Sports Investing: An Athlete-Centric Approach

Date postedNovember 6, 2025

This piece discusses investment opportunities within the sports, media, and entertainment industry, providing an overview of the growing global sports market and, in particular, the compelling, athlete-centric opportunity set available to investors.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

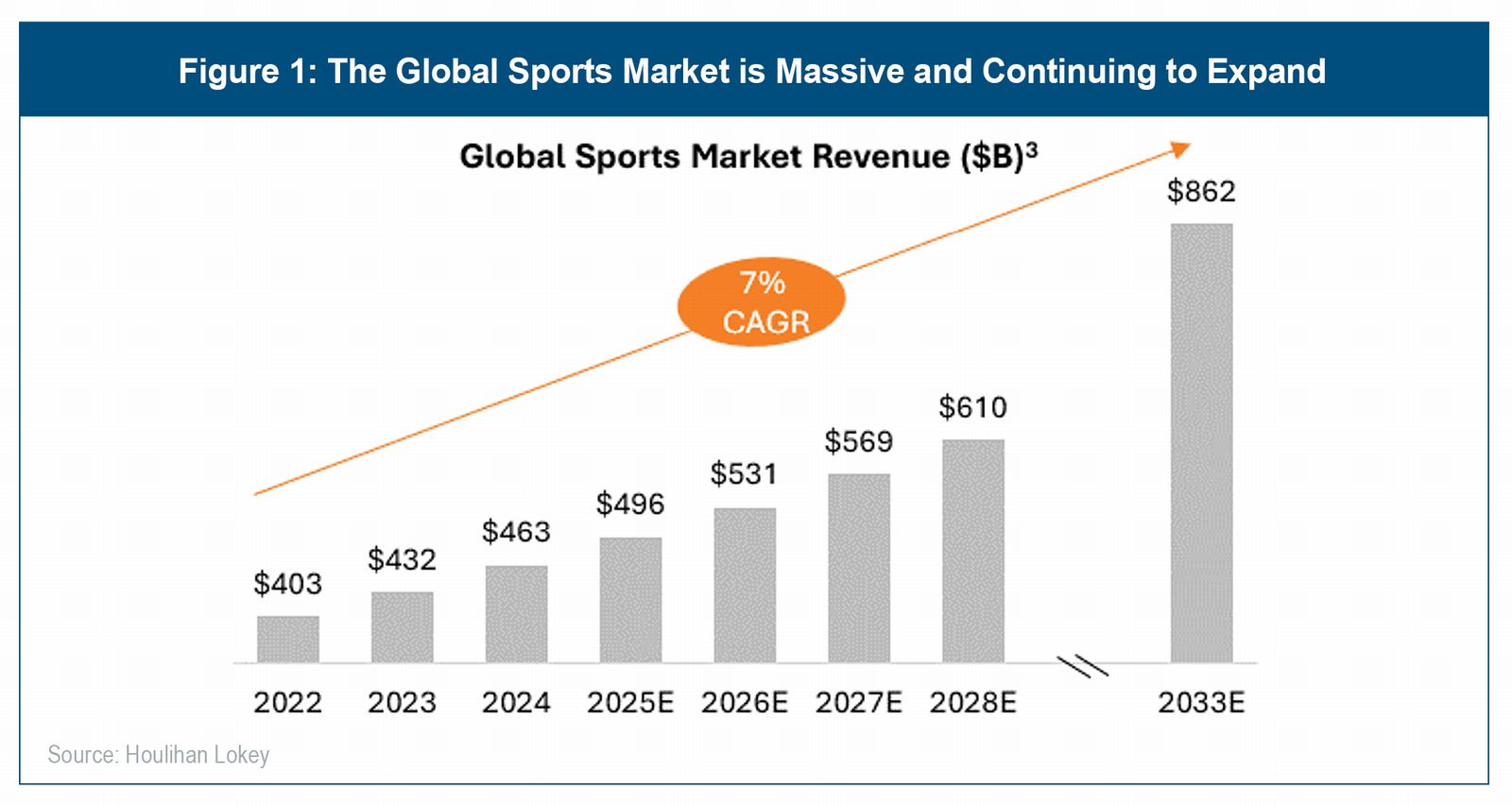

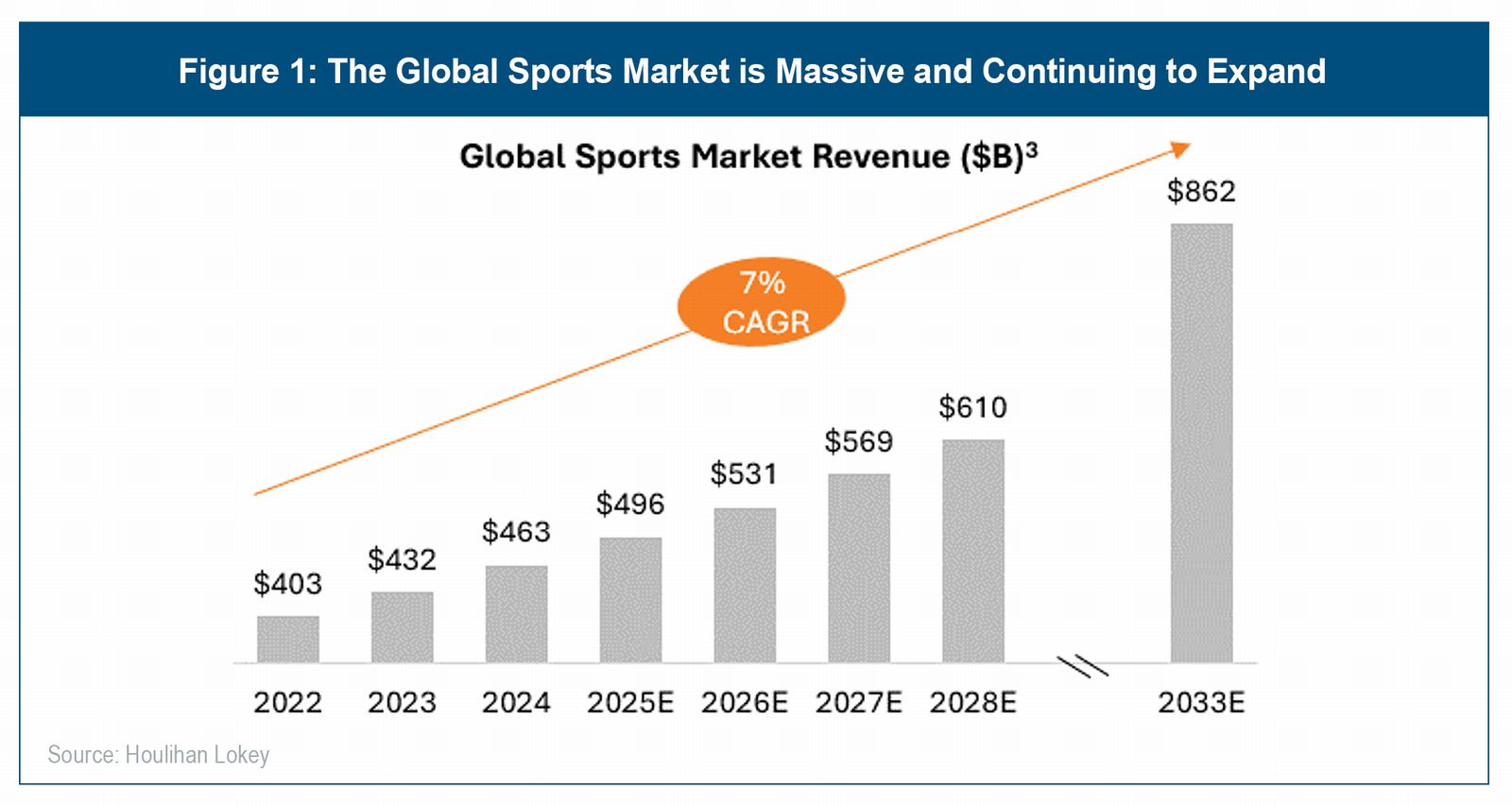

The sports, media, and entertainment (“SME”) industry has experienced remarkable growth, propelled in part by skyrocketing demand for sports and sports-adjacent sectors. The global sports industry reflects a massive and growing market, supported by positive secular trends that include increasingly accessible content facilitated by streaming and other platforms, growing consumer spend on live experiences, and rising viewership and fan engagement both inside and outside of the stadium (e.g., e-sports and interactive digital features). As a result of these powerful trends, the global sports market has demonstrated consistent revenue growth, building to what is now a nearly $500 billion market (see Figure 1).

