Historical Impact of Real Estate on Investor Portfolio Returns

By: Nicholas Vician, TerraCap Management

This article discusses the current state of the commercial real estate market and why the reset pricing that has occurred over the past couple of years could present an opportunity to generate outsized returns in future years on investments that are made at the reset pricing. A brief history of the reason for the change in real estate values is reviewed, and there is a brief overview of how real estate has historically impacted portfolio returns.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

It is no secret that real estate has been under pressure over the past two years in the face of higher interest rates that the Federal Reserve raised to combat the historic inflation that occurred throughout 2021 and 2022. The reason this is important for real estate is because real estate prices typically move inversely to interest rates. In other words, when interest rates are low, investors can pay more for real estate since there is more property cash flow available for discretionary uses. Conversely, when interest rates are high, investors cannot pay as much for real estate since more property cash flow must be used to service debt as opposed to discretionary uses. While higher interest rates today mean that values of real estate are lower than they were three years ago, if history is any indicator, this could be considered an opportune time to buy real estate to generate future outsized returns in an investor's portfolio.

Many investors are familiar with the investment strategy of dollar cost averaging in the stock market, and when the stock market declines, many investors look at it as a good time to buy. The same investment strategy could be applied to real estate, if you believe in buying through cycles, including when asset prices could be at their lowest. When you look at the historical performance of real estate, some of the best buying opportunities have come from market corrections. For example, closed-end value-add real estate funds that invested coming out of the Great Financial Crisis in 2011, 2012, and 2013 outperformed the real estate funds that were launched in the subsequent 8 years through 2021.

