Beyond Beta: Systematic Factors in 2026

By: Jordan Dekhayser, Northern Trust

Systematic factors such as value, quality, and momentum have historically provided resilient, diversified sources of return across global equity markets, especially during periods of market concentration and elevated valuations. For public fund investors, incorporating these factors into portfolio design can help address challenges of moderating beta returns and enhance long-term objectives through disciplined, risk-efficient strategies.

Entering 2026, equity investors are coming off three consecutive years of double-digit returns — driven by AI-fueled market dynamics, strong corporate earnings, and economic data that consistently exceeded expectations. Over this stretch, simply holding “the market” was enough to capture these tailwinds. Today, however, the backdrop looks very different: extreme concentration and elevated valuations set a challenging starting point. Investors now face the task of recalibrating beta return assumptions and identifying alternative sources of return—while remaining disciplined with active risk budgets. One approach that has quietly delivered over recent years, yet often goes overlooked, is systematic factors such as value, quality, and momentum.

Why Systematic Factors Now?

To navigate today’s market environment, investors are seeking strategies that offer well-researched return premia, resilience in a recalibrated return landscape, and a modest level of active risk. Systematic factors — when designed and implemented with risk efficiency — deliver on all these fronts. While beta has dominated the post-crisis era, history underscores the enduring importance of diversification. Beta will remain the primary driver of portfolio outcomes for pension plans, but incorporating factors such as value, quality, and momentum can help address the challenges outlined above. These factors have historically exhibited “preferred habitats” — market environments where their return profiles tend to be stronger — and many of these conditions may align well with the dynamics expected in 2026. For example:

- Value and Quality often shine in late-cycle or slowing growth phases.

- Momentum thrives in trending markets but can falter during leadership rotations.

