Filling the Gap: The Increasing Importance of Institutional Investors Addressing Corporate Misconduc

By: Erin Woods, Nancy Kulesa, and William Massa, Bleichmar Fonti & Auld LLP

Without the deterrent power of strong enforcement, investors face increased risks of transacting in securities without complete and accurate information about a particular issuer. Congress entrusted regulators as well as private actors, such as public pension plans, with the power to enforce such laws. Regulators, however, have recently exhibited a marked decline in enforcement. By taking a more active role in corporate governance and related litigation, trustees can protect plan assets, enhance long-term returns, and work toward upholding the integrity of a fair and transparent market.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

The integrity of the capital markets is premised on enforcement of the federal securities laws to redress corporate wrongdoing. Without the deterrent power of strong enforcement, investors face increased risks of transacting in securities without complete and accurate information about a particular issuer. Congress entrusted regulators as well as private actors, such as public pension plans, with the power to enforce such laws. Regulators, however, have recently exhibited a marked decline in enforcement. What's more, broader government developments reflect a policy shift that's leaving a burgeoning gap. This provides an opportunity for trustees of public pension funds to fill the enforcement gap, thereby supporting a level playing field for market participants, recovering monetary sums for aggrieved investors, and protecting the value of plan assets.

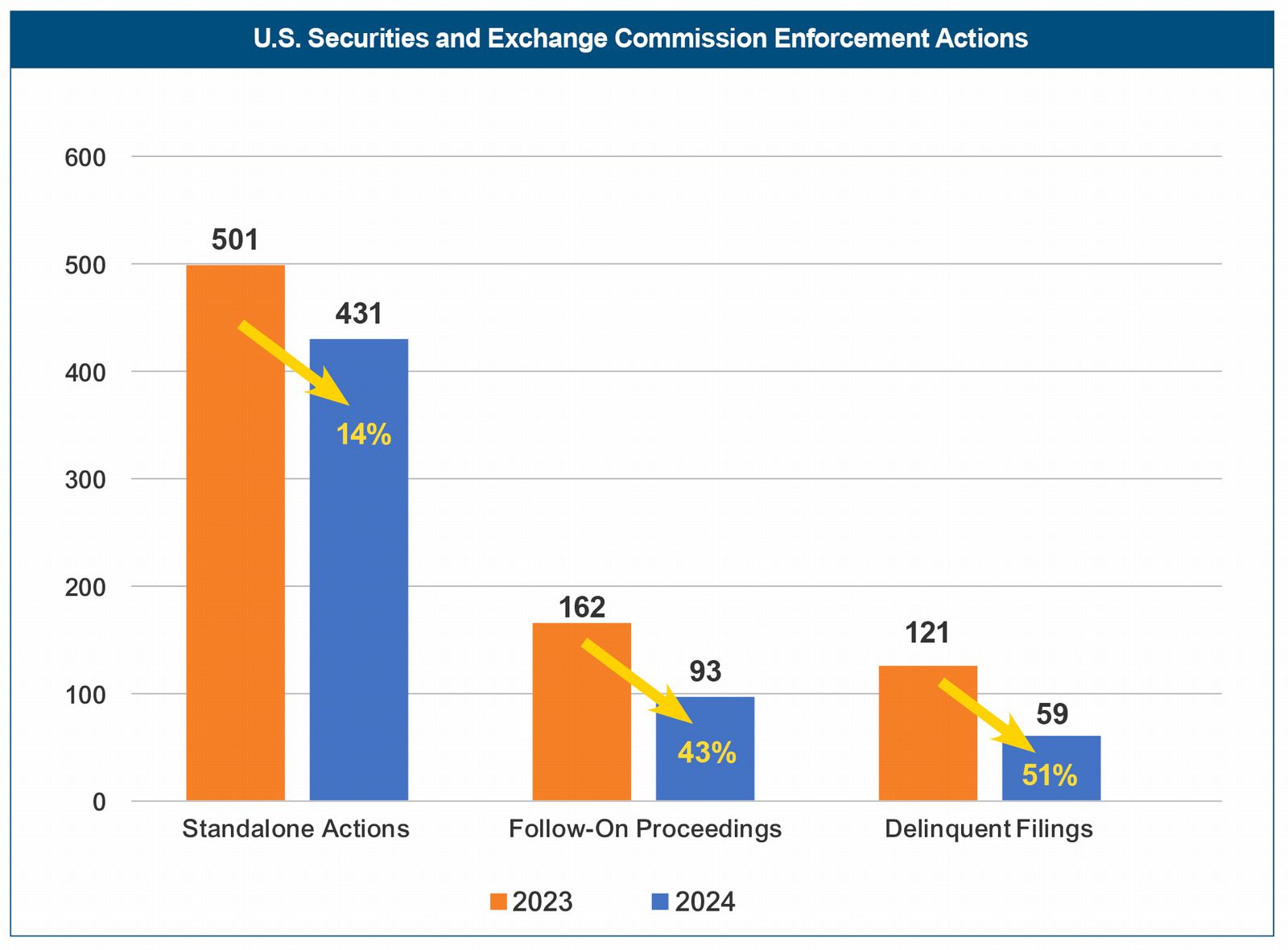

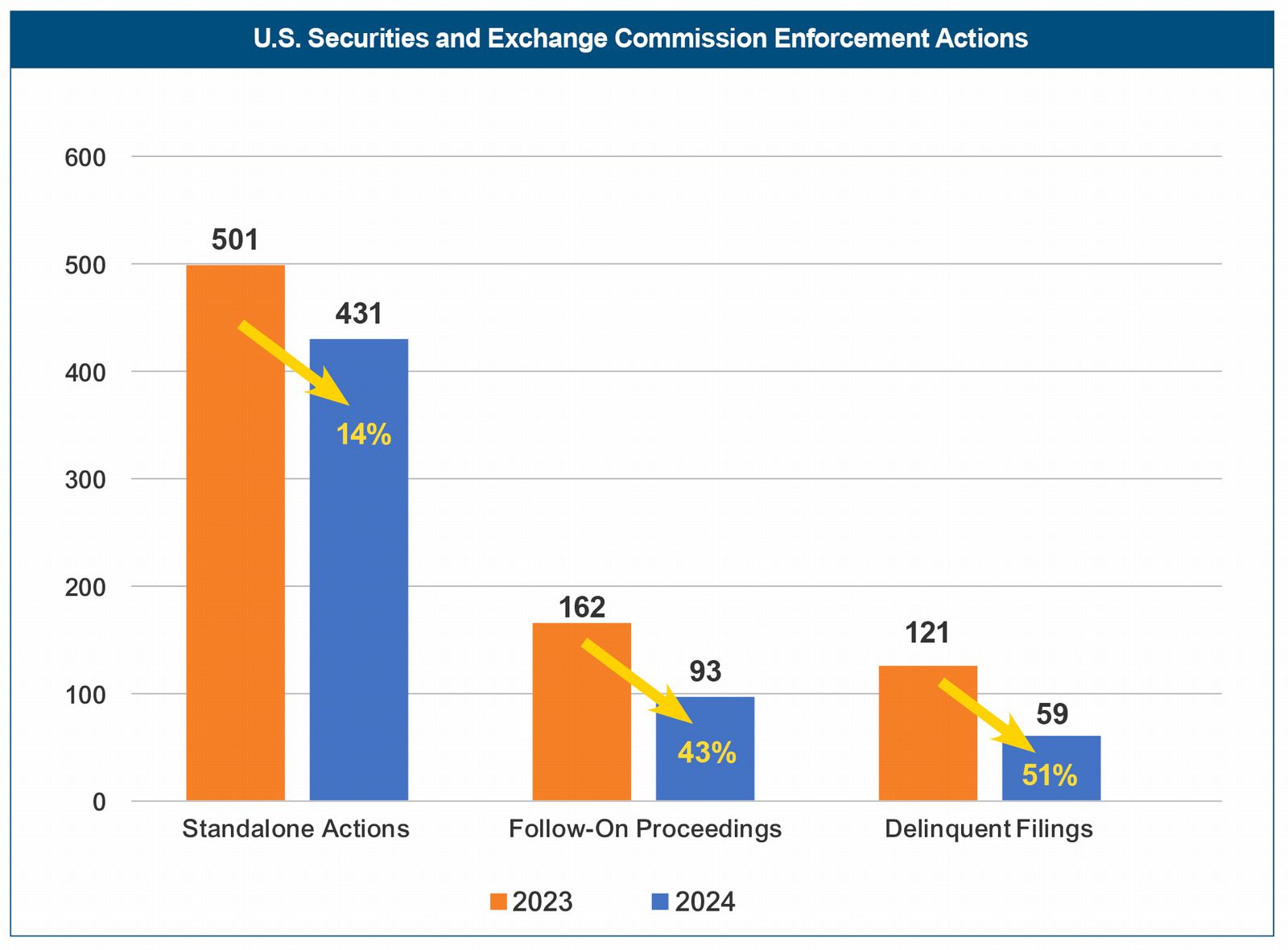

Recent enforcement data from the U.S. Securities and Exchange Commission (SEC) reveals significant declines across several key metrics. In 2024, the SEC filed 431 standalone enforcement actions—a 14% drop from 2023 and the lowest annual total in a decade, excluding the pandemic-disrupted year of 2020.i Follow-on administrative proceedings, which seek sanctions based on prior criminal convictions, civil injunctions, or regulatory orders, fell to 93—a 43% decline and the lowest in ten years.ii Similarly, the SEC brought just 59 delinquent filing cases against issuers, down 51% from 2023 and also a decade low.iii While the SEC recovered a record $8.2 billion in financial remedies in 2024, roughly 56% of that amount stemmed from one trial victory against Terraform Labs and Do Kwon, who were charged in one of the largest securities fraud cases in U.S. history.iv

The decline in enforcement is surprising, given statements from then-SEC Chairman, Gary Gensler, who analogized the SEC's Division of Enforcement to “a steadfast cop on the beat” that holds all wrongdoers accountable.”v There are also reasons to suspect enforcement metrics may continue to decline. Mr. Gensler's successor, Paul Atkins, who assumed the role of Chairman in April 2025, stated