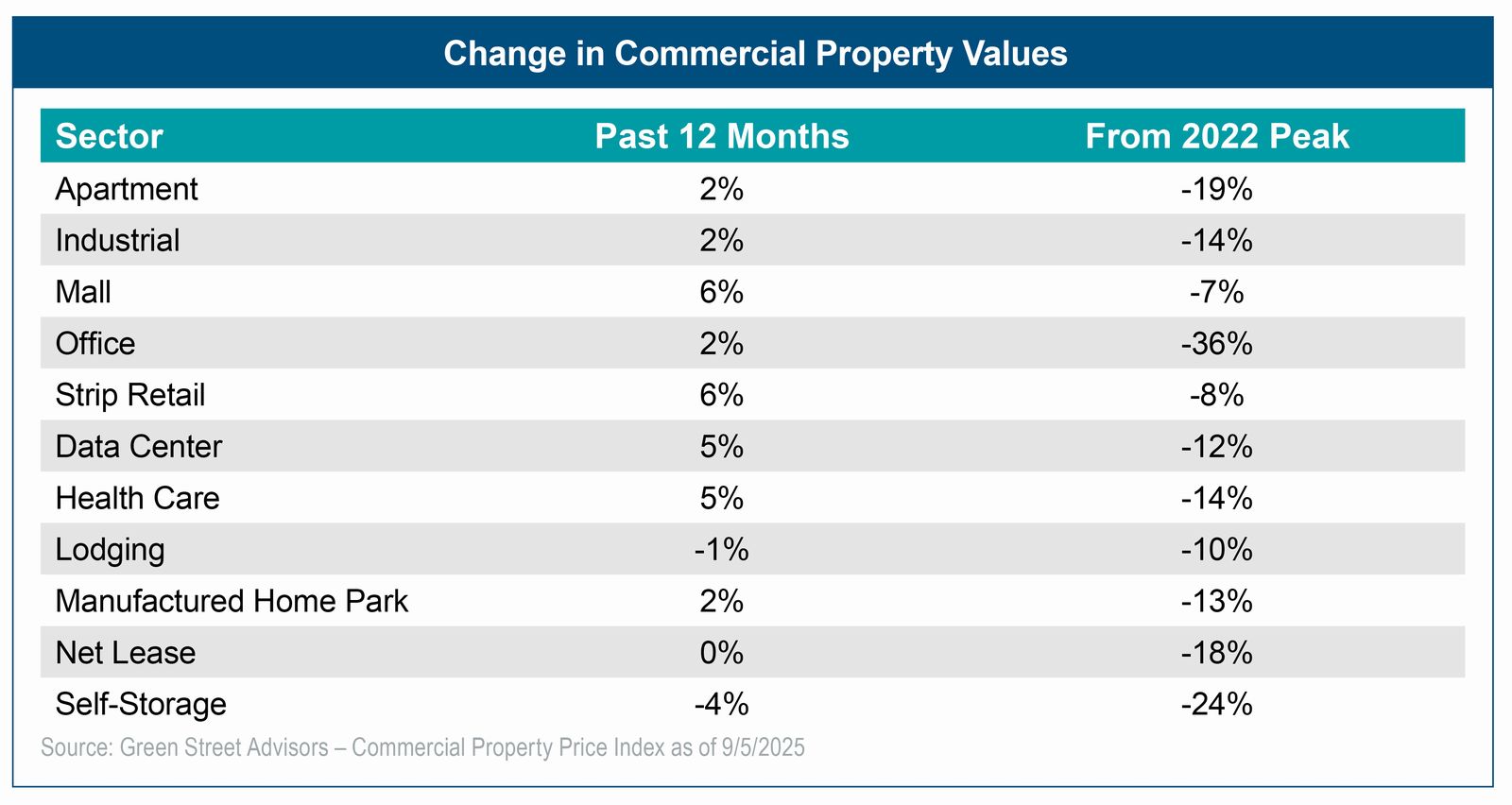

The current market correction that was primarily driven by the interest rate increases appears to have similarities to prior downturns, and this has created buying opportunities that could lead to outsized performance in future years. The table below shows commercial property prices over the past 12 months and the change from the 2022 peak pricing. As we can see, pricing is down today from the 2022 peak in all asset classes. The good news is that many asset classes have seen positive price improvements in the past 12 months. This appears to be an opportune time to buy real estate, as it seems we have reached the bottom in terms of pricing.

There is also empirical evidence that adding real estate to an investment portfolio of stocks and bonds has provided higher returns and lower volatility over the past 30 years compared to portfolios without a real estate allocation. In fact, if the real estate allocation increased from 10% to 15% in an investment portfolio over this period, the returns increased even further while volatility was also lower in this hypothetical portfolio. While there are both public and private real estate investment options, private real estate has historically had less volatility since the private markets are more immune to the daily, weekly, and monthly price fluctuations that can occur in the public markets.

Understanding that the real estate market has seen a correction over the past couple of years, and that investors with exposure to real estate have historically seen higher portfolio returns with a lower standard deviation than investors without a real estate allocation, many investors wonder where they should invest. At this time, identifying sellers that are under pressure and that own either relatively new real estate in good locations, or older real estate in irreplaceable infill locations that can benefit from repositioning could lead to buying opportunities that could generate outsized returns in future years. There are plenty of examples of apartment complexes that are selling for prices below replacement cost due to the fact that the owners are forced sellers. Buying properties below replacement cost gives an investor a defensive basis that can be rewarding once the market begins another upward trajectory. Most asset classes are cyclical, and having the conviction to buy at a time when prices are low has historically been the way investors have been able to earn outsized returns on their investment. Real estate has gone through a correction in the past two years, and the timing appears to be attractive to invest in real estate to earn outsized returns in the future.

Disclosures: The opinions expressed in this article?are solely those of the author and do not necessarily?reflect the views of TerraCap.

Bio: Nicholas Vician is the Managing Director & Partner at TerraCap Management, where he leads the finance, accounting, compliance, and human resources departments. Mr. Vician is closely involved in the overall portfolio strategy by leading research initiatives to define and refine sector and geographic targets for investment. In his role, Mr. Vician works closely with the investor relations, acquisitions, and asset management teams on various initiatives at the Investment Manager.