Buy-Now, Pay Later (BNPL) Data Is Coming to Your Plan Members’ Credit Scores

By: Thomas M. Anichini, CFA, CFP, GuidedChoice

FICO announced it will introduce BNPL data to credit scores this fall. This announcement raises concerns about cashflow risk for members, especially for younger and lower-credit score members who might already be living paycheck to paycheck.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

Recently1 FICO announced it will introduce BNPL data to credit scores this Fall. This announcement raises concerns about cashflow risk for members, especially for younger and lower-credit score members who might already be living paycheck to paycheck.

FICO: The dominant provider of credit scores

While less visible than the Big 3 credit bureaus – Equifax, Experian, and Transunion, which collect and store consumer finance data on all of us, FICO is arguably more important. FICO is a predictive analytics and data science company.2 Among other services, FICO provides credit scoring algorithms used by the Big 3 and by lenders of all sizes.

What is BNPL?

“Buy Now, Pay Later (BNPL) is a type of installment loan that typically allows you to purchase something immediately with little or no initial payment and pay off the balance over four or fewer payments.”3 While BNPL lenders do not charge consumers interest, they do charge fees for late and missed payments. Transaction sizes range from a few dollars to thousands, such as to pay for a vacation or luxury exercise equipment.

You have seen BNPL options available at online and physical checkout, offered by brands such as Affirm, Klarna, Afterpay, Zip, and Sezzle. According to CapitalOne Shopping, these five lenders account for over 95% of the market share.4

Unlike with credit cards, the financing costs for BNPL are born by the seller, not the purchaser. In effect, BNPL allows sellers to reach consumers who might otherwise not make the purchase.

Until now, BNPL data have remained in silos. While card issuers can view a consumer's other cards and balances, most lenders never see the consumer's BNPL transactions with competing platforms.

Who Uses BNPL?

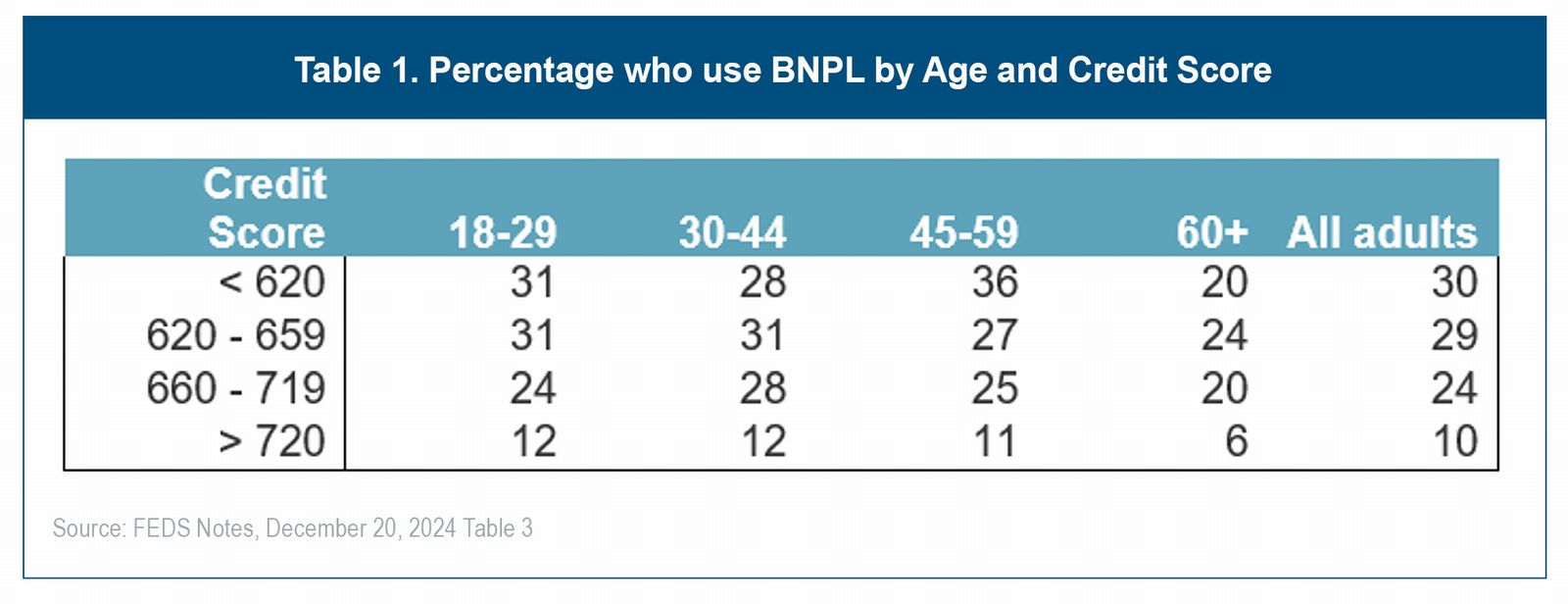

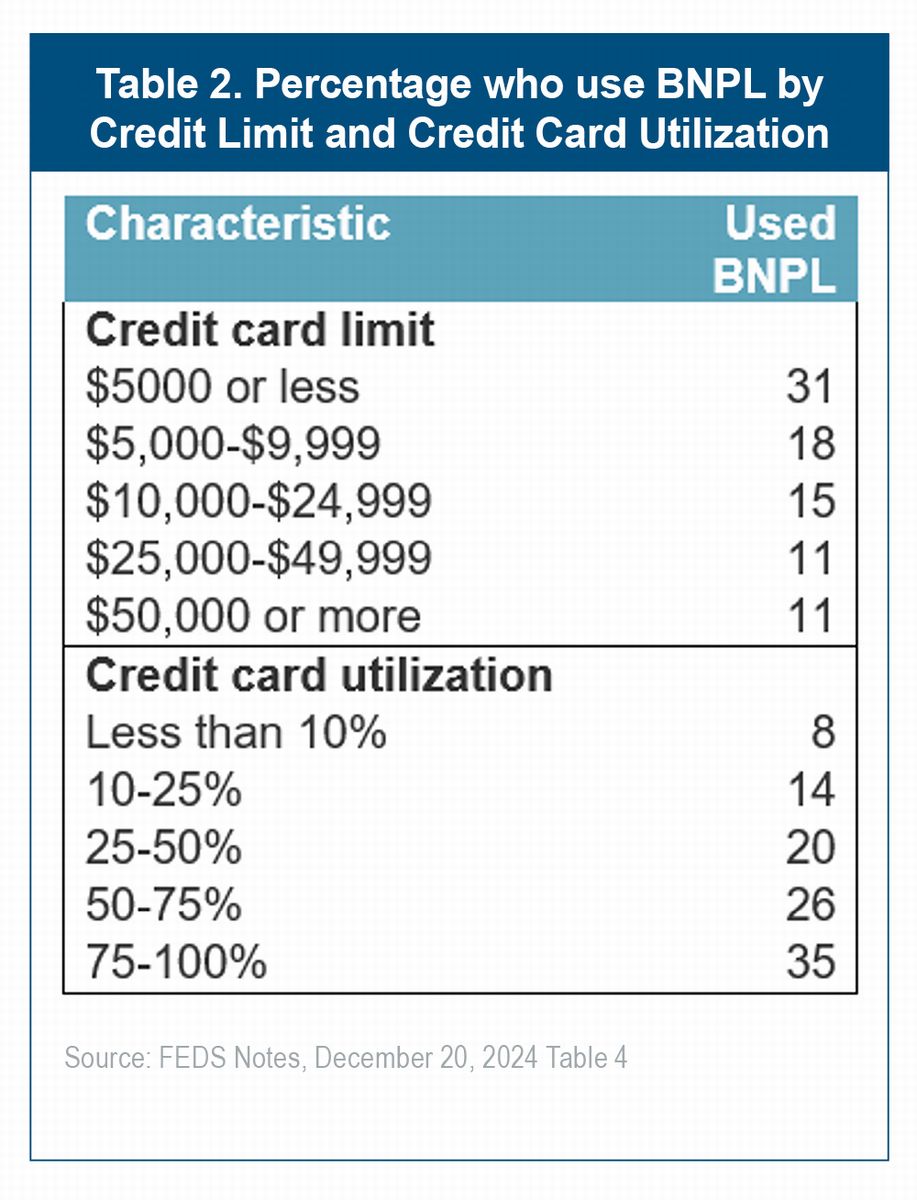

Federal Reserve calculations based on 2023 data5 show BNPL users tend to be young, have low credit scores, and high credit card utilization, as depicted in Tables 1 and 2.

What impact will FICO's inclusion of BNPL data have on your members' credit scores?

What impact will FICO's inclusion of BNPL data have on your members' credit scores?

Plan members who use BNPL and pay on time might see some of their credit scores improve. Those who do not pay on time might see some of their scores decline.

FICO supports a variety of score versions.6 The press release mentioned above specifies FICO will evolve its Score 10 and Score 10 T to include BNPL data. If FICO's earlier versions, especially Score 8 and Score 9, remain widely used, scores calculated by those models should not be affected. It seems reasonable that versions using BNPL data will be used by lenders marketing to Millennials and to higher risk borrowers, possibly to first-time home buyers.

Who benefits and who loses from this decision?

Including BNPL data in credit scores should benefit convenience borrowers who repay on time – higher scores should result in marginally lower interest rates. BNPL data will probably lower scores of consumers who are delinquent, raising interest rates lenders charge them.

Takeaways

- Until now, BNPL data has flown under the radar in widely used credit scores

- Consumers who repay BNPL loans on time may benefit; those who are delinquent may find their credit scores hurt

- Make sure to boost your plan members' financial literacy - about credit scores, their effect on borrowing rates, and the importance of repaying loans on time

Endnotes:

- FICO Unveils Groundbreaking Credit Scores That Incorporate Buy Now, Pay Later Data, downloaded June 24, 2025 12:17pm PDT

- https://www.fico.com/en/about-us, downloaded June 24, 2025 4:58pm PDT

- What is a Buy Now, Pay Later (BNPL) loan? downloaded June 25, 2025 3:23pm PDT

- Buy Now Pay Later Statistics (updated June 23, 2025) downloaded June 25, 2025 4:16pm PDT

- "The Only Way I Could Afford It": Who Uses BNPL and Why, FEDS Notes, December 20, 2024, downloaded June 25, 2025 10:44am PDT

- https://www.myfico.com/credit-education/credit-scores/fico-score-versions, downloaded June 25, 2025 3:17pm PST

Bio: Thomas Anichini, CFA, CFP, is Chief Investment Strategist with GuidedChoice / 3Nickels, with over 30 years of actuarial and investment experience.

Tom is a member of GuidedChoice's Investment Committee. He refines GuidedChoice's capital market assumptions and proprietary return model, and also contributes to GuidedChoice's retirement advice engine and 3Nickels financial advice engine. Tom communicates about the firm's philosophy and advice, and represents the investment team when facing clients and consultants.

Prior to joining the firm, Tom gained experience in various actuarial, investment consulting, and portfolio management positions, including for EnnisKnupp & Associates, Mercer, Westpeak Global Advisors, and Freeman Investment Management.

Comments

There have been no comments made on this article. Why not be the first and add your own comment using the form below.

Leave a comment

Please complete the form below to submit a comment on this article. A valid email address is required to submit a comment though it will not be displayed on the site.

HTML has been disabled but if you wish to add any hyperlinks or text formatting you can use any of the following codes: [B]**bold text**[/B], [I]*italic text*[/I], [U]underlined text[/U], [S]~~strike through text~~[/S], [URL]http://www.yourlink.com[/URL], [URL=http//www.yourlink.com]your text[/URL]