Power Surge: Capitalizing on the Electricity Boom

Date postedSeptember 18, 2025

By: James Rich, CurvePoint Capital

As electricity demand surges and renewables scale, the U.S. grid is transforming—creating timely, strategic opportunities for pension fund managers to invest in the future of the electric grid.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

As the U.S. electricity sector undergoes an historic transformation driven by surging demand and a rapid shift toward renewables, pension fund managers are uniquely positioned to capitalize on this opportunity. According to BloombergNEF, global energy transition investment needs to reach $2.5-3.4 trillion annually by 2030.

The energy transition offers attractive investment potential for pension fund managers and the opportunity to align with sustainability mandates. Legacy investment theses may underperform as capital flows shift decisively toward decentralized and renewable energy systems. Pension managers must ensure their investment managers are aware of these trends and actively allocating capital in alignment with them.

Private credit is increasingly recognized as a catalyst for financing renewable energy, distributed energy resources, and grid modernization. According to Goldman Sachs, while private equity has historically dominated energy transition capital flows, the next phase of growth will be driven by credit due to the maturation of clean energy technologies, which now offer lower risk profiles, making them good candidates for debt financing.

Growing Demand & Supply

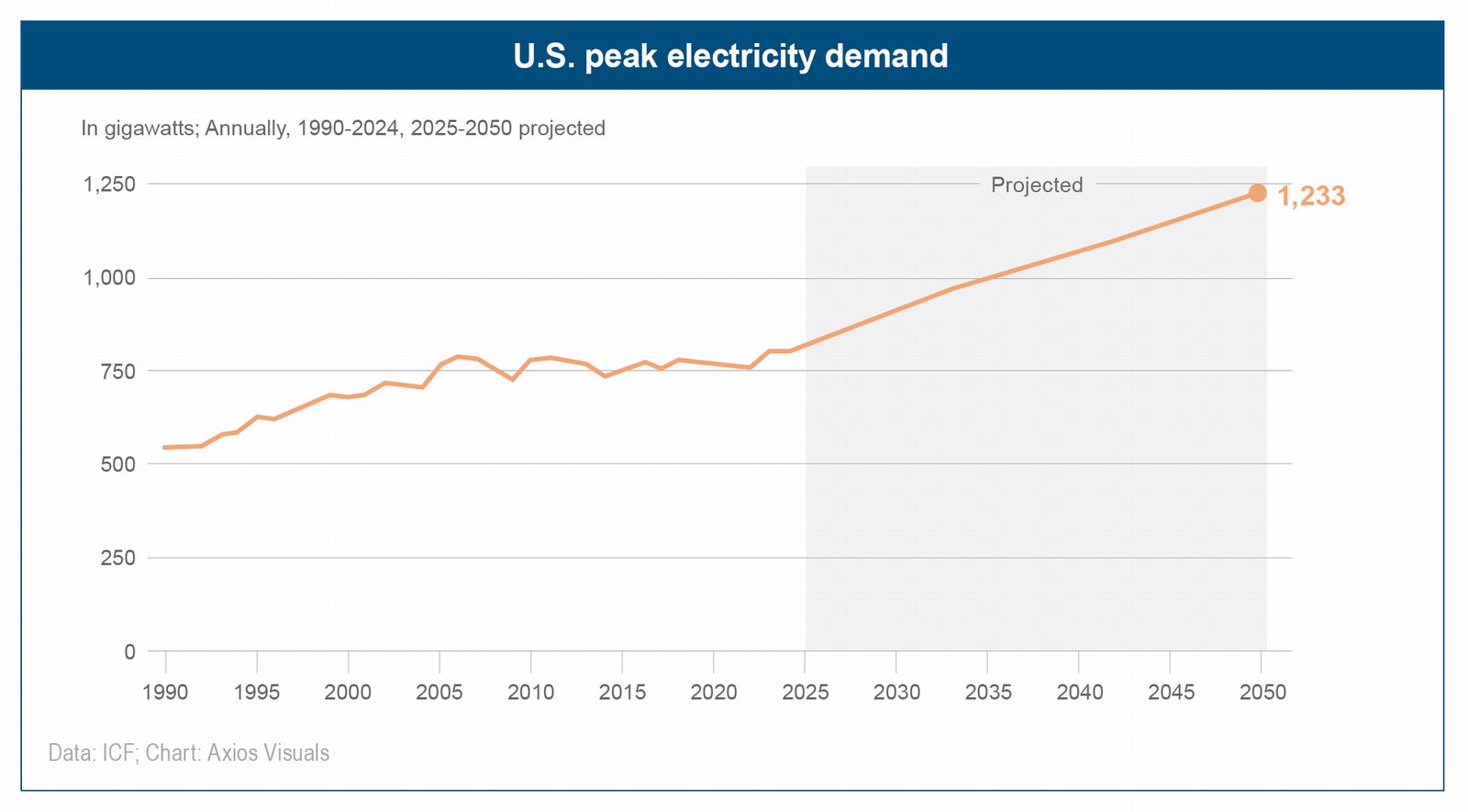

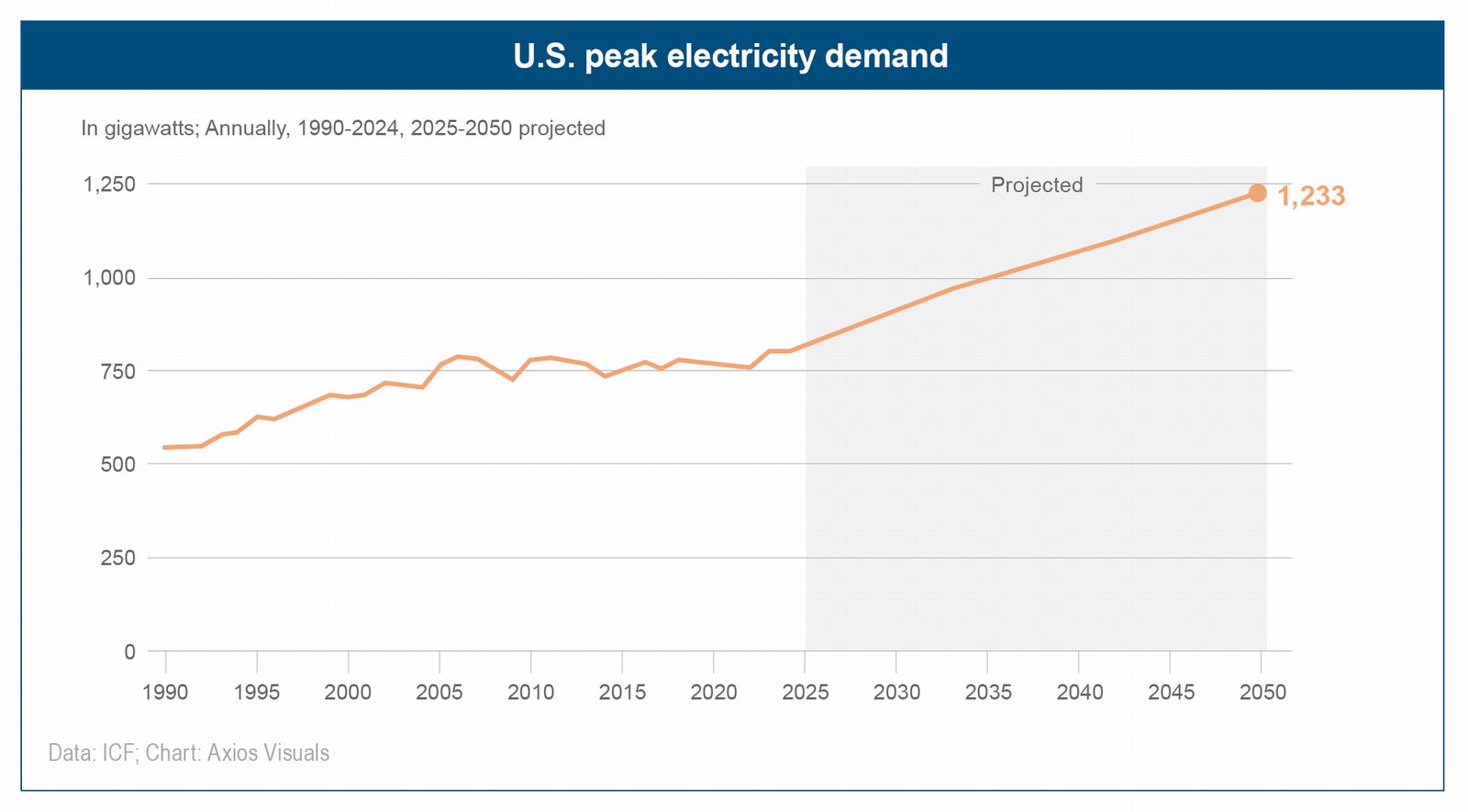

The demand for electricity in the U.S. is on a steep upward trajectory after a decade of flat usage. The rapid growth of data centers to support AI technology, the electrification of transportation from electric vehicles, the increasing prevalence of heat pumps, and the rising use of air conditioners due to climate change are all contributing to this demand growth. Consulting firm ICF suggests that U.S. electricity demand is expected to grow by as much as 25% by 2030 and by 78% by 2050, compared to 2023.

The U.S. power sector is in the midst of a transformation, retiring older plants while rapidly building new ones, especially renewables. To meet even moderate demand growth, the pace of capacity additions will need to accelerate. According to an analysis by ICF, the U.S. will need to add 80 GW of new generating capacity every year from 2025 through 2045 to satisfy rising demand and replace retiring units That is double the recent rate of additions, which averaged ~40 GW/year over 2018–2022. In other words, an immense build-out is required – on par with constructing dozens of new power plants each year. This 80 GW/year figure encompasses all generation types and assumes an “all-of-the-above” mindset, including renewables, gas, nuclear, and storage.