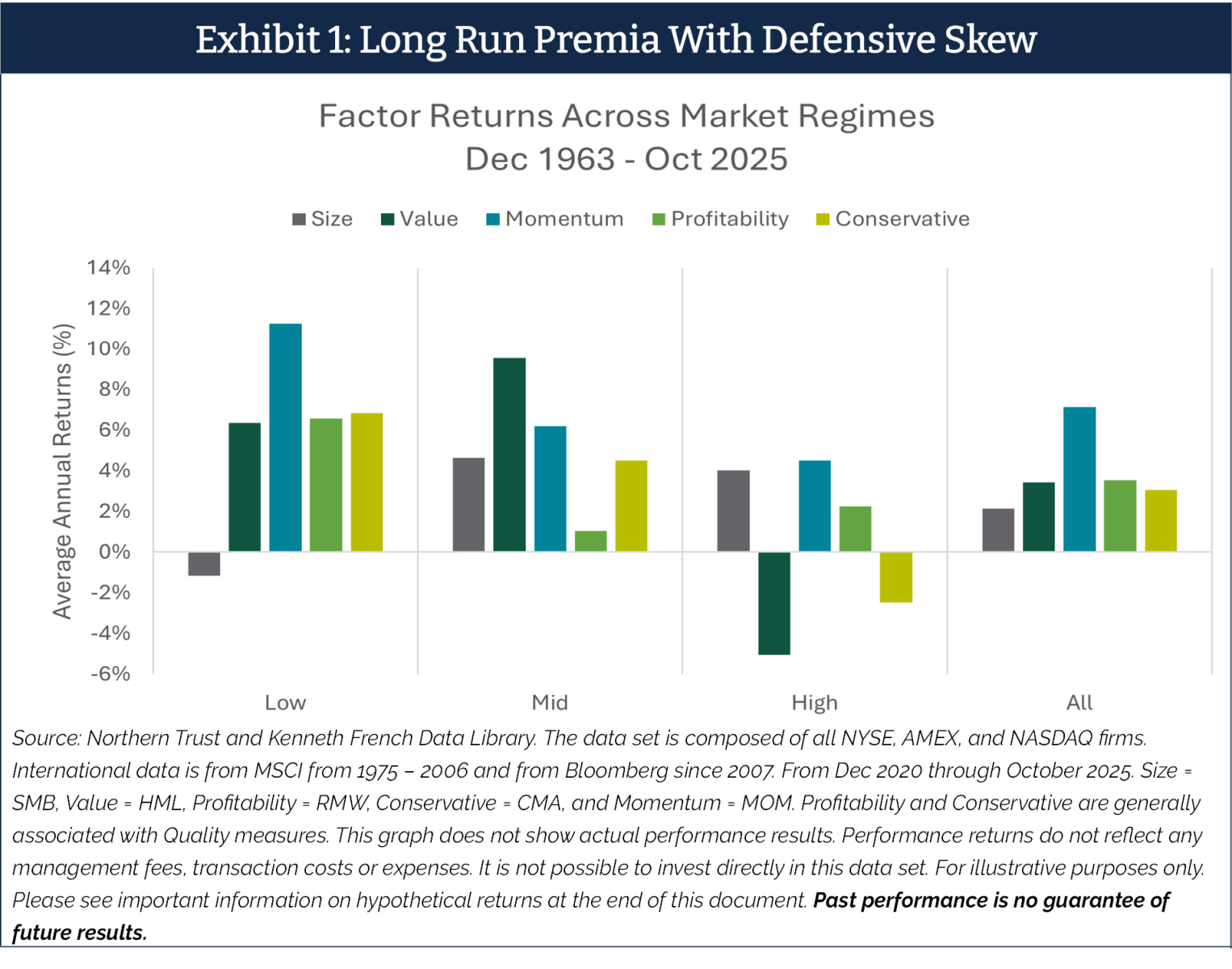

This regime sensitivity makes factors a powerful complement to traditional beta — especially when dispersion rises and macro signals turn noisy. Exhibit 1 illustrates how these factors have performed across different U.S. market return regimes. While aggregate performance is positive across all environments, factors have historically delivered particularly strong results during modest-return periods.

This analysis uses simple, single-characteristic metrics as evidence. A deeper discussion — beyond the scope of this paper — would explore advanced factor definitions that leverage traditional and alternative datasets, as well as sophisticated processing techniques to manage embedded risks.

As shown in Exhibit 1, long-term data tells a compelling story: since 1963, factors such as value, quality, and momentum have delivered strong performance across diverse market conditions. Most — excluding size — have even exhibited somewhat defensive characteristics. Should beta returns moderate in the coming years, these incremental sources of return are well positioned to help investors achieve their objectives.

What’s particularly encouraging is the recent history. Despite an environment dominated by exceptionally strong beta returns, factors have continued to deliver solid results—both in the U.S. and abroad. This resilience underscores their versatility and reinforces their role as a powerful complement to traditional beta. We explore this in more detail next.