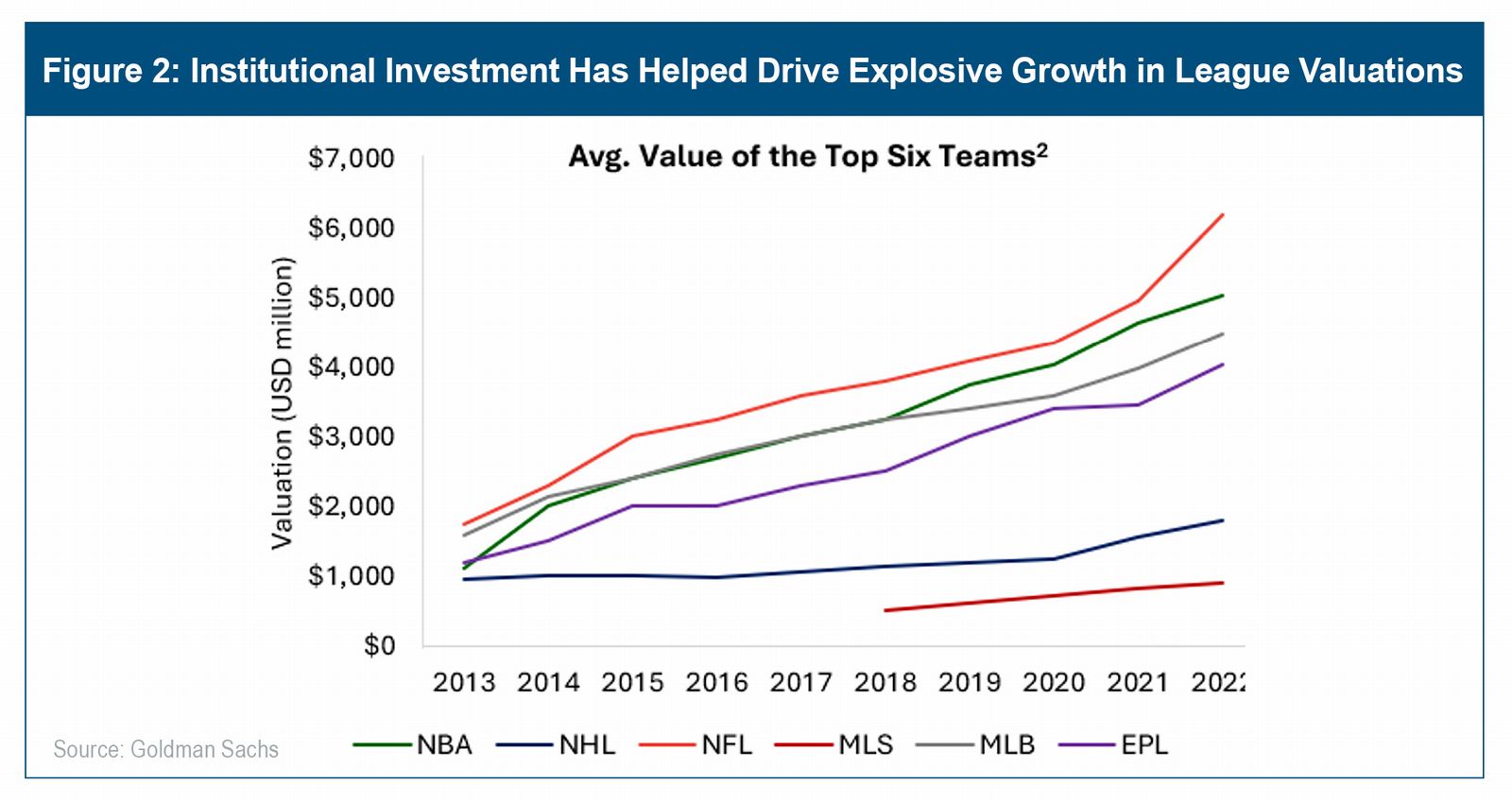

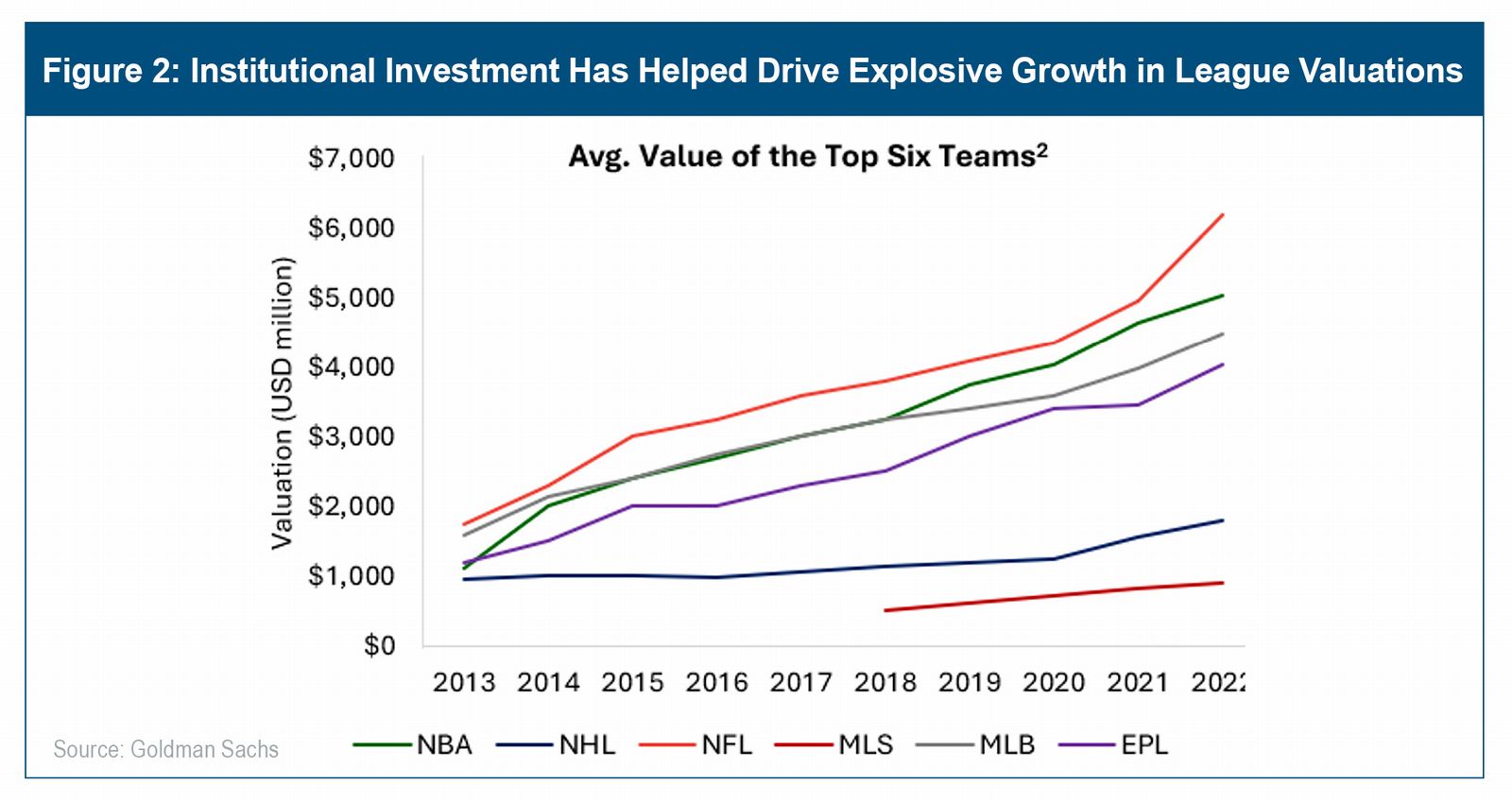

The global appeal and cultural relevance of sports that has grown over the past 10+ years has driven institutional demand for access to sports opportunities. The ability for institutional capital to invest directly into certain of the largest sports leagues has helped boost valuations and spike demand across sports-related transactions generally (see Figure 2). Institutional allocations to sports have grown due to its attractive features: its uncorrelated nature, the scarcity of franchise assets, and the valuable media rights and real estate/infrastructure-related opportunities associated with leagues and teams. Institutional investors' demand for sports-related opportunities is expected to continue; in a recent survey of 507 global sports leaders, over 83% of participants expect institutional allocations to sports to grow over the next 3-5 years.1

