Understanding and Measuring Risk

By: Lauren Gellhaus, Wilshire

While often thought of as something to avoid, risk is an inherent aspect of investing. Understanding risk tolerance, measures of risk, and effective diversification are crucial for optimizing risk-adjusted returns and avoiding pitfalls like DINO (Diversification in Name Only).

This is an excerpt from NCPERS Spring 2025 issue of PERSist.

We invest using insights from historical data, our understanding of the present, and our expectations for the future. However, risk exists because the future is unknown. Given the uncertainty of risk, it is important that investors understand their risk tolerance levels.

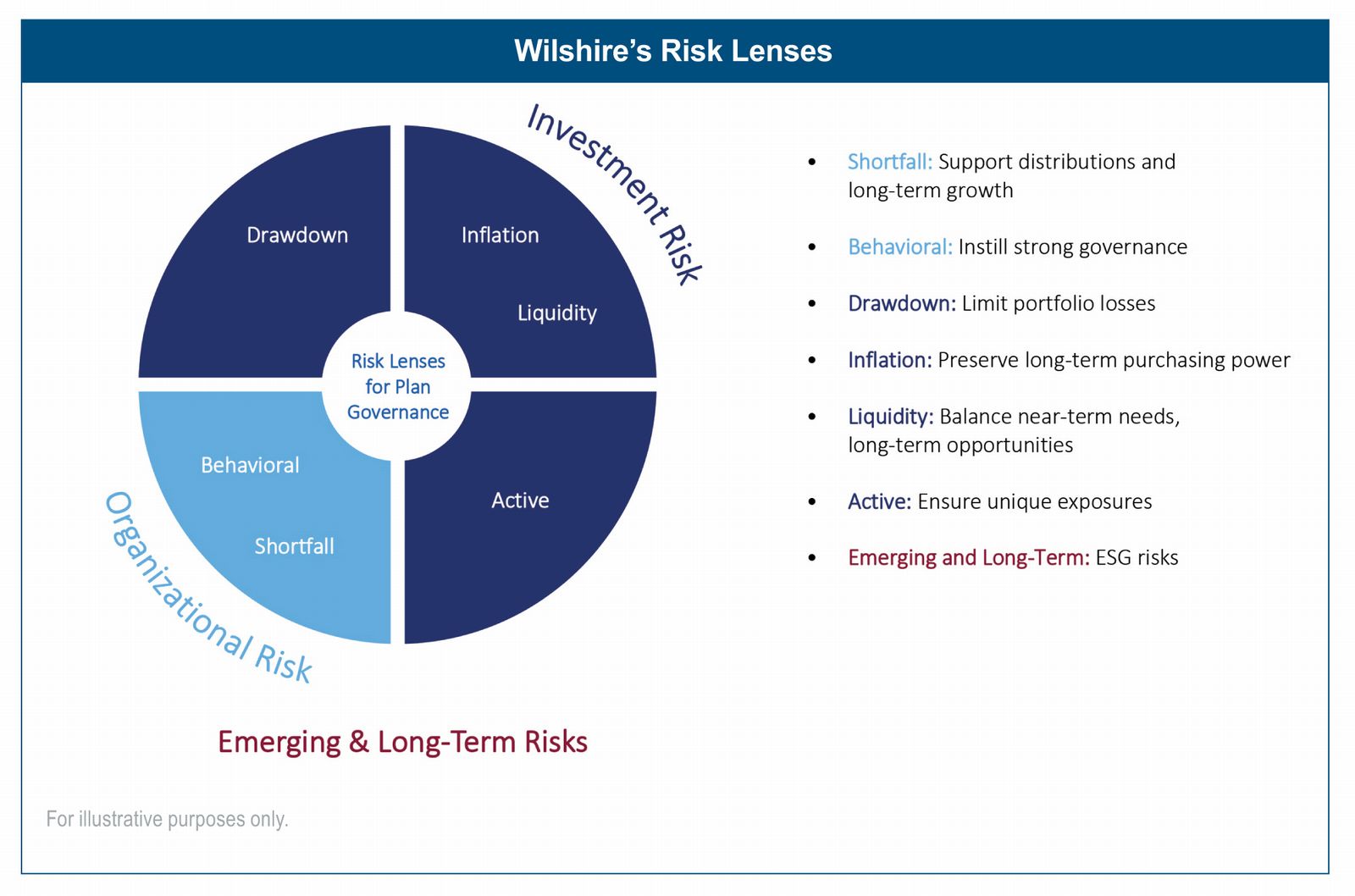

Risk Lenses

Risk is multi-faceted and can be viewed across a spectrum. Investors must consider how different risks influence performance, and boards must decide which guardrails are necessary to manage these risks, working with staff and consultants, and codifying governing document guardrails.

Tracking Error

Tracking error is either the realized or expected volatility of excess returns. Plans should only accept tracking error if: 1) they expect compensation through generating additional return, or 2) that risk is unavoidable to access the underlying beta.

When assessing risk, consider total fund tracking error or the aggregate active risk of all investments versus the strategic policy. This can, and should, be split up among the various stakeholders (e.g., decisions made by staff/board and decisions made by active managers).