that the SEC will shift its focus away from “ad hoc enforcement actions” and instead will prioritize enforcement of clearly established obligations, such as those relating to fraud and manipulation.vi Already, this has led the agency to drop lawsuits and discontinue investigations involving several cryptocurrency firms, including Coinbase and Binance.vii What's more, the SEC is expected to undergo significant staff reductions, as Mr. Atkins recently requested funding from Congress for 4,101 positions for fiscal year 2026—a 16% decrease from fiscal 2024.viii

The decline in enforcement is surprising, given statements from then-SEC Chairman, Gary Gensler, who analogized the SEC's Division of Enforcement to “a steadfast cop on the beat” that holds all wrongdoers accountable.”v There are also reasons to suspect enforcement metrics may continue to decline. Mr. Gensler's successor, Paul Atkins, who assumed the role of Chairman in April 2025, stated that the SEC will shift its focus away from “ad hoc enforcement actions” and instead will prioritize enforcement of clearly established obligations, such as those relating to fraud and manipulation.vi Already, this has led the agency to drop lawsuits and discontinue investigations involving several cryptocurrency firms, including Coinbase and Binance.vii What's more, the SEC is expected to undergo significant staff reductions, as Mr. Atkins recently requested funding from Congress for 4,101 positions for fiscal year 2026—a 16% decrease from fiscal 2024.viii