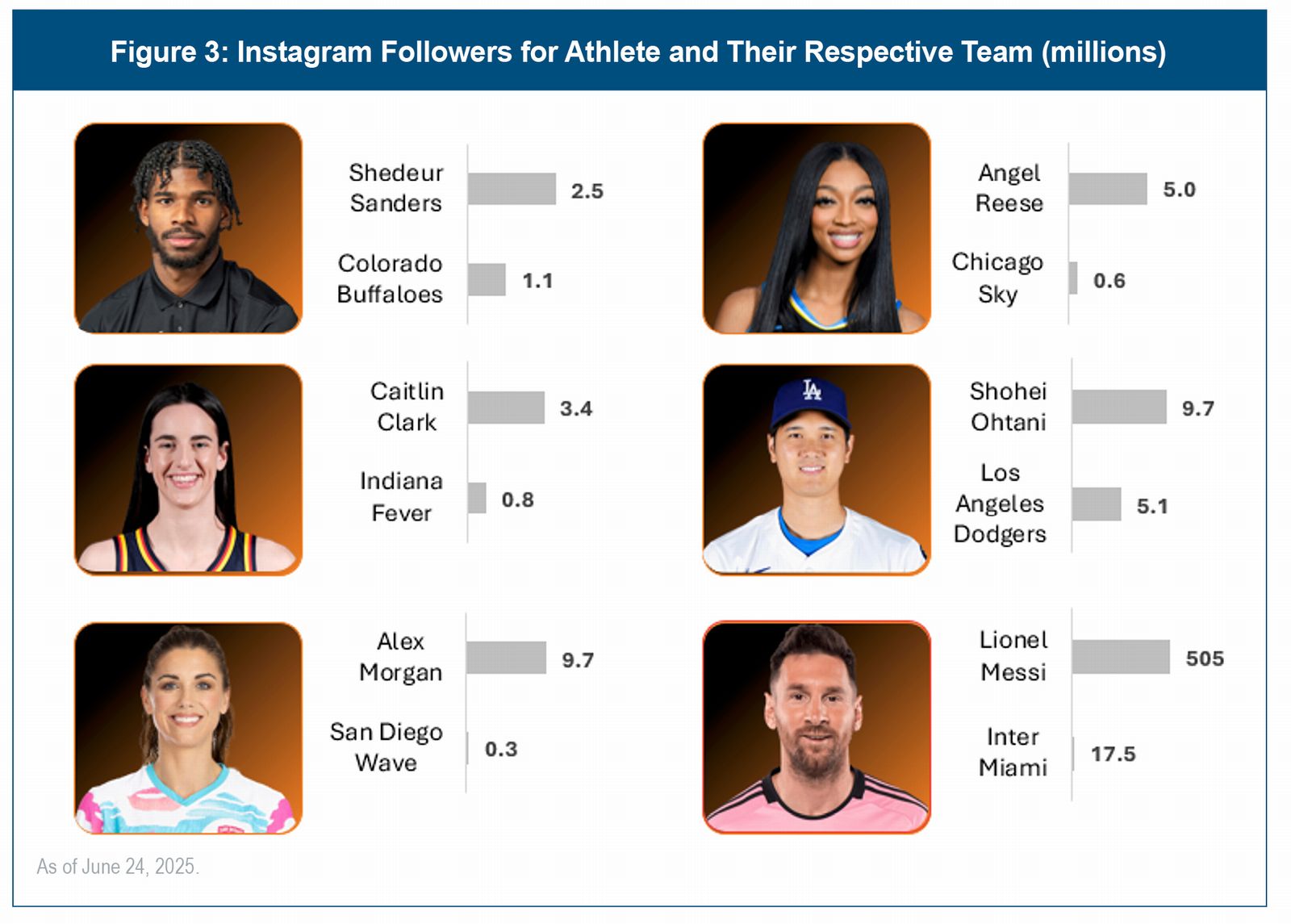

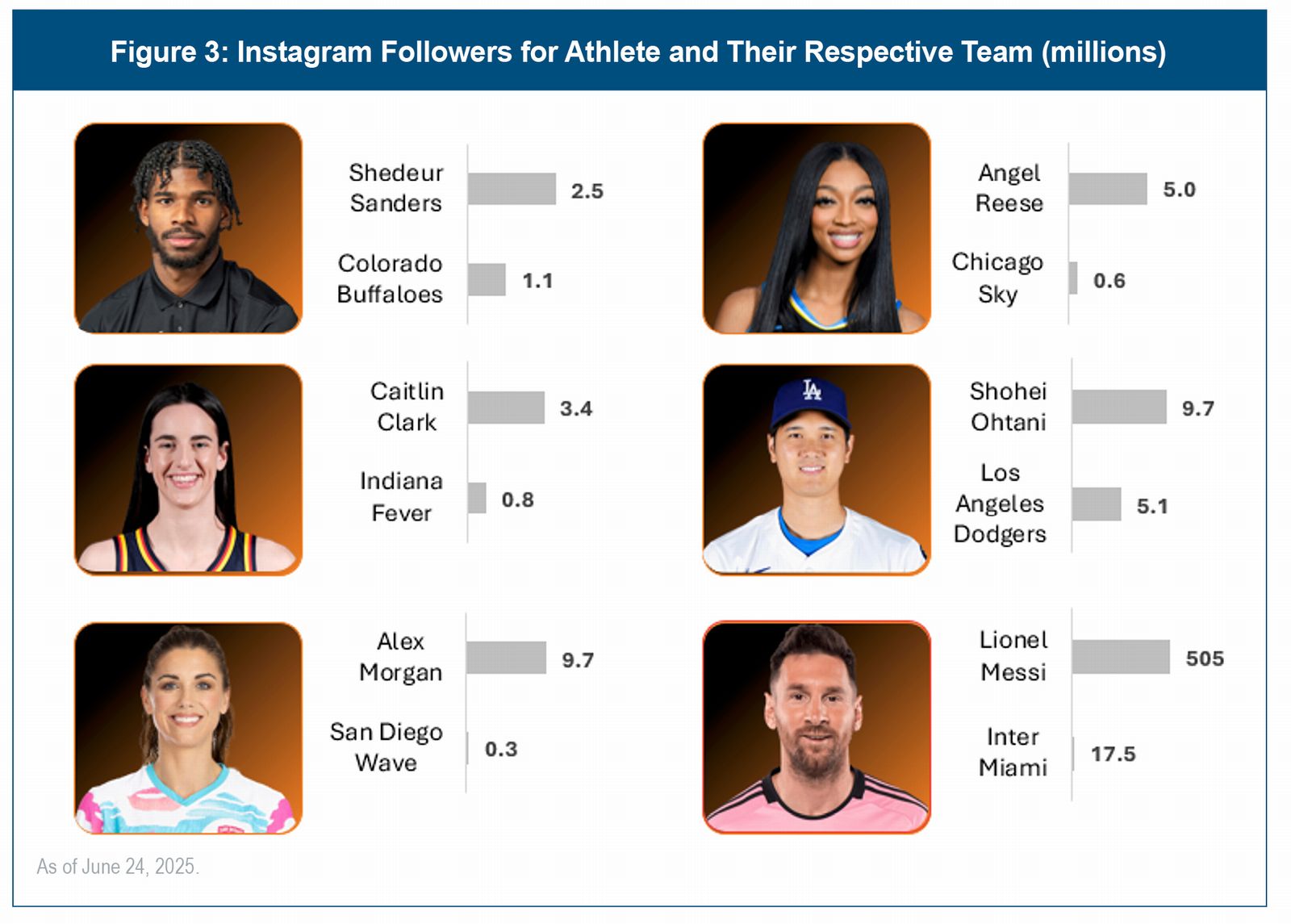

The momentum in demand for sports reaches far beyond areas traditionally associated with the industry, and sports “fandom” is a cultural phenomenon that is widely recognized by a broad range of consumer-facing companies, from the sportswear market to food/beverage companies that can capitalize on fandom through sponsorships and other marketing activations. Driven by the proliferation of social media and diversifying ways to consume athlete-centric products, the phenomenon of sports “fandom” is transitioning from teams to athletes, with focus on the name on the “back of the jersey” versus the logo “on the front”. Athletes are now recognized as multifaceted entrepreneurs, creators, influencers, and cultural icons. To be sure, fans are engaging with athlete content at a significantly greater level than with the teams for which they play (see Figure 3). The traditional paradigm of athletes as mere performers has been replaced by one in which athletes are the value drivers behind sports. This includes record demand for athlete-related products, with the global trading cards and memorabilia market – which is dominated by athlete-centered collectibles – expected to grow at a ~22% CAGR to hit an astonishing $271 billion in revenues by 2024.2 The popularity of individual athletes is impossible to ignore: Inter Miami merchandise sales increased 50x when superstar Lionel Messi joined the team in 2023.3 And since making her professional debut in 2024, WNBA game attendance has been shown to increase 105% when Caitlin Clark is playing.4

