Capital at Sea: Navigating Downside Protection in Maritime Finance

By: Bryan Schneider, EnTrust Global

Maritime finance offers lenders a distinctive combination of downside protection, liquidity and high cash flow. Structuring senior secured loans as sole debt providers can allow investors to manage risk and capture attractive returns.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

Among the numerous dimensions of the value proposition, the downside protection inherent in maritime finance helps distinguish the strategy. Alternative credit providers to the shipping industry can take advantage of the disconnect between the significant annual capital needs and the limited availability of capital to structure senior secured loans with robust covenants, collateralized by liquid hard assets that are indispensable to global trade. By sourcing transactions on a primary basis and avoiding club deals, lenders benefit as the sole debt provider in customized SPVs, sitting at the top of the capital structure with first-priority mortgages over the underlying ringfenced collateral assets.

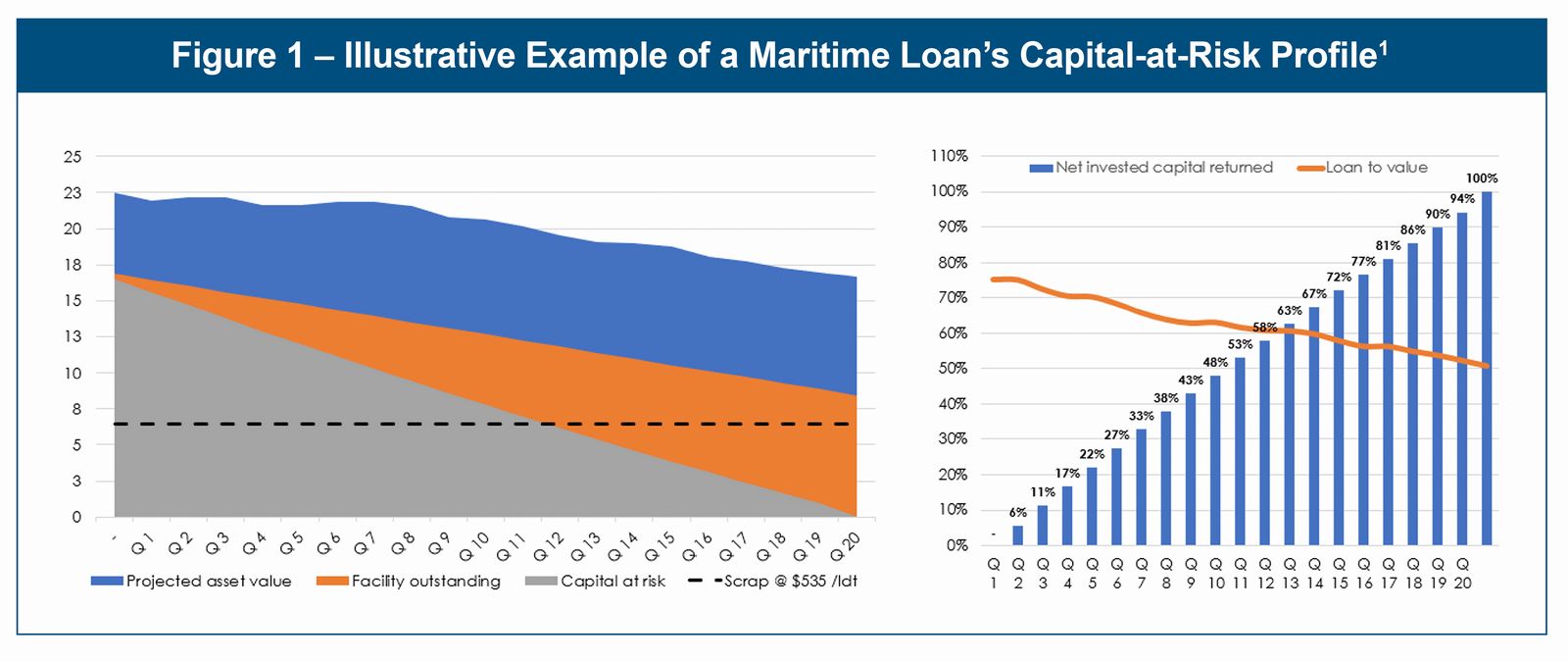

As a hard asset lending strategy, senior secured direct lending transactions in maritime finance are typically expected to generate substantial cash flow. On average, 15-20% of a lender's capital-at-risk is reduced annually through the receipt of interest, principal and fees. Typical structures for senior secured maritime loans can include:

