization receives a group monthly bill for the premiums.

Is the Plan subject to rate increases?

Yes. However, this has not happened in the life of the Plan. On eight occasions the benefits have been increased without a premium change. The Plan, that originally started with a $6 premium is upgraded every few years for inflation, and members are given the opportunity to upgrade to a Plan with proportionally higher benefits and premiums.

Would we need to have open bidding before adopting this Plan?

Since there is no retirement system contribution or cost, bidding is not ordinarily required. In states that require bidding regardless of cost, this Plan is often considered to be a "Sole Available Provider" Plan, and exempt from the bid process because its history and design make it difficult to duplicate.

What is the NCPERS role in this Plan?

NCPERS sponsors the Plan, and is the policyholder. Retirement systems must be an NCPERS member to participate. Since NCPERS is a non-profit organization organized to provide education and support of public employee retirement systems, it has no role in the administration or management of the NCPERS Life Insurance Plan. NCPERS is compensated solely for the use of its name, service marks and mailing lists. NCPERS exercises general oversight of the Plan, and its interest is that the Plan remains a viable and beneficial Plan for its membership, and that the logo and service marks are used tastefully and properly.

* A.M. Best has Pru at No. 4 in world’s largest insurance companies by assets. (Source: A.M. Best, January 2016.) http://www3.ambest.com/ambv/bestnews/presscontent.aspx?altsrc=14&refnum=23496

**Prudential Underwriting, 2017.

The NCPERS life insurance program is sponsored by NCPERS. The life insurance program is issued by The Prudential Insurance Company of America (“Prudential”), Newark, NJ. Membership in NCPERS is required for the Program. Prudential, and not NCPERS, is solely responsible for administering the benefits under the policy. The benefits under the policy are guaranteed by Prudential’s general account and are subject to Prudential’s claims paying ability.

Public Employee Financial Protection Plan (formerly Group Decreasing Term Life Insurance, Dependent Group Decreasing Term Life Insurance, and Accidental Death & Dismemberment Insurance) is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, New Jersey. Contract Series: 83500. This AD&D policy provides ACCIDENT insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York Department of Financial Services.

IMPORTANT NOTICE—THIS POLICY DOES NOT PROVIDE COVERAGE FOR SICKNESS. The Plan is administered by Member Benefits, Inc. and Gallagher Benefit Services, Inc. which are not affiliates of Prudential. 1024883-00002-00