The momentum in demand for sports reaches far beyond areas traditionally associated with the industry, and sports “fandom” is a cultural phenomenon that is widely recognized by a broad range of consumer-facing companies, from the sportswear market to food/beverage companies that can capitalize on fandom through sponsorships and other marketing activations. Driven by the proliferation of social media and diversifying ways to consume athlete-centric products, the phenomenon of sports “fandom” is transitioning from teams to athletes, with focus on the name on the “back of the jersey” versus the logo “on the front”. Athletes are now recognized as multifaceted entrepreneurs, creators, influencers, and cultural icons. To be sure, fans are engaging with athlete content at a significantly greater level than with the teams for which they play (see Figure 3). The traditional paradigm of athletes as mere performers has been replaced by one in which athletes are the value drivers behind sports. This includes record demand for athlete-related products, with the global trading cards and memorabilia market – which is dominated by athlete-centered collectibles – expected to grow at a ~22% CAGR to hit an astonishing $271 billion in revenues by 2024.2 The popularity of individual athletes is impossible to ignore: Inter Miami merchandise sales increased 50x when superstar Lionel Messi joined the team in 2023.3 And since making her professional debut in 2024, WNBA game attendance has been shown to increase 105% when Caitlin Clark is playing.4

There is a compelling investment opportunity to target the SME market by tapping into the influence of the athletes that underpin the sports industry. As cultural phenomena with the power to influence, access to athletes and the ability to capitalize on their name, image and likeness (“NIL”) through sponsorship and licensing deals can meaningfully increase company value. Indeed, 67% of women's sports fans make a point to support brands that sponsor their favorite teams or athletes.5 These dynamics are not going unrecognized by advertisers; costs of advertising during the most recent WNBA playoff grew by over 100%.6 Today, athlete-driven brands, content, and businesses are experiencing unprecedented momentum, creating prime opportunities for rapid growth and scalable investment. With the evolution of direct-to-consumer platforms, digital media, and athlete-controlled IP, athletes and their strategic partners are now able to commercialize sports in ways that were once exclusive to franchise owners and leagues. And the omni-channel capabilities are increasingly important; more than 90% of Gen Z and millennial fans surveyed use social media to consume sports-related content (e.g., live events, game clips, and news),7 while overall 68% of U.S. sports fans report watching sports live on TV or through an online streaming service.8 There are ample investment opportunities where athlete IP/NIL, influence, and marketing power are central to value creation. These opportunities span some of the most dynamic and fastest-growing verticals in the industry, including media, merchandising, collectibles, live events, human performance solutions, sports betting/fantasy, data analytics, and artificial intelligence.

Endnotes:

1Source: PwC

2Source: Sports Illustrated (citing Market Decipher report).

3Source: Behind Sport

4Source: Behind Sport

5Source: Sportico

6Source: Horizon Sports & Experiences

7Source: Deloitte

8Source: S&P Global

Disclosures: PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Statements or opinions reflecting predictions or perceived trends in the sports, media and entertainment industry may be incorrect. Charts, tables and graphs contained in this document are not intended to be used to assist the reader in determining which securities to buy or sell or when to buy or sell securities. Targeted projections are HYPOTHETICAL and are not actual returns, profit forecasts or predictions. They are presented for illustrative purposes only and may only be achieved under certain conditions. There is no guarantee that these conditions will occur. This presentation does not represent all possible scenarios or outcomes and actual performance results may vary materially.

Bio: Greta Ulvad is a Senior Vice President on EnTrust Global's Opportunistic Investment Team. She is responsible for the sourcing, diligencing, and monitoring of investments across the capital structure in both private and public companies. Before joining the firm in 2016, Greta was an Associate in the Financial Restructuring Group at Milbank, Tweed, Hadley & McCloy LLP. She holds a JD from Vanderbilt University Law School and a BA in Psychology summa cum laude from Vanderbilt University.

Peter Iannicelli is a Senior Vice President on EnTrust Global's Opportunistic Investment Team. Peter has led both private and public company deals in sports, collectibles, retail, and financials at EnTrust. Peter joined the firm in 2015, before which he was an Associate Director at UBS Investment Bank covering hedge funds. Peter holds a BS in Finance from St. John's University and holds the Chartered Financial Analyst designation.