The Role of Renewable Energy

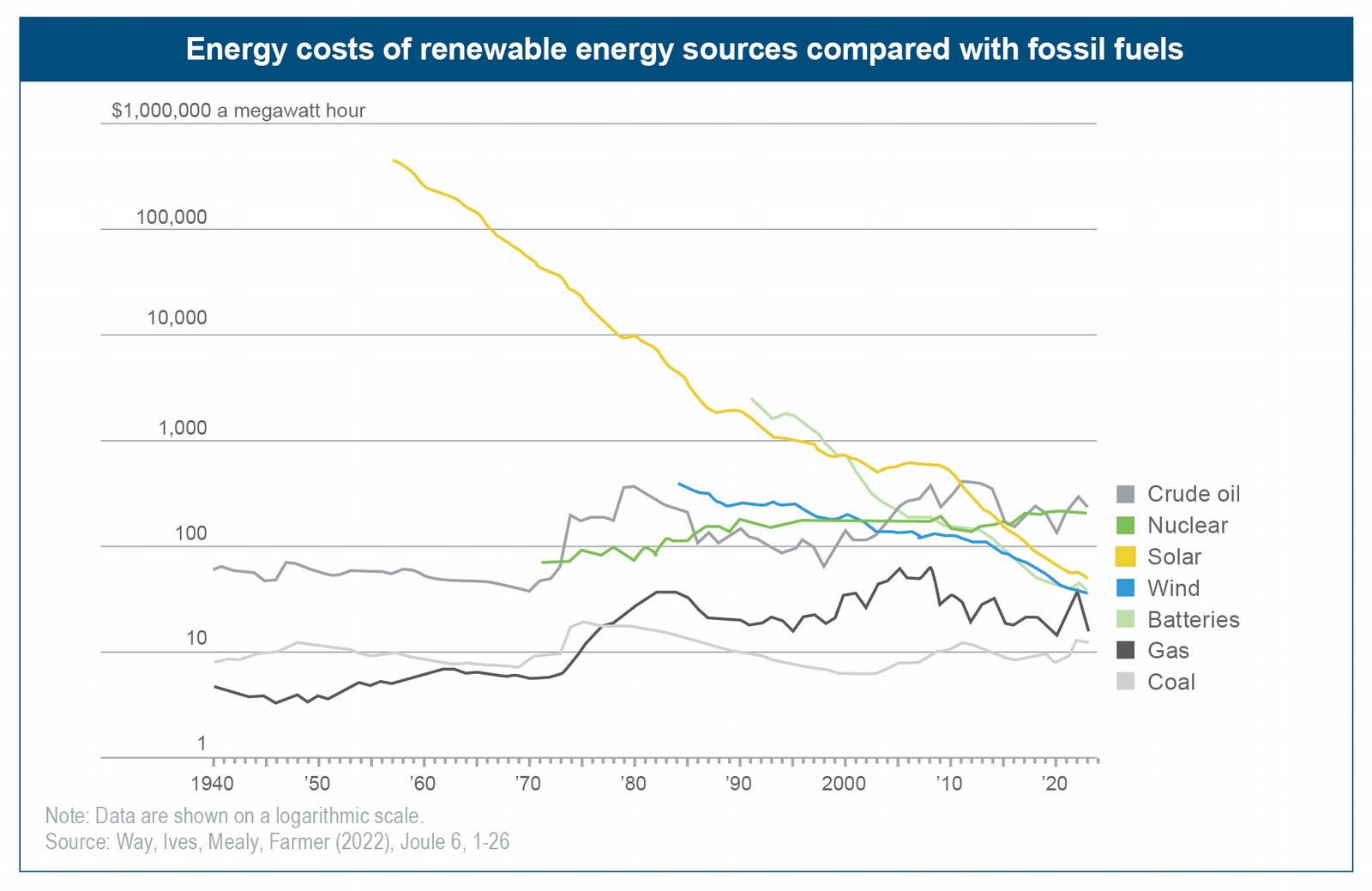

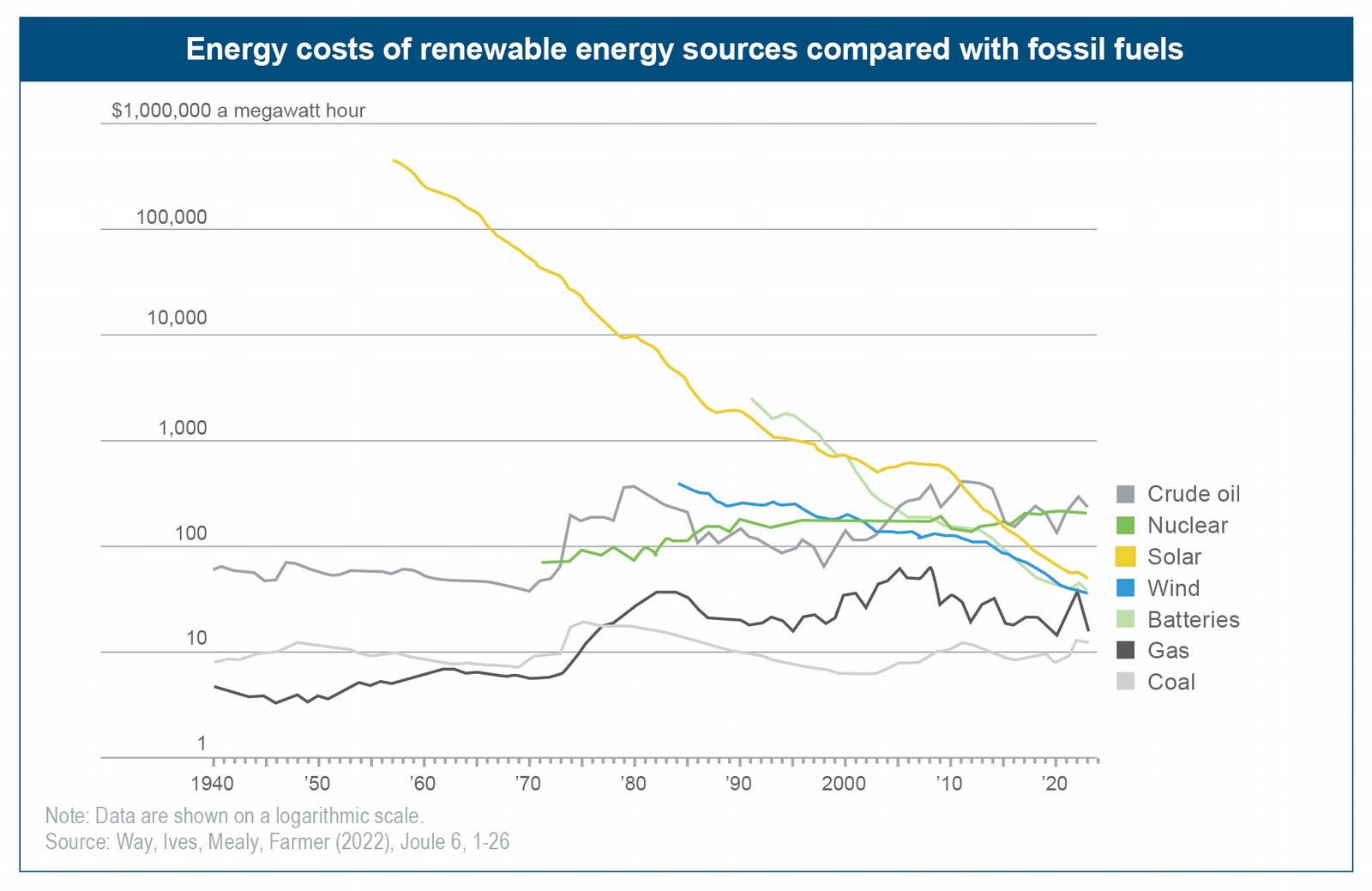

Renewable energy in the US comprised approximately 24% of total U.S. utility-scale electricity generation in 2025 and continues to grow. Even if policy support from policies like the Inflation Reduction Act is removed entirely, renewable energy remains among the cheapest forms of electricity generation and significant amounts of renewable energy will still need to be built. The cost of renewable energy and other climate technologies has and continues to decrease significantly, making them competitive even without government subsidies.

In 2025, 93% of new power generation capacity being installed in the U.S. is from renewables, including solar, battery storage, and wind, illustrating the strong demand for renewable energy due to its advantages over legacy energy sources. Renewable energy continues to improve in efficacy and become cheaper, while fossil fuels become harder to extract with every barrel produced and ultimately less competitive in the long run.

