Compressed Growth Differentials Could Favor Non-US Equities

Date postedNovember 20, 2025

By: Alaina Anderson, William Blair

We believe several forces—tariffs that weigh on U.S. household income, shifts in fiscal and economic policy abroad, and evolving macroeconomic conditions—could compress growth differentials between the United States, Europe, Japan, and China. As a result, the valuation per unit of growth equation looks increasingly favorable for markets outside the United States, potentially supporting greater capital flows into non-U.S. equities.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

We believe several forces—tariffs that weigh on U.S. household income, shifts in fiscal and economic policy abroad, and evolving macroeconomic conditions—could compress growth differentials between the United States, Europe, Japan, and China.

Force No. 1: Tariffs

U.S. households are likely to bear the brunt of tariff-driven price increases, eroding purchasing power and curbing consumption. As tariffs broaden, domestic demand should contract more sharply than abroad, even as some non-U.S. markets benefit from offsetting tailwinds. The “Liberation Day” tariffs have pushed the effective U.S. tariff rate to levels last seen in the early 1900s, raising the risk of slower U.S. growth, stickier inflation, delayed rate cuts, and a weaker dollar. At the same time, retaliation and new trade barriers abroad will aim to block goods redirected from the United States, reinforcing a global turn toward protectionism and accelerating the fragmentation of global trade.

Force No. 2: Shifts in Fiscal and Economic Policy Abroad

Both Europe and China are recalibrating their growth strategies, offering potential opportunities for globally diversified investors.

European policymakers now frame weak growth as a security risk, spurring a shift from an export-led model toward stimulating domestic demand and attracting capital. Germany's suspension of its debt brake underscores this pivot, while policies encouraging joint ventures with Chinese firms could redirect capacity into Europe and contain inflation. At the same time, a weaker U.S. dollar has amplified losses on U.S. exposure, increasing the appeal of repatriating capital. These shifts are beginning to narrow the growth gap with the United States.

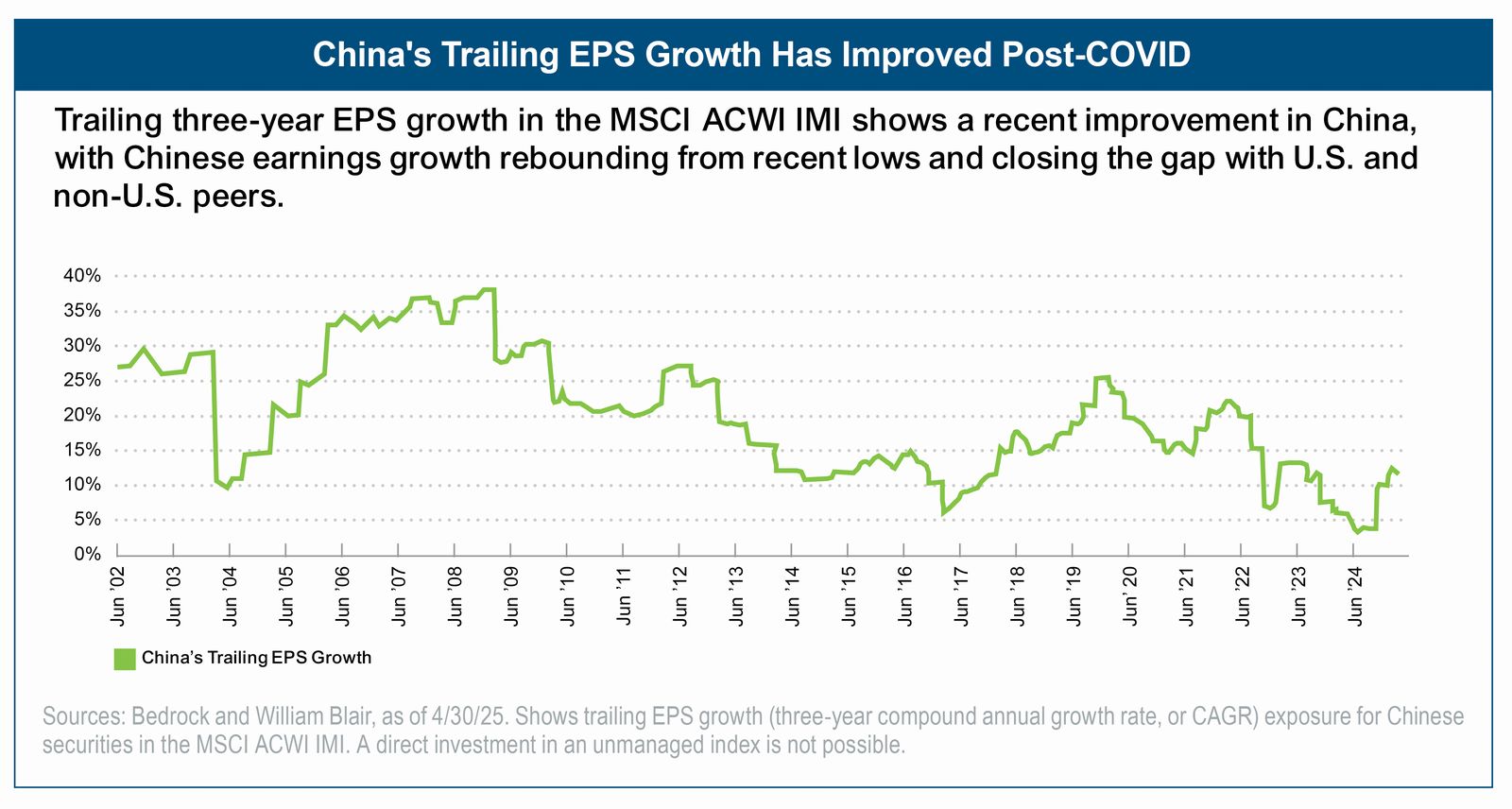

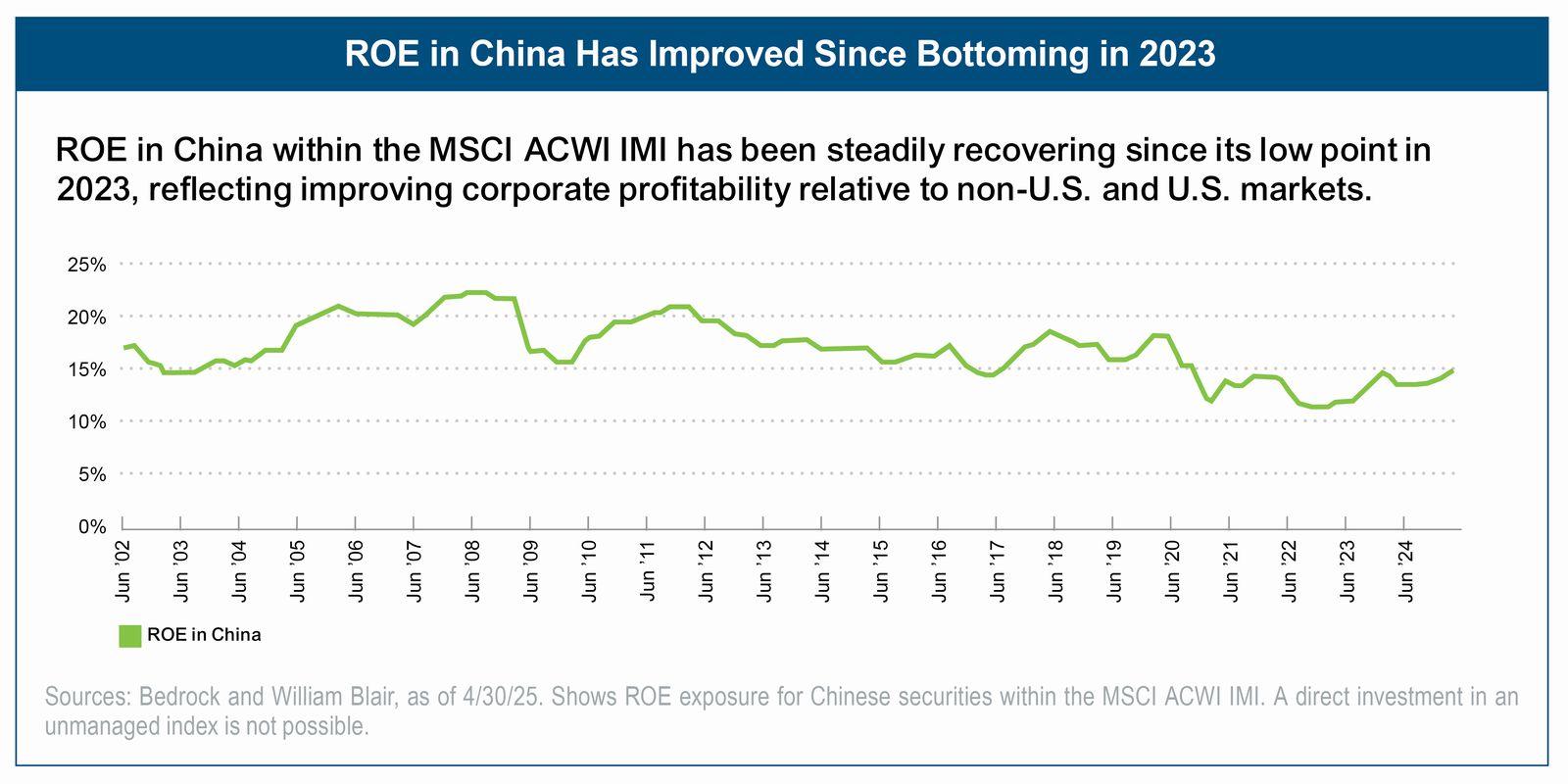

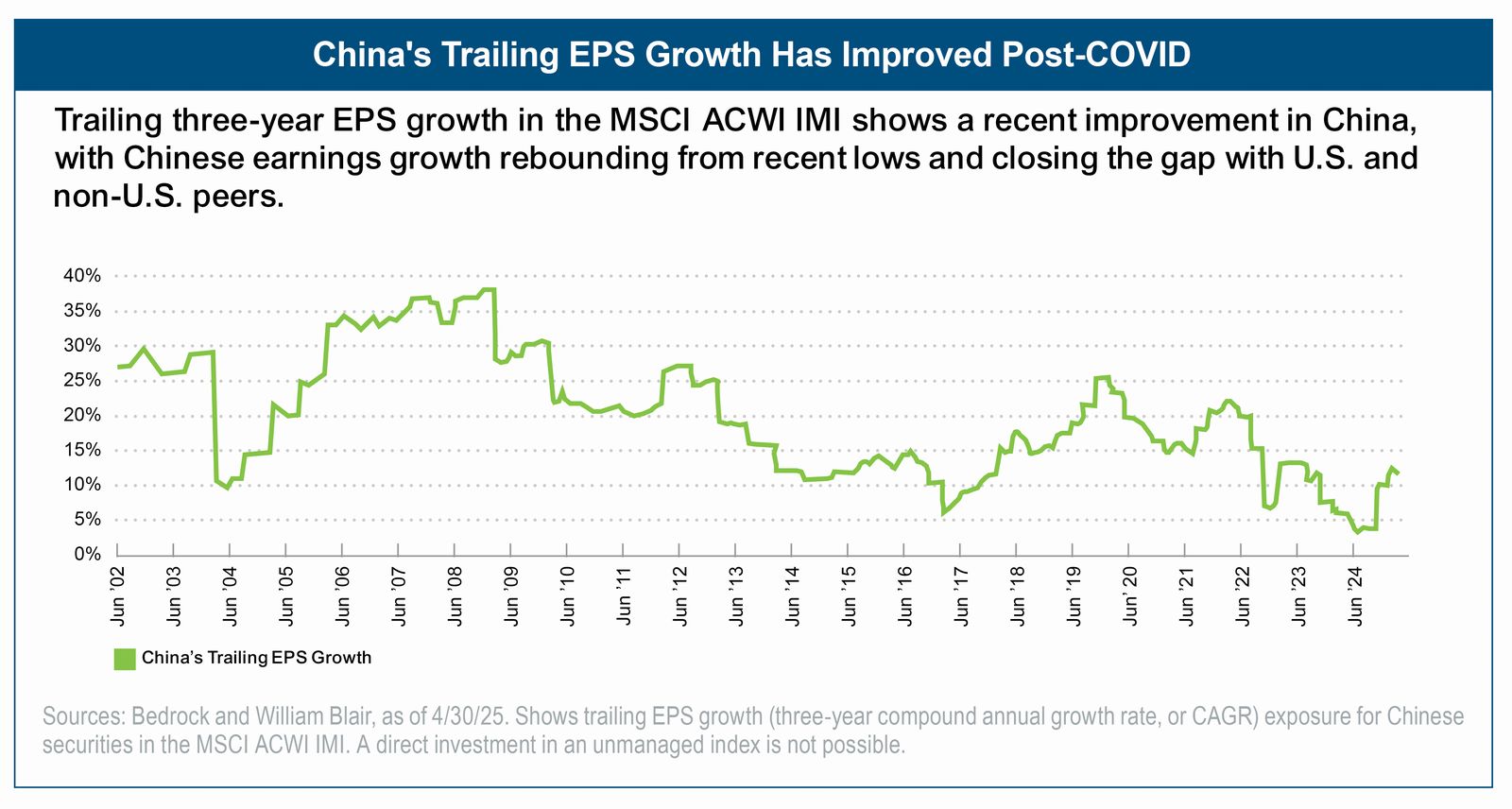

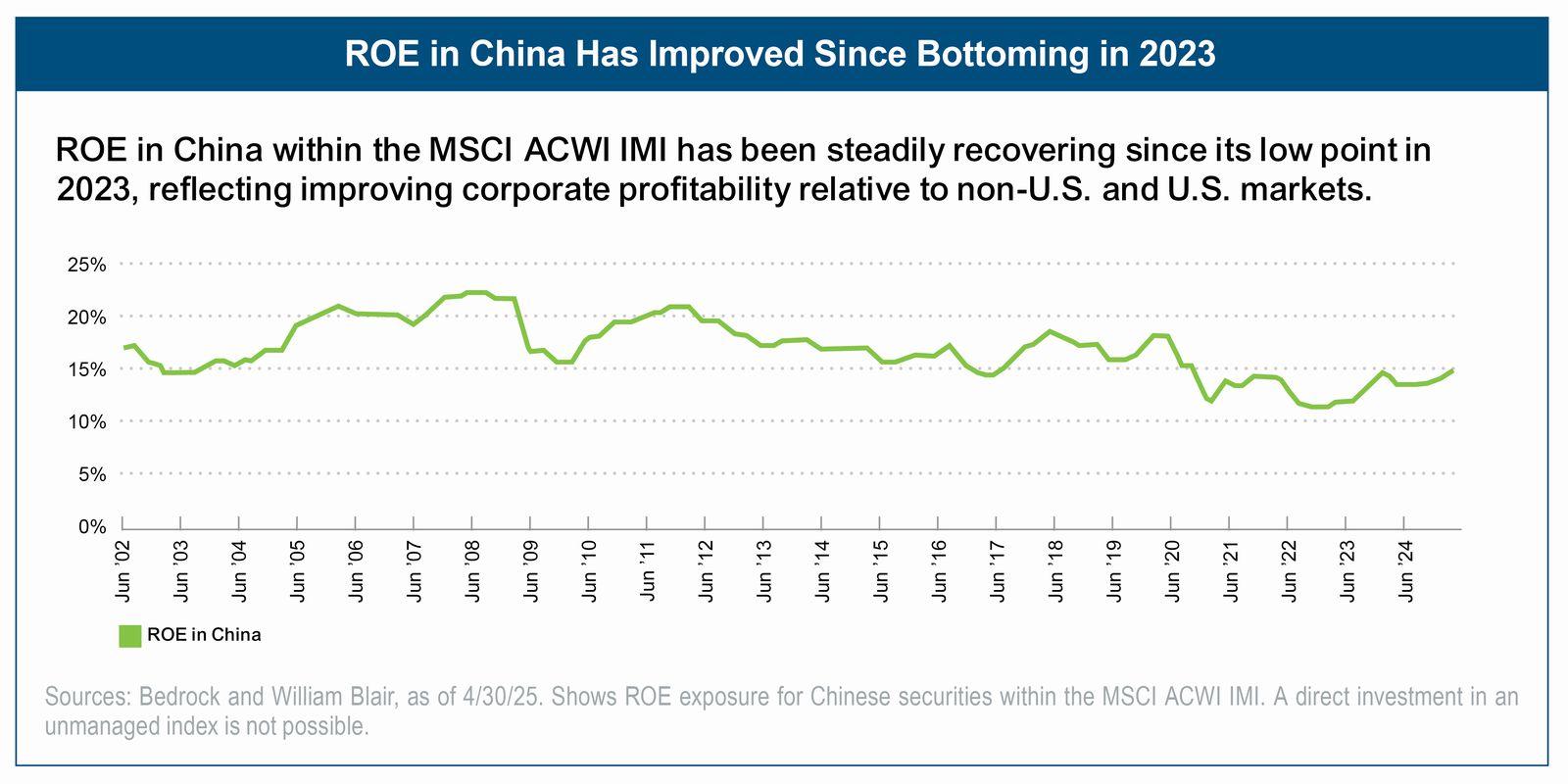

Beijing is addressing fiscal drag through local government support, bank recapitalizations, selective property aid, and targeted income programs—measures expected to lift GDP growth in 2025—while also pushing for greater self-sufficiency and industrial upgrading across autos, semiconductors, and consumer electronics. Beyond exports, domestic capacity is expanding: China now produces 400 billion semiconductors annually, its tech firms are gaining global market share, and U.S. reindustrialization could even create opportunities for Chinese companies to build capacity stateside. Earnings and profitability metrics have improved sharply since 2023, underscoring resilience in China's growth outlook and the strengthening leadership of its technology sector.

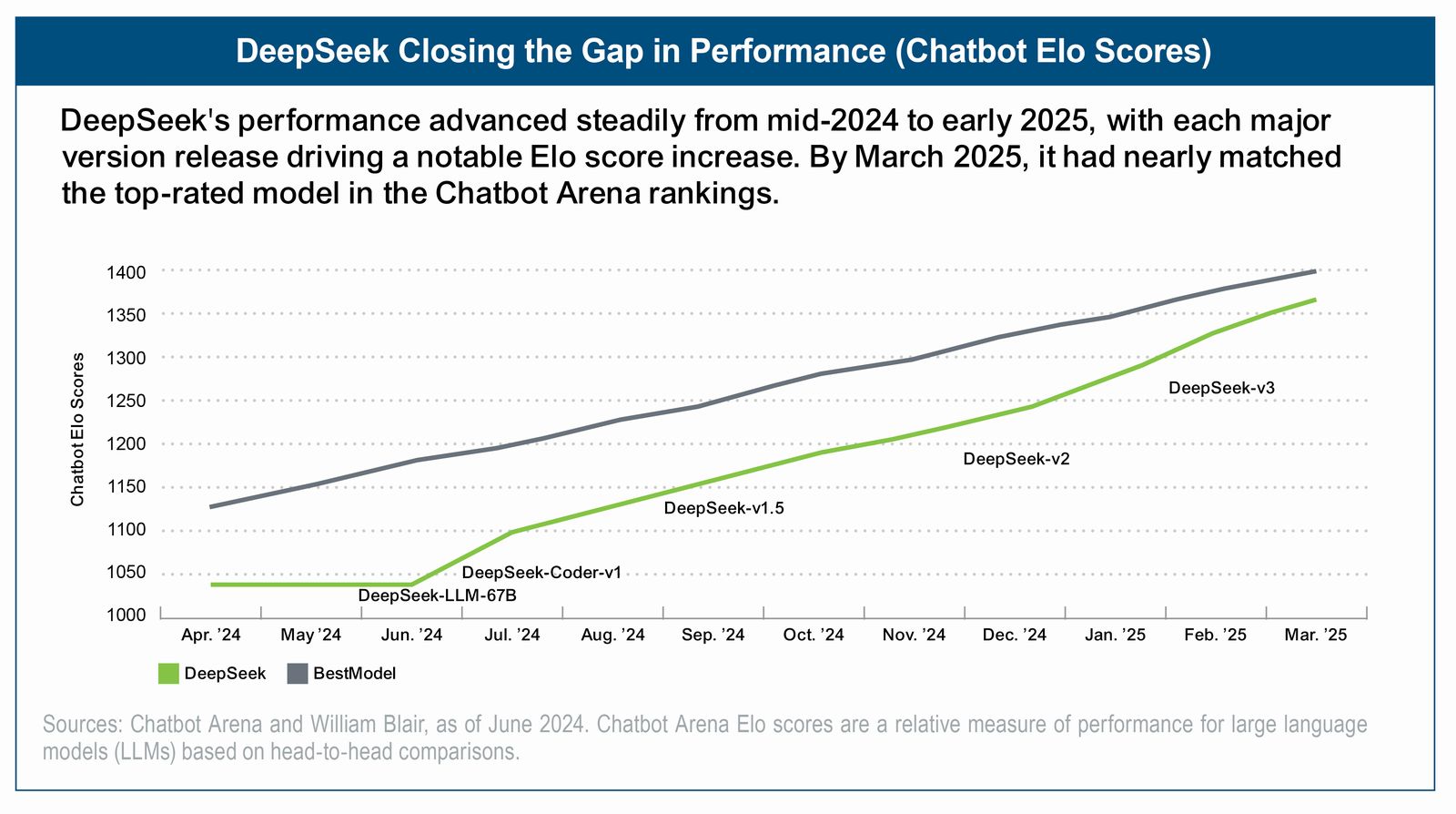

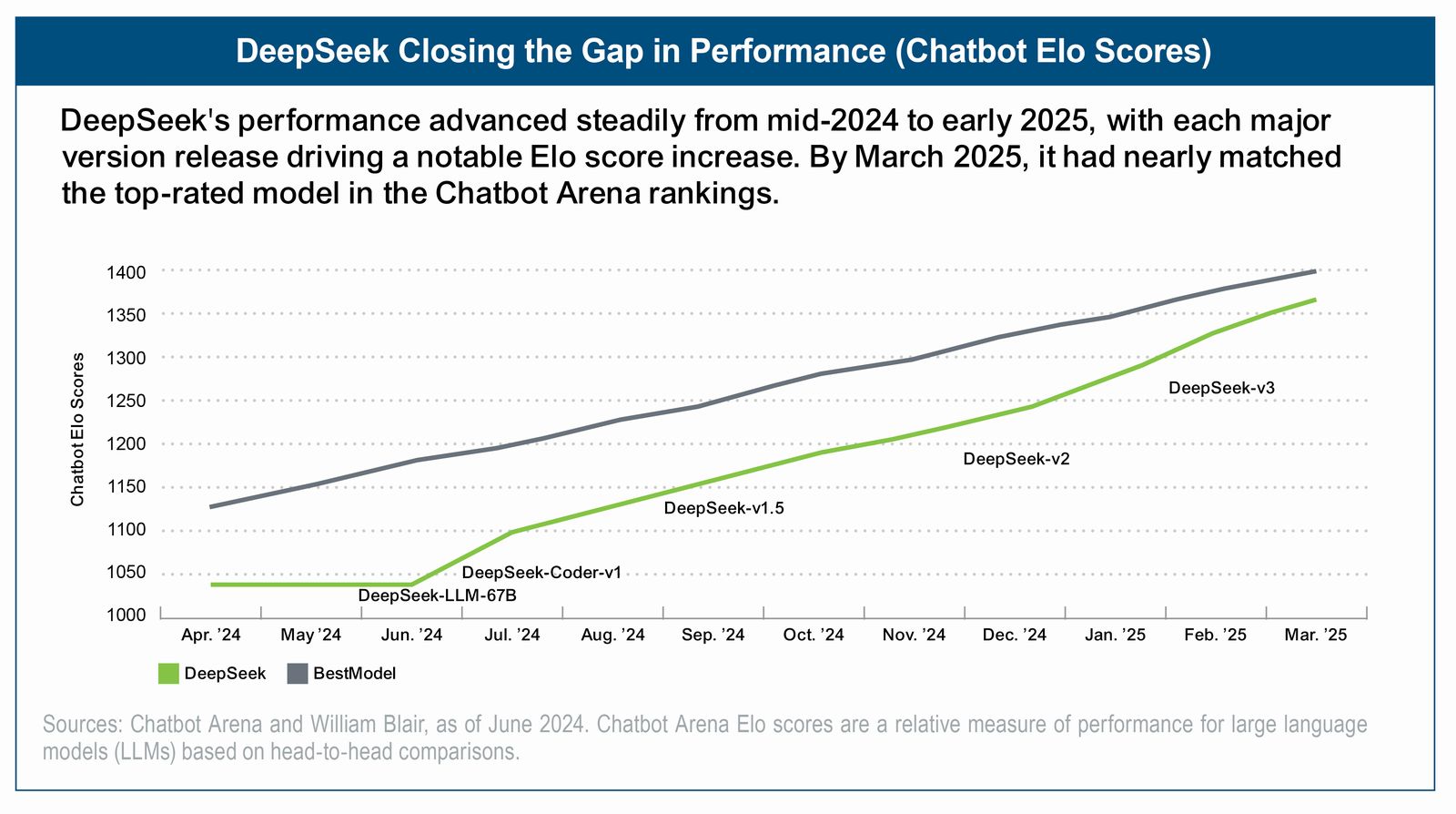

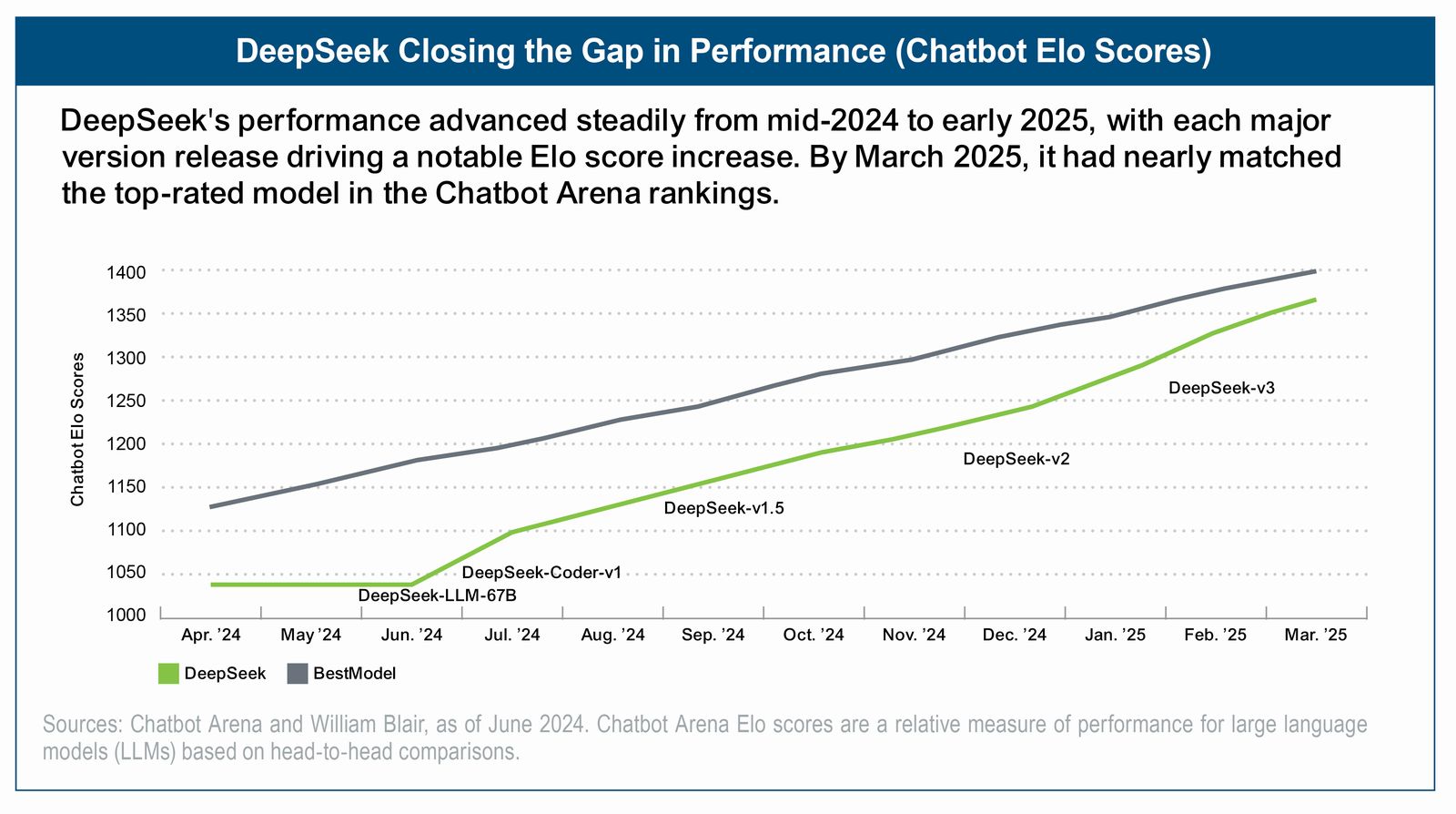

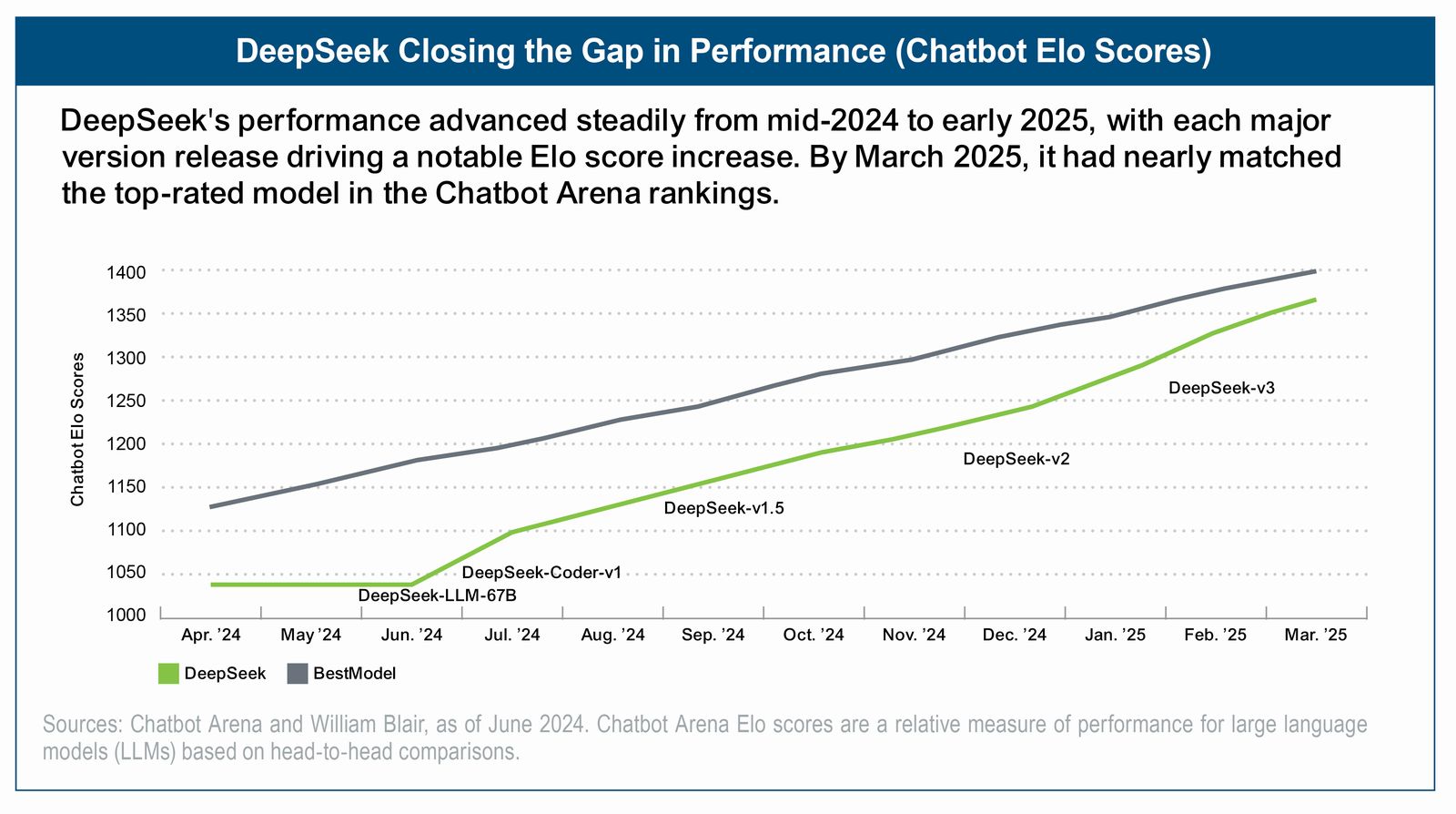

Innovation is another driver. The launch of DeepSeek's low-cost AI technology disrupted markets reliant on capital-intensive models, sparking a sharp de-rating in global semiconductor and hyperscaler stocks. Beyond AI, China leads in 57 of 64 critical technologies, up from just three in the mid-2000s.

Innovation is another driver. The launch of DeepSeek's low-cost AI technology disrupted markets reliant on capital-intensive models, sparking a sharp de-rating in global semiconductor and hyperscaler stocks. Beyond AI, China leads in 57 of 64 critical technologies, up from just three in the mid-2000s.

Both Europe and China are signaling stronger growth commitments through policy and innovation. For investors, the result may be new opportunities as earnings trajectories improve, capital flows shift, and technological leadership becomes more geographically dispersed.

Innovation is another driver. The launch of DeepSeek's low-cost AI technology disrupted markets reliant on capital-intensive models, sparking a sharp de-rating in global semiconductor and hyperscaler stocks. Beyond AI, China leads in 57 of 64 critical technologies, up from just three in the mid-2000s.

Innovation is another driver. The launch of DeepSeek's low-cost AI technology disrupted markets reliant on capital-intensive models, sparking a sharp de-rating in global semiconductor and hyperscaler stocks. Beyond AI, China leads in 57 of 64 critical technologies, up from just three in the mid-2000s.

Both Europe and China are signaling stronger growth commitments through policy and innovation. For investors, the result may be new opportunities as earnings trajectories improve, capital flows shift, and technological leadership becomes more geographically dispersed.

Force No. 3: Evolving Macroeconomic Conditions

Fