Staying the Course: Why Tariff Concerns May Not Warrant Portfolio Changes

By: Wes Crill, Senior Client Solutions Director & VP, Dimensional Fund Advisors

This article addresses two of the most pressing concerns facing institutional investors in 2025: tariff-induced market volatility and rising inflation expectations. The article provides what institutional investors need – data driven reassurance backed by rigorous historical analysis.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

News concerning developments with tariff imposition has been a roller coaster ride this year. The stark shift in US tariff policy announced on April 2, and ongoing responses worldwide, put many investors on edge. The ensuing negotiations with other nations have muddied the picture for where tariff rates may eventually land.

Markets reflected this uncertainty with substantial volatility in April. The VIX Index closed at 52.3 on April 7, the highest since March of 2020. The S&P 500 Index moved by at least two percentage points on eight days during April. This volatility suggests market participants were continuously forming and revising expectations for how tariffs will impact the macroeconomy, particularly the potential for reduced economic output and rising consumer prices.

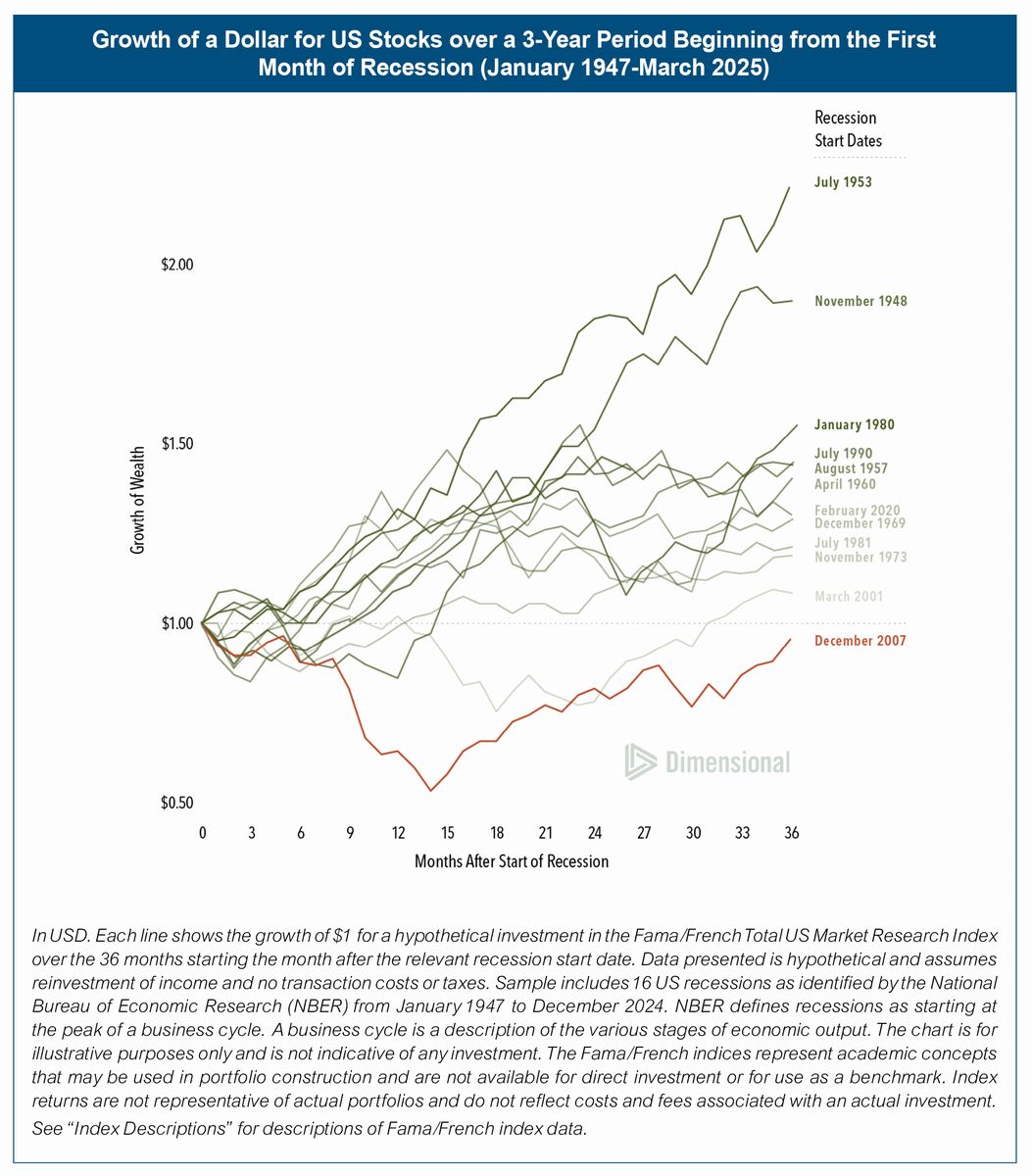

The good news for investors is the fallout from tariffs may not merit asset allocation changes. Take an economic slowdown, for example. The National Bureau of Economic Research identifies recessions using backward-looking data, so we won't know we're in recession until after it's begun. But the forward-looking nature of markets means that expected stock returns are positive even when the economic outlook is weak.

This is borne out in the historical data. One dollar invested at the start of a recession saw positive returns after three years in 11 out of 12 past recessions. The average of the three-year returns after the start of a recession was 43.2%, which is nearly identical to the 41.8% average return of all three-year periods from 1947 to 2024.

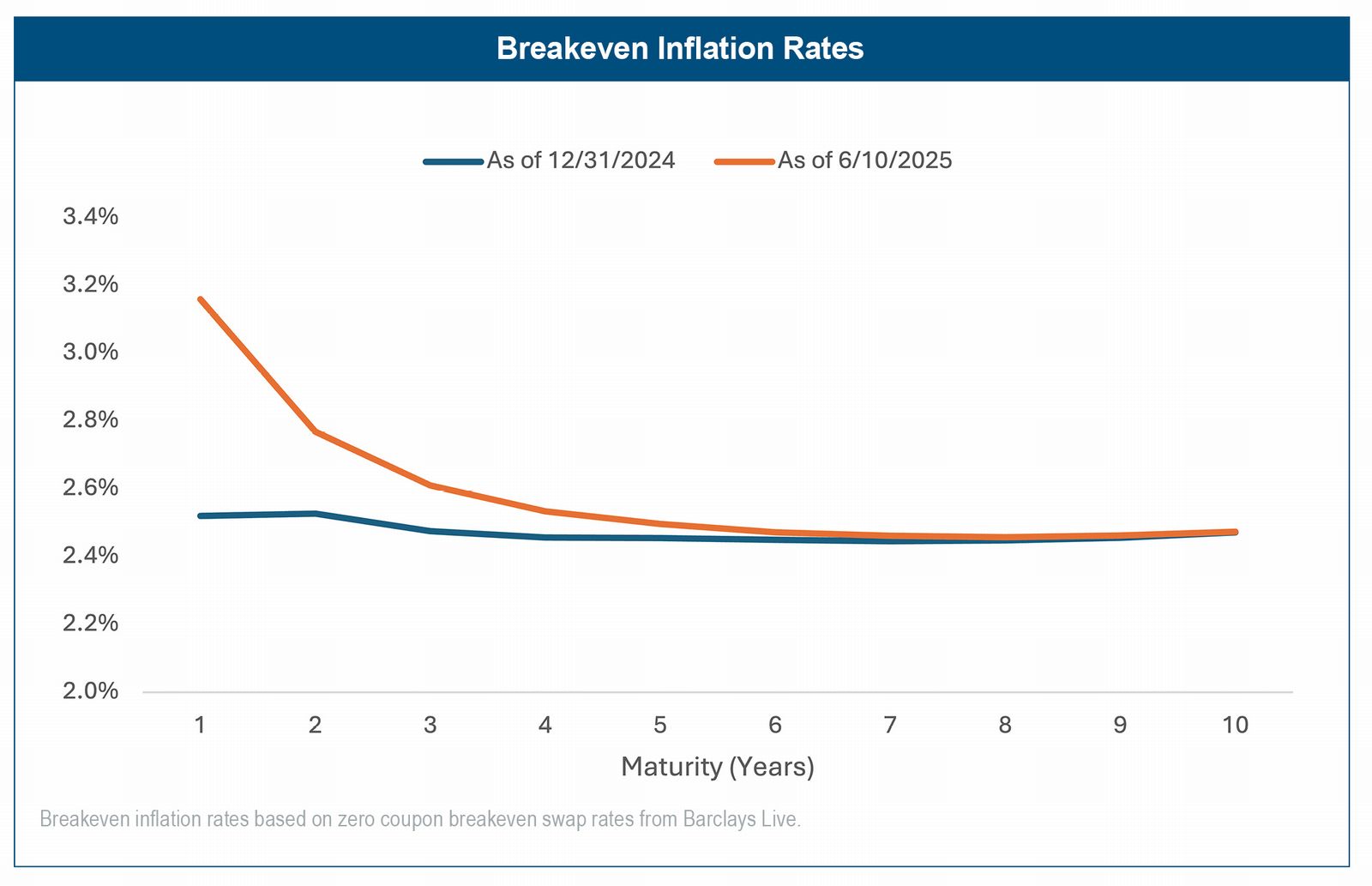

On the inflation front, bond market data suggests investors are expecting a rise in consumer prices in the short term. Breakeven inflation, composed of expected inflation plus a premium for bearing inflation risk, jumped at the one-year horizon from 2.5% at the start of the year to 3.2% as of June 10.

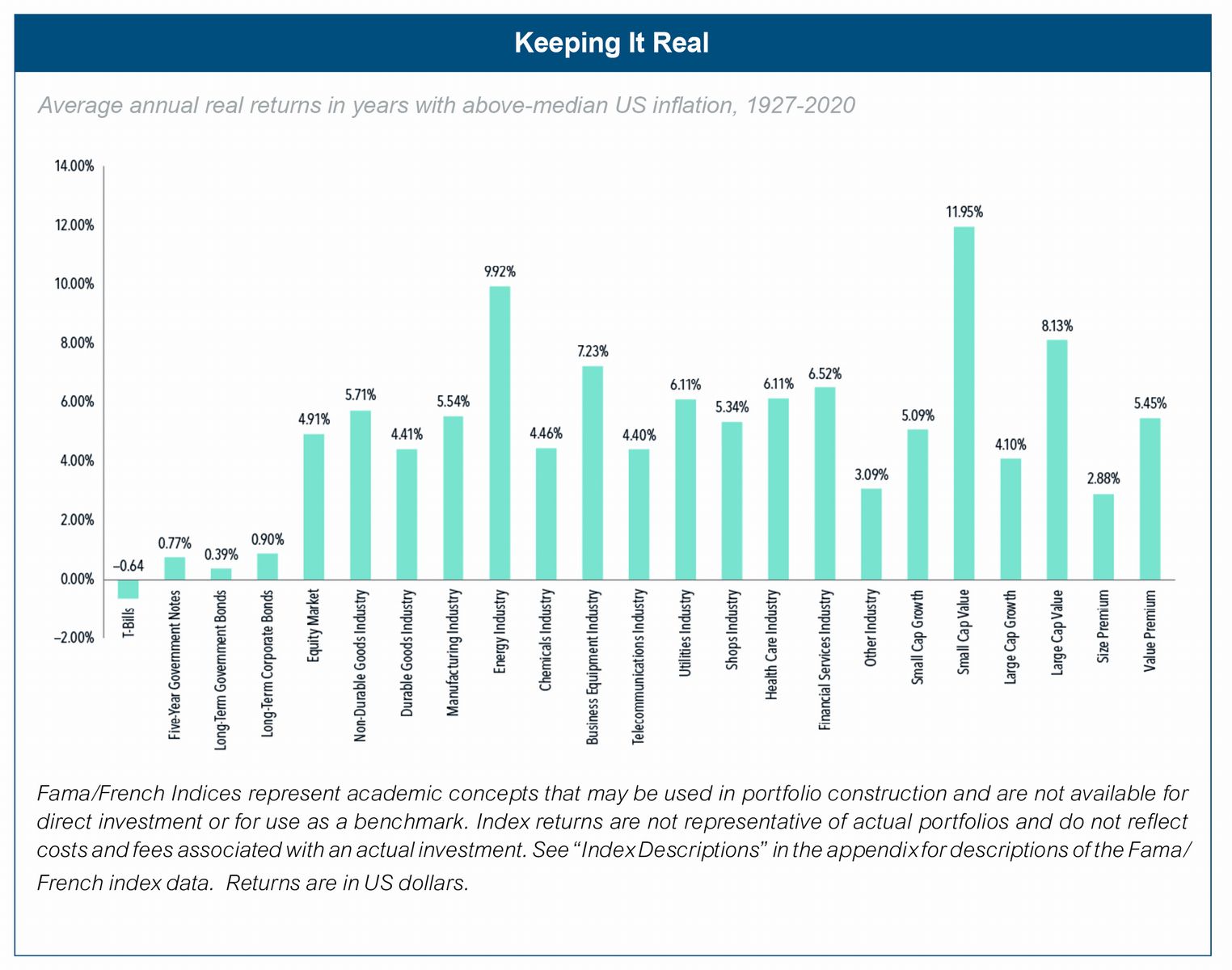

Rising inflation expectations don't necessarily mean investors should take action with their portfolios. Expected inflation is continuously incorporated into current market prices. Stock and bond market prices should be set to a level where expected returns compensate investors for the effects of inflation. This is consistent with the long-run data, which show that most stock and bond market segments have had positive average real returns even in years with high inflation. So, if actual inflation pans out similarly to expectations, investors can likely stay the course with their current asset allocation.

Endnotes:

1 Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website.

Fama/French US Small Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973) that have smaller market capitalization than the median NYSE company.

Fama/French US Small Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973) that have smaller market capitalization than the median NYSE company.

Fama/French US Large Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973) that have larger market capitalization than the median NYSE company.

Fama/French US Large Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973) that have larger market capitalization than the median NYSE company.

Results shown during periods prior to each index's index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Disclosures: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX) call and put options. Data sourced from CBOE. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Bio: Wes Crill is Senior Client Solutions Director in Dimensional's Global Client Group and a Vice President. He serves as a spokesperson for the firm, communicating with clients on topics ranging from deep dives on Dimensional's investment process to economic forecasts and asset allocation considerations. A frequent speaker at Dimensional and industry events, Wes works to translate Dimensional's research insights into thought leadership content for the firm's websites and social media. He is the primary author of Above the Fray, a weekly, online commentary highlighting Dimensional's take on current market events.

Wes previously spent over a decade on Dimensional's Research team, conducting rigorous research on a wide gamut of investment initiatives and questions pertaining to both the broad investment landscape and Dimensional's own strategy innovations.

Wes earned a BS and a PhD in materials science engineering from North Carolina State University.