In 2025, 93% of new power generation capacity being installed in the U.S. is from renewables, including solar, battery storage, and wind, illustrating the strong demand for renewable energy due to its advantages over legacy energy sources. Renewable energy continues to improve in efficacy and become cheaper, while fossil fuels become harder to extract with every barrel produced and ultimately less competitive in the long run.

Investment Opportunities

The transition to a sustainable energy system is not just about building solar farms and wind turbines, but also about innovating all the “glue” technologies that allow a myriad of small resources to work together. Numerous products and services will be needed to support the growth in supply of renewable and other energy sources, representing an estimated $2.5-3.4 trillion of annual investment opportunity by 2030.

Distributed energy technologies are emerging as some of the most attractive investment opportunities in the renewable energy sector. These technologies – ranging from virtual power plants (VPPs) to microgrids, battery storage systems, demand response and energy efficiency systems, and intelligent grid monitoring devices – play critical roles across the renewable energy value chain. Unlike utility-scale wind farms or solar parks, these are typically modular solutions that enhance grid resilience, improve energy security, and capitalize on technological advancements to reduce costs.

A detailed write up of each these investment opportunities and data sources is available here.

Bio: James Rich is Managing Partner and Co-Founder of CurvePoint Capital, with 22 years of investment experience in private and public investments across diverse asset classes. Before co-founding CurvePoint, he spent 15 years at Aegon Asset Management, where he co-founded the Aegon Climate Capital strategy. He also served on the board of the Aegon Transamerica Foundation, supporting financial and social empowerment initiatives. Earlier in his career, James worked at Madison Dearborn Partners and Morgan Stanley. A frequent speaker and guest lecturer, he has been featured in the Financial Times, Barron's, the Wall Street Journal, Bloomberg, and more. He mentors climate ventures through Third Derivative and holds an MBA from Kellogg and an ScB from Brown University. He lives in Boulder, CO with his wife and three children.