- Interest rates in the low-to-mid teens (fixed or floating)

- 1-3% original issue discounts (“OID”)

- 50-80% loan-to-value (“LTV”) on collateral

- Back-end fees (fixed or variable)

- Quarterly amortization scheduled at a steeper pace than the underlying depreciation rate, increasing the probability of equity build over time

Together, these structures produce predictable cash flows that can rapidly reduce capital-at-risk, offering investors enhanced downside protection.

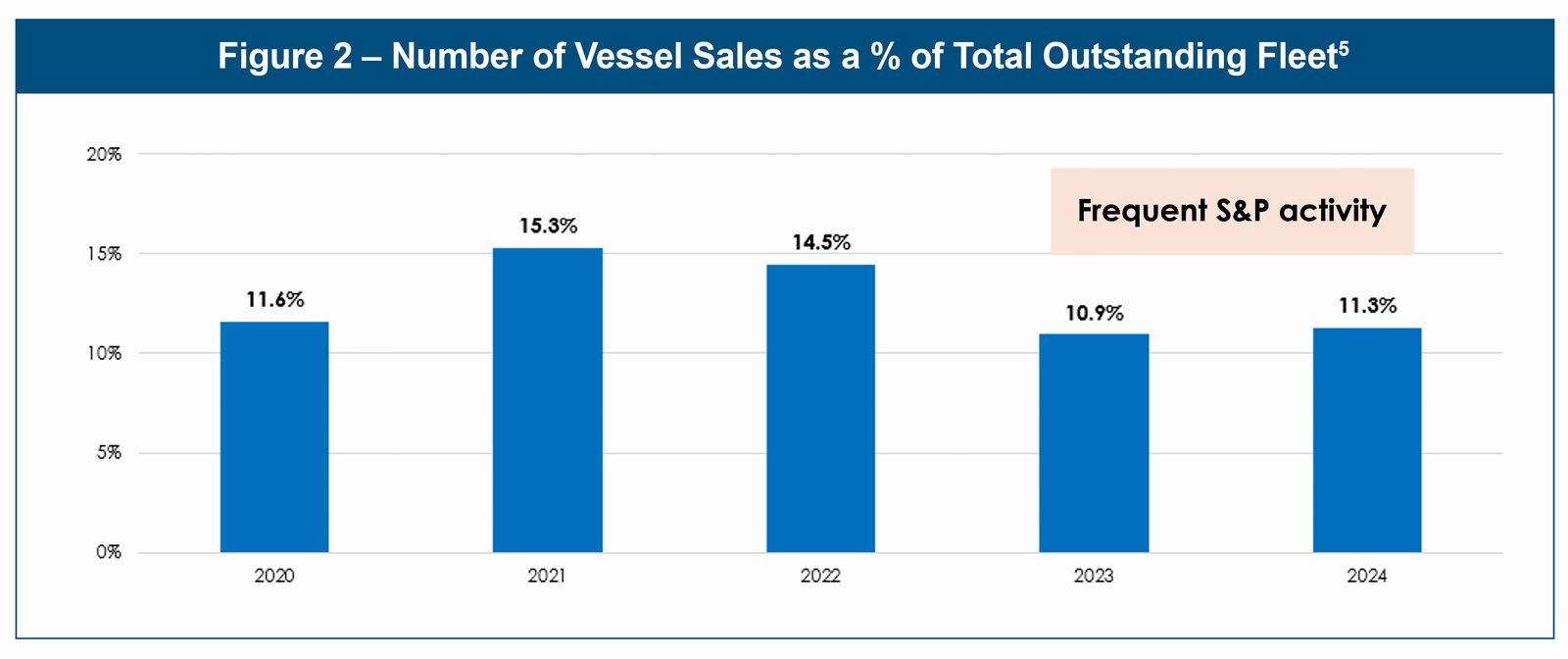

Understanding the credit-enhancing qualities of the collateral is an important factor in maritime finance. The global maritime industry plays a pivotal role in the worldwide economy, with 86% of world trade carried out by sea.2 The global shipping fleet is estimated to be comprised of ~120,000 vessels3 across more than 10 distinct sectors with a combined value of approximately $2 trillion.4 As an industry with centuries of history, it has a deep and liquid secondary market, which helps senior secured creditors to convert collateral into cash in the event of a negative credit development. From 2020 to 2024, 10-14% of the ~30,000 vessels in the dry bulk, tanker, containership and gas sectors changed hands annually, a turnover rate that represents 3-4x the liquidity of most commercial real estate markets. With its scale and global footprint, replacement risk for the shipping industry is considered low.