Mr. Atkins's enforcement approach is not an outlier. Amid broader trends of reduced government spending, the federal government has advanced efforts to eliminate or scale back agencies tasked with protecting the public. Sights have been set on notable targets, including the Department of Justice's Consumer Protection Branch (CPB) and National Cryptocurrency Enforcement Team (NCET), the Consumer Financial Protection Bureau (CFPB), and the Public Company Accounting Oversight Board (PCAOB), a nonprofit established by Congress in the wake of the Enron and WorldCom accounting scandals.ix

In short, while securities litigation settlements achieved by public pension plans have long outpaced those achieved by the SEC, recent developments create a meaningful opportunity for pension plan trustees to further close the growing gap in the government's enforcement. As former SEC Chairman Arthur Levitt—its longest-serving leader—recognized, private enforcement is “fundamental” to the integrity and success of the securities markets.x By taking a more active role in corporate governance and related litigation, trustees can protect plan assets, enhance long-term returns, and work toward upholding the integrity of a fair and transparent market.

Disclosures: The views set forth herein are the personal views of the authors and do not necessarily reflect the views of Bleichmar Fonti & Auld LLP. This publication should not be construed as legal advice on any specific facts or circumstances. The contents are intended for general information purposes only and may not be quoted or referred to in any publication or proceeding without the prior written consent of the Firm. The mailing of this publication is not intended to create, and receipt of it does not constitute, an attorney-client relationship.

Endnotes:

i A Press Release, SEC Announces Enforcement Results for Fiscal Year 2024, SEC (Nov. 22, 2024), https://www.sec.gov/newsroom/press-releases/2024-186.

ii Id.

iii Id

iv Id

v Id

vi Paul S. Atkins, Keynote Address at the Crypto Task Force Roundtable on Tokenization, SEC (May 12, 2025), https://www.sec.gov/newsroom/speeches-statements/atkins-remarks-crypto-roundtable-tokenization-051225-keynote-address-crypto-task-force-roundtable-tokenization.

vii Joel Khalili, The SEC Is Abandoning Its Biggest Crypto Lawsuits, WIRED (Feb. 28, 2025), https://www.wired.com/story/sec-is-giving-up-biggest-cryptolawsuits/.

viii Jessica Corso, SEC Seeks To Cut Enforcement Staff To 2010 Levels, LAW 360 (June 5, 2025), https://www.law360.com/articles/2349239/sec-seeks-to-cutenforcement-staff-to-2010-levels.

ix See, e.g., Sarah N. Lynch, US Justice Department unit for drug and food safety cases being disbanded, REUTERS (Apr. 25, 2025), https://www.reuters. com/business/healthcare-pharmaceuticals/us-justice-department-unit-drug-food-safety-cases-being-disbanded-2025-04-25/; Filip Timotija, Trump administration to cut 90 percent of CFPB in latest layoffs: Reports, THE HILL (Apr. 17, 2025), https://thehill.com/business/5255231-trump-admin-to-cut-90percent-of-cfpb-in-latest-layoffs-reports/; Jacob Horowitz, House Bill Looks to Dissolve the PCAOB, Cut Regulatory Budgets, INTERNAL AUDIT 360° (May 8, 2025), https://internalaudit360.com/house-bill-looks-to-dissolve-the-pcaob-cut-regulatory-budgets/.

x Arthur Levitt, Between Caveat Emptor and Caveat Vendor: The Middle Ground of Litigation Reform, REMARKS AT THE 22ND ANNUAL SECURITIES REGULATION INSTITUTE (Jan. 25, 1995), https://www.sec.gov/news/speech/speecharchive/1995/spch023.txt.

Bio: Erin Woods, Nancy Kulesa, and William Massa are attorneys at Bleichmar Fonti & Auld LLP, a law firm focusing on securities class action and shareholder litigation as well as settlement claim form filing on behalf of institutional investors. Each of their biographies is available at www.bfalaw.com.