Global Benefits: Resilience and Diversification

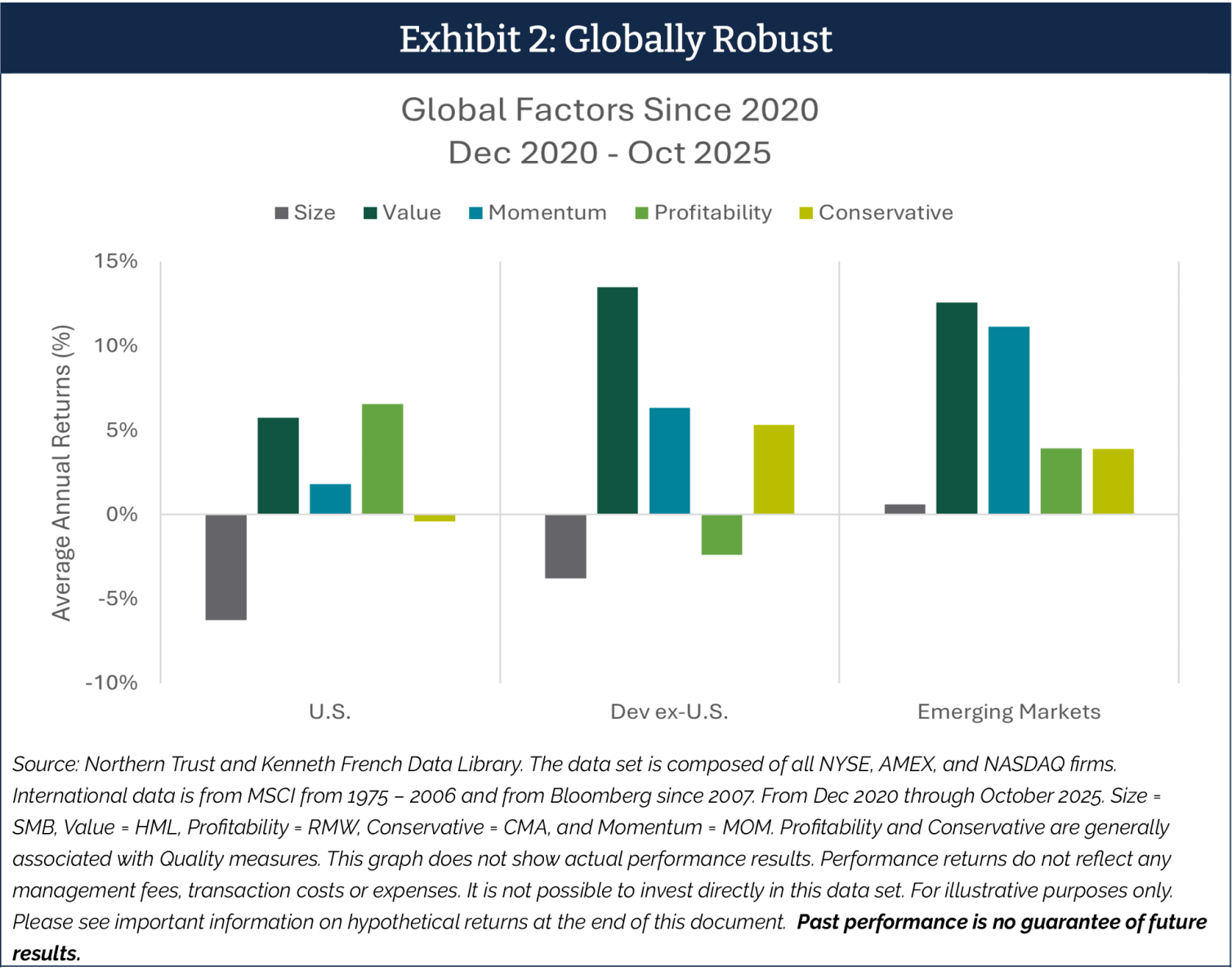

Over the past five years — since the moderation of the COVID crisis — systematic factors have delivered positive results globally. This strength is not confined to the U.S.; Developed Markets ex-U.S. and Emerging Markets have also seen meaningful benefits from exposures to quality, value, and momentum.

- Cross-Regional Strength: Value has delivered double-digit annualized returns outside the U.S. during a period dominated by growth stocks, while U.S. value posted solid mid-single-digit gains.

- Diversification Across Regions and Cycles: Factor performance does not move in lockstep across regions. Even the same factor behaves differently across markets, creating asynchronous return patterns that smooths portfolio outcomes and reduces reliance on any single regime.

These results are shown in Exhibit 2 and underscore a critical point: systematic strategies that harness factors can provide both return and diversification benefits. For pension funds seeking resilience, this global dimension is not just additive — it can be essential to achieving long-term objectives.

Strategic Implications for 2026

Recent equity strength may persist, but elevated valuations and record market concentration suggest a focus beyond beta is warranted. In this context, systematic factors offer a disciplined approach to portfolio construction. While many factors exhibit defensive characteristics, their utility extends beyond this property. They can help investors navigate a range of market environments. Finally, global diversification remains a key advantage. Factor cycles do not operate in lockstep across regions, and this asynchronous behavior can help smooth portfolio outcomes over time. For U.S. pension funds, the takeaway is clear: systematic strategies deserve renewed attention — not as a niche allocation, but as a core component of equity design.

About the author: Jordan Dekhayser, CFA is Head of Client Portfolio Management (CPM) Strategy at Northern Trust. Jordan has expertise in Quantitative and Index investing, innovation, portfolio construction, trading, ESG integration, and developing market insights.

Prior to this role, Jordan was a Senior Portfolio Manager and Lead Equity ETF Portfolio Manager where he led a team of portfolio managers responsible for a variety of index-based and quantitative strategies. Before joining Northern Trust in 2008, Jordan worked for Deutsche Bank as a sales-trader for the Global Equity Program Trading team where he covered US institutional clients trading global equities. Jordan has a Bachelor of Science in Finance from Rutgers University where he graduated in 2003 with Highest Honors. Jordan is a CFA Charterholder, and has a certificate in Applied Responsible Investment from the PRI. Jordan is a member of the CFA Institute and the CFA Society of Chicago. Jordan is a youth league sports coach for the Northbrook Park District and Northbrook Girls Softball Association. In his spare time, Jordan enjoys distance running, baseball (more watching than playing!), and reading.

Disclosures: IMPORTANT INFORMATION

For Use with Institutional Investors Only. Not For Retail Use.

This document may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of Northern Trust Asset Management (NTAM). The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc (NTI) or its affiliates. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

© 2025 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.