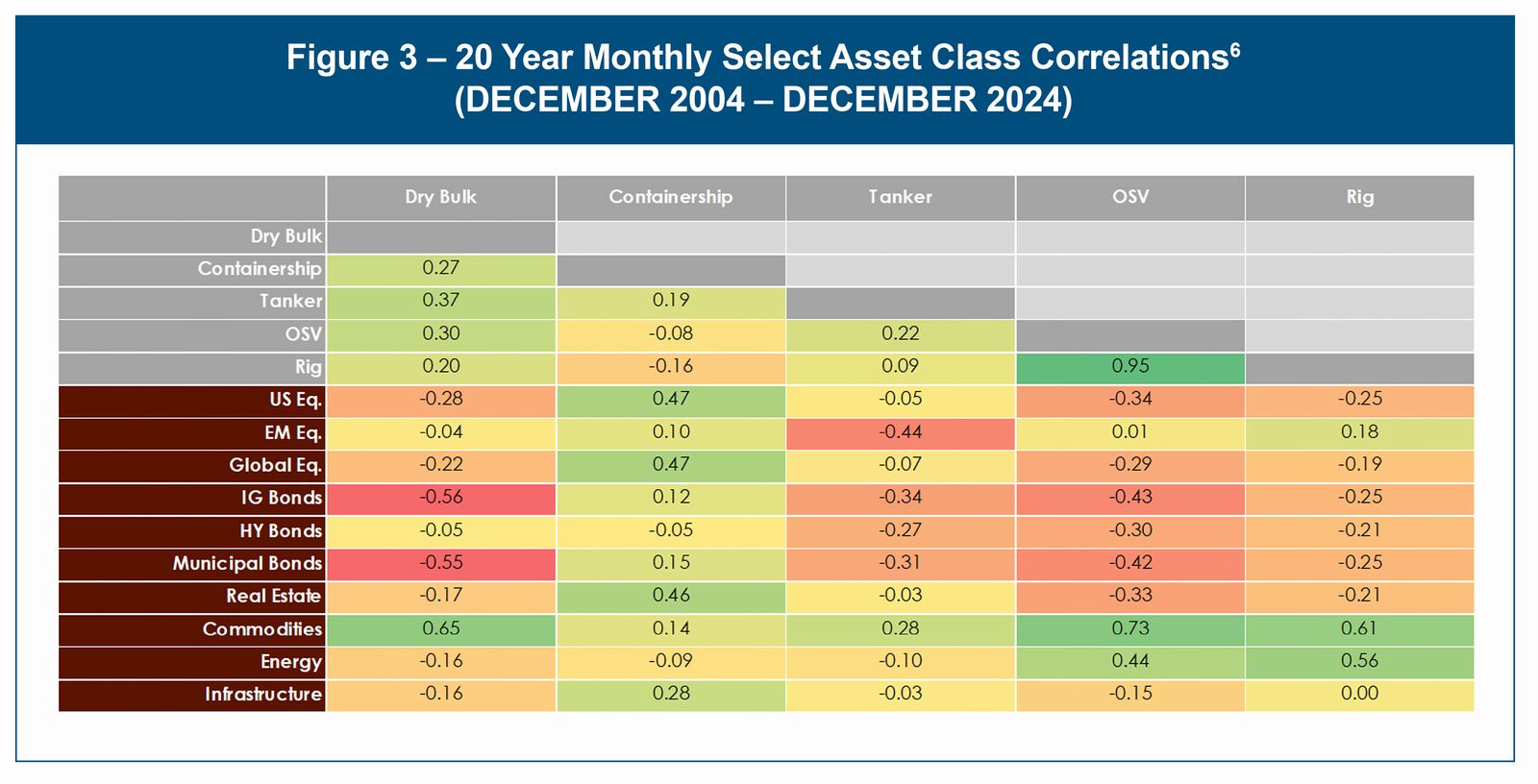

Another important tool that helps mitigate downside risk is recognizing the cyclical dynamics of maritime sub-sectors and establishing a framework for countercyclical capital deployment. Sub-sectors have historically shown low correlations to each other due to the sector-specific supply and demand factors driving the cash flow, earnings, and ultimate value of the collateral assets. Skilled investors who monitor these drivers can make calculated deployment decisions on a countercyclical basis and capitalize on opportunities that arise during different boom periods.

While trade volumes correlate with global GDP, maritime assets have consistently demonstrated a low correlation with other alternative investments, including real assets. This can allow investors to achieve meaningful portfolio diversification by allocating to maritime. Real assets are often grouped broadly, yet nuances exist: expected risk, return, yield and diversification can vary across categories. Within this landscape, maritime finance is differentiated by its yield potential, collateral strength and liquidity.

The characteristics of senior secured loans in maritime finance provide strong downside protection and should lower the probability of loss. The prevalence of high cash flows, collateralized by high-quality, liquid collateral assets, allows lenders to quickly reduce their capital-at-risk while maintaining confidence in hard asset coverage. Additionally, the ability for alternative lenders to structure senior secured loans as sole debt providers on a primary basis further supports their ability to take control of the situation in the event of a negative credit development. Together, these factors enable alternative lenders to participate in opportunities offering superior risk-adjusted returns.

Endnotes:

1 Assumptions: 2013-built, mid-sized dry bulk carrier, 75% LTV, 2.00% upfront and back-end fees, 12.00% fixed interest rate, and 10-year amortization profile.

2 Source: Clarksons Research Services, Seaborne Trade monitor, December 2024.

3 Source: Clarksons Shipping Intelligence Network – August 2025.

4 Source: VesselValues.com.

5 Source: Clarksons Shipping Intelligence Network – December 2024. Includes dry bulk, container, tanker, and gas vessel sales.

6 Source Maritime Sectors: Clarksons Research Services; Source Remaining Sectors: Bloomberg & FactSet. Statements regarding current conditions, trends or expectations in connection with the financial or shipping markets or the global economy are based on subjective viewpoints and may be incorrect. There is no guarantee that the investment objective will be achieved or that losses will not occur. Characteristics and performance of investments discussed herein are for illustrative purposes only; characteristics and performance of actual investments may vary. Correlation analysis and other measures presented herein are used for measurement or comparison purposes and only as a guide for prospective investors to evaluate the investment. The weighting of such subjective factors in a different manner would likely lead to different conclusions.

Bios: Bryan Schneider is a Senior Managing Director & Product Specialist at EnTrust Global on the Blue Ocean team. Mr. Schneider joined the firm as a Senior Vice President in January 2010 with 10 years of prior experience in the financial services industry. Before joining the firm, Mr. Schneider was a Senior Consultant at NEPC where he was responsible for overseeing more than $20 billion of client investments. Mr. Schneider holds a BA in Mathematics from Saint Anselm College and is a member of the Boston Security Analysts Society, the CFA Institute and holds the Chartered Financial Analyst designation.