The Changing World of Credit

The traditional boundaries between public and private lending are rapidly dissolving, creating unprecedented opportunities for investors. The future of credit investing won't be about choosing between public and private markets, but about combining them strategically to create portfolios that seek to withstand market cycles over the medium to long term.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

The post-COVID era has redefined the credit landscape. Higher base interest rates, more dynamic private markets and persistent macro and geopolitical uncertainty have reset expectations for institutional investors. The traditional boundaries between public and private lending are rapidly dissolving, creating unprecedented opportunities for investors.

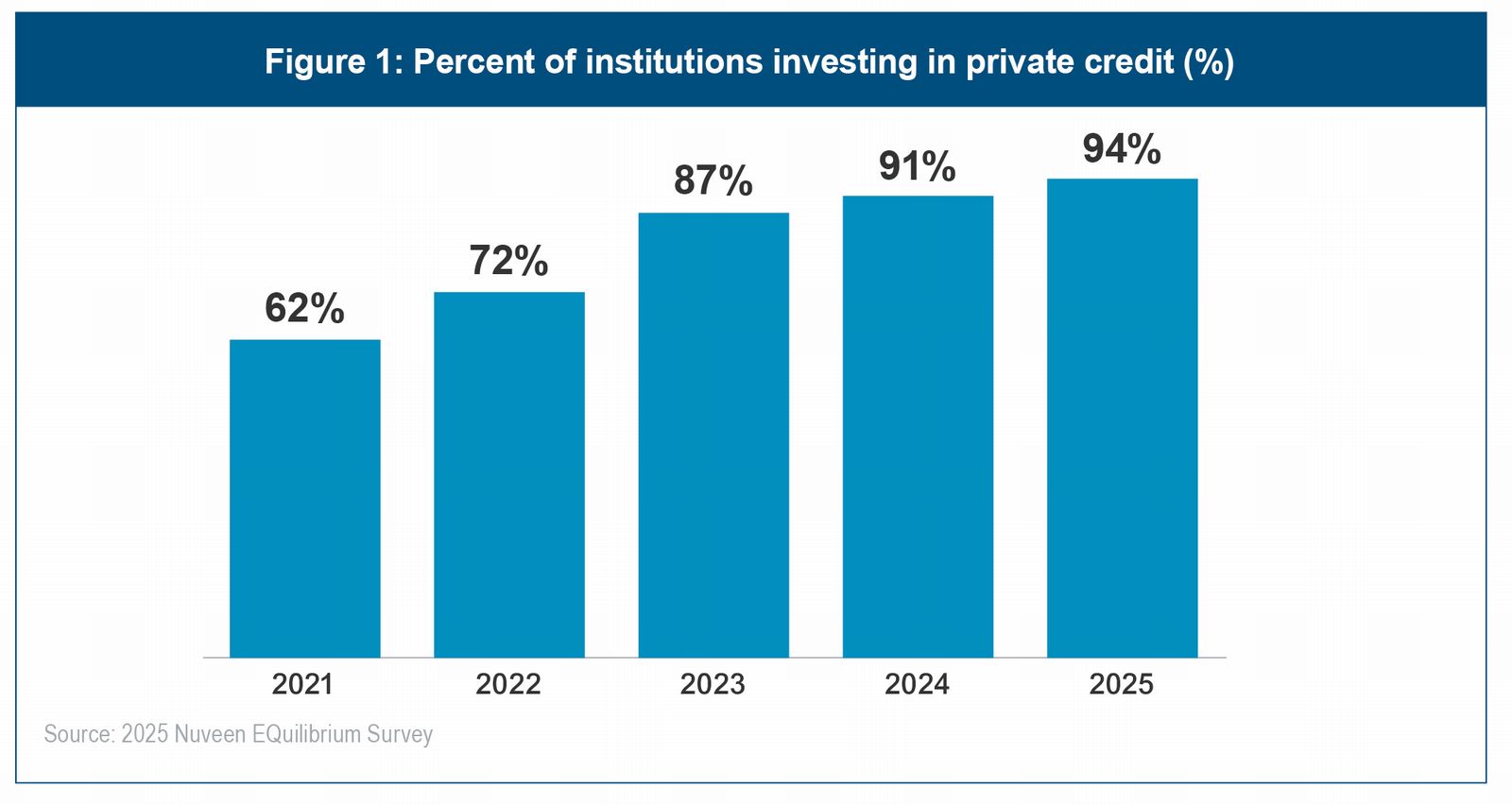

Nuveen's latest EQuilibrium survey shows that 94 percent of institutional investors now hold private credit in their portfolios, marking a significant jump in the last five years. At the same time, investors are reengaging with public fixed-income markets with the recent rise in yields.