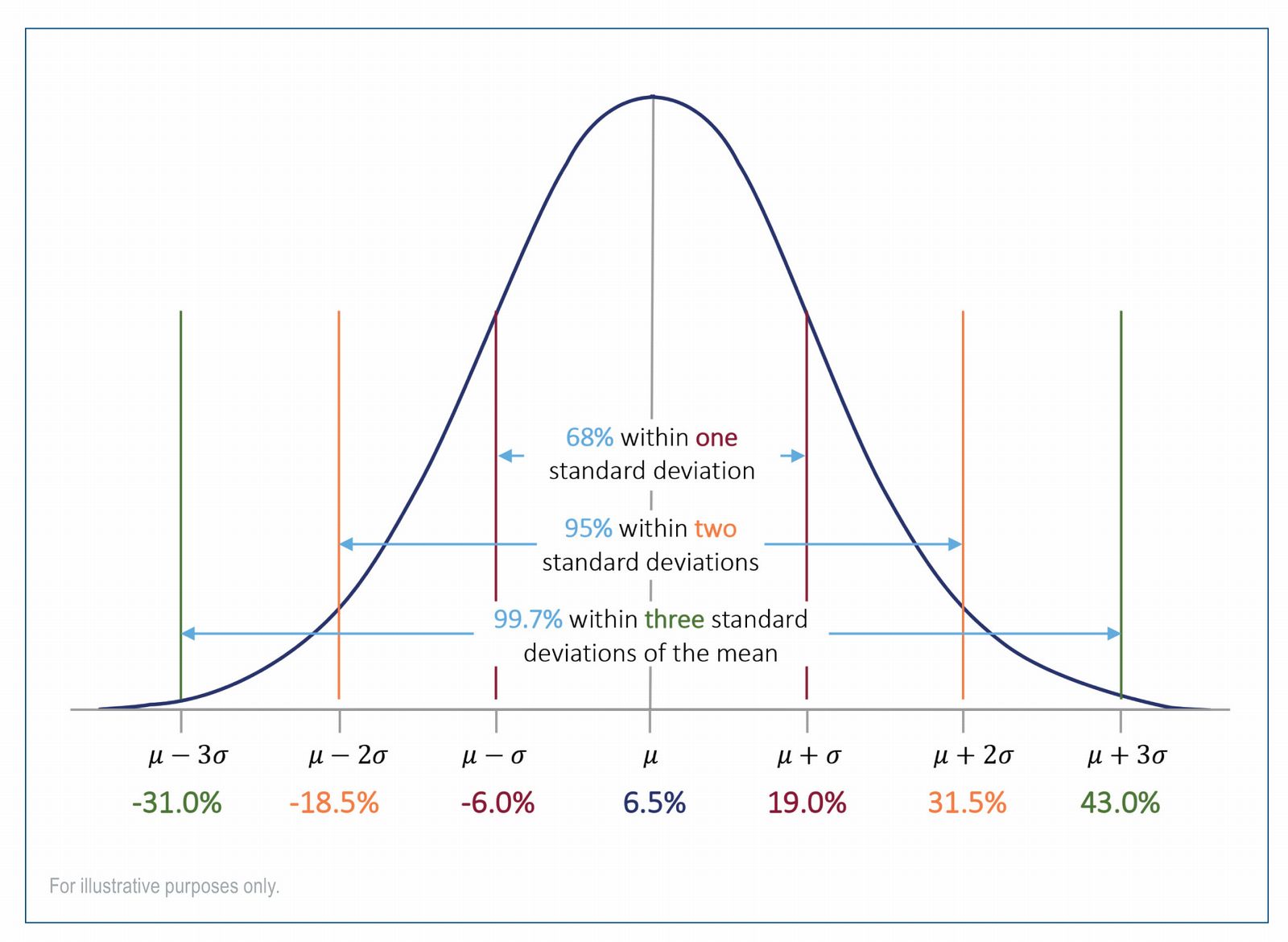

Standard Deviation

Boards should consider the range of outcomes inherent in adding risk to the portfolio, along with which risks and how much risk they are willing to endure. Standard deviation measures variation around a central point. In this case, the central point is expected return.

Value at Risk

Value at risk (VaR) and conditional value at risk (CVaR) methods are more complex and seek to link underlying risk factors to portfolio performance. Both VaR and CvaR require decomposition of portfolio performance into risk factors with stress testing and scenario analysis to assess risk under different market conditions.