As banks curtailed lending activity in the wake of the global financial crisis, alternative credit sources emerged offering investors diversification and yield at a time of ultra-low rates. From under $300 billion at end 2008, assets under management for private debt strategies grew to over $2 trillion by 2024, according to alternative asset data provider Preqin.

But as rates have risen over the last two years, almost half of investors surveyed by Nuveen indicated plans to increase allocations to public fixed income. Institutional investors and wealth advisers are once again seeing opportunities in traditional bonds, with the Bloomberg US Aggregate Index ending Q1 2025 at 4.6 percent – approaching double its 2010-2019 average of 2.5 per cent.

Rather than viewing public and private credit as distinct alternatives, agile investors are embracing more flexible approaches that consider opportunities across both spaces. Commercial real estate exposure, for example, can be captured through publicly available CMBS – commercial mortgage-backed securities – or through private options such as direct real estate debt or specialist finance for clean energy upgrades.

This broader toolkit enables investors to fine-tune their portfolios beyond conventional levers such as duration, rating or sector. It involves balancing liquid and illiquid assets for steady cash flow management, blending fixed and floating rate exposures to hedge macro risks and selecting from a broad range of credit structures based on relative value and execution.

Accessing the opportunities

Innovation in financial product design is also changing how investments are delivered to investors. Asset managers are working with institutional investors to design capital-efficient vehicles – such as rated note feeders, credit-protected wrappers and semi-liquid funds – that facilitate exposure to attractive credit segments while navigating regulatory changes. This includes the post-financial crisis reform of Basel III Endgame that increased capital requirements and improved risk management among financial institutions.

Public-to-private wrappers, meanwhile, allow capital to enter liquid assets on day one and migrate into higher-yielding illiquid assets over time. Open-ended evergreen funds, co-investment sleeves and hybrid structures investing in public and private assets exemplify how asset managers are delivering tailored solutions for their clients' specific requirements.

New vehicles that combine flexibility, yield and liquidity in a unified framework are gaining ground with private wealth clients. Preqin noted that the number of evergreen funds doubled in five years to 520 in 2024, representing net asset value of more than $350 billion, as asset managers offer private capital solutions to wealth investors. These fund developments are effectively democratising access to private credit, allowing high-net-worth individuals to participate in opportunities previously reserved for institutional investors.

Partnering for success

Asset managers and advisers will play a crucial role in helping clients navigate this evolving credit environment, from sourcing public and private market investments to analyzing the risks and return potential. The key lies in understanding each client's unique needs – from liquidity requirements and risk tolerance to income goals and tax considerations – and applying the full range of credit opportunities to build resilient portfolios.

The future of credit investing won't be about choosing between public and private markets, but about combining them strategically to create portfolios that seek to withstand market cycles over the medium to long term.

Find out more in The new architecture of institutional credit

Disclosures: This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Financial professionals should independently evaluate the risks associated with products or services and exercise independent judgment with respect to their clients.

Investors should be aware that alternative investments including private equity and private debt are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales and concentrated investments and may involve complex tax structures and investment strategies. Alternative investments may be illiquid, there may be no liquid secondary market or ready purchasers for such securities, and they may be subject to high fees and expenses, which will reduce profits. Real estate investments are subject to various risks associated with ownership of real estate-related assets, including fluctuations in property values, higher expenses or lower income than expected, potential environmental problems and liability, and risks related to leasing of properties.

Nuveen, LLC provides investment solutions through its investment specialists.

4613080

Bio: Anders Persson, CFA, is the fixed income chief investment officer and a member of the Nuveen Senior Leadership Team. He oversees all public and private global fixed income activities, including portfolio management, research, trading and investment risk management activities. Anders is also member of the Global Investment Committee and chairs the Global Fixed Income Investment Council.

Anders graduated with a B.S. from Lander College and an M.B.A. from Winthrop University. He is a member of the CFA Institute and the North Carolina Society of Security Analysts. Anders serves on the Board of the North Carolina Chapter of the Juvenile Diabetes Research Foundation.