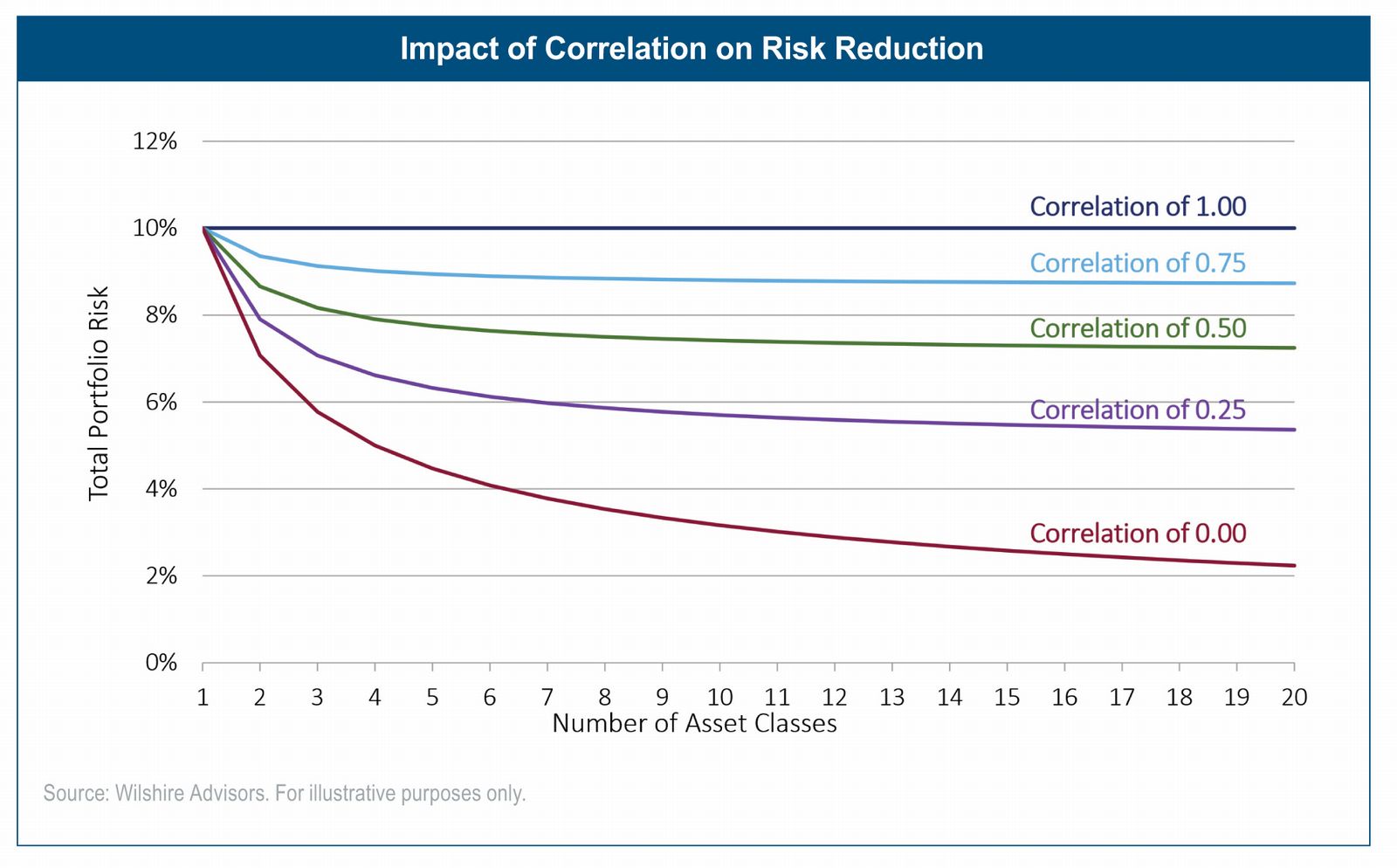

Diversification of Asset Classes

The importance of diversification stems from asset classes having different correlations – the movement of asset class returns in relation to one another. Increasing the number of asset classes across a portfolio can reduce total portfolio risk.

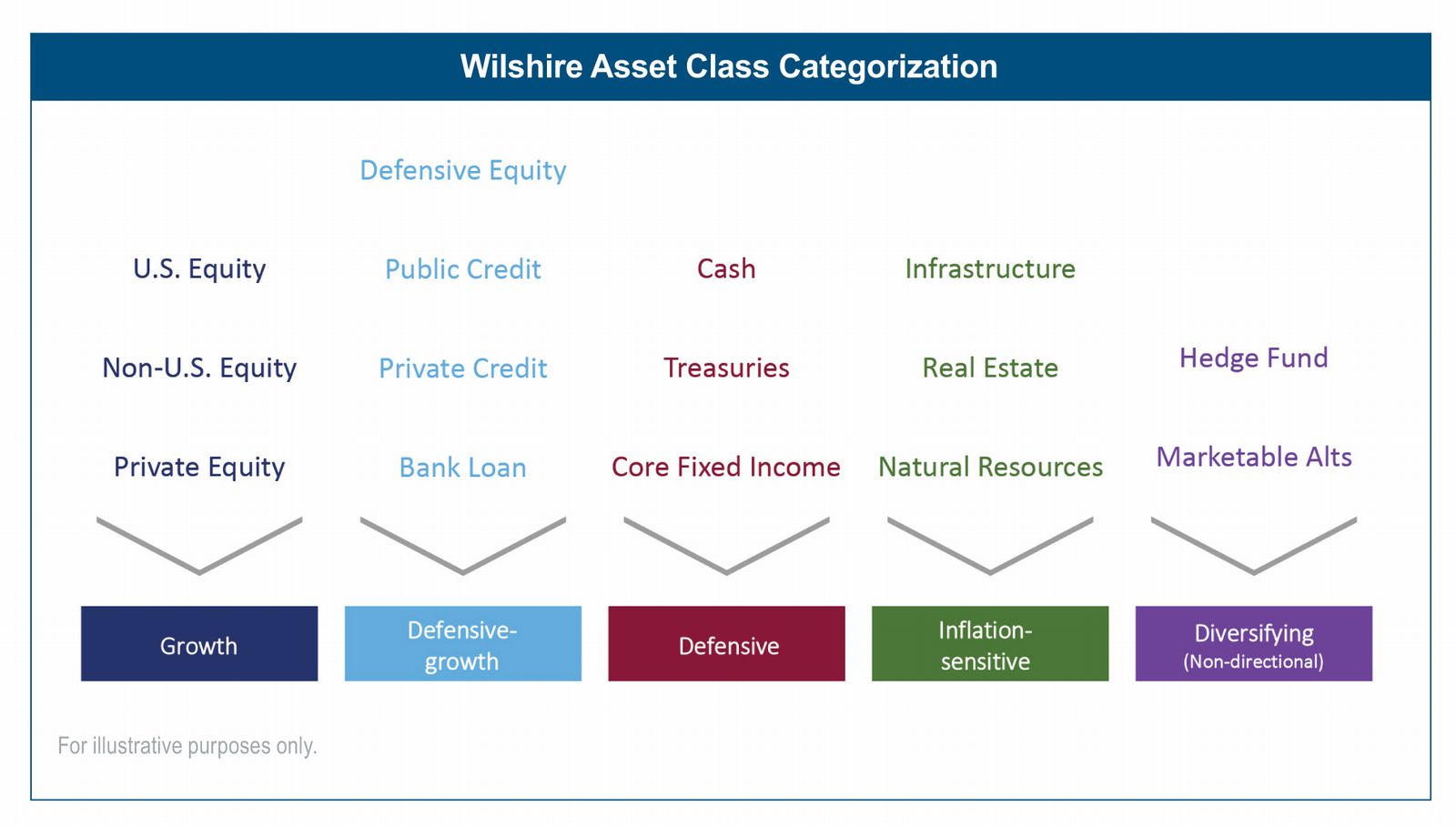

Investors should seek to avoid DINO, Diversification in Name Only. DINO occurs when adding an asset class increases the number of assets yet provides minimal portfolio benefit in terms of minimizing risk or enhancing returns.

Select asset classes from across the various buckets to help capture the benefits of diversification and avoid DINO.

Conclusion

While often viewed as something to avoid, risk is an important part of investing. Moreover, understanding risk is essential to achieving optimal risk-adjusted returns.

Disclosures: Wilshire believes that the information obtained from third party sources contained herein is reliable, but has not undertaken to verify such information. Wilshire gives no representations or warranties as to the accuracy of such information, and accepts no responsibility or liability (including for indirect, consequential or incidental damages) for any error, omission or inaccuracy in such information and for results obtained from its use. This material is intended for informational purposes only and should not be construed as legal, accounting, tax, investment, or other professional advice. Final terms set forth in a written agreement will prevail. Any charts, graphics, projections, and forecasts included in this Presentation are presented for illustrative purposes only, in order to provide information and context. None of the statements or information contained in this Presentation constitute investment performance, nor should the inclusion of any information be treated as indicative of, or a proxy for, the investment performance of Wilshire.

This material may include estimates, projections, assumptions and other "forward-looking statements." Forward-looking statements represent Wilshire's current beliefs and opinions in respect of potential future events. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual events, performance and financial results to differ materially from any projections. Forward-looking statements speak only as of the date on which they are made and are subject to change without notice. Wilshire undertakes no obligation to update or revise any forward-looking statements.

Bio: Lauren Gellhaus, CAIA is a Vice President serving on the client solutions team, focusing on pension plans and sustainability. Prior to joining Wilshire in 2022, Lauren was the head of environmental, social and governance (ESG) investing at the Teacher Retirement System of Texas where she developed the ESG strategic vision and roadmap for the investment management division's initiatives. She received her bachelor's degree in corporate finance from the University of Texas at Austin and is a CAIA Charterholder. Lauren has a certification in ESG investing from the CFA Institute. She also earned the Foundations in Responsible Investment certificate from the Principles for Responsible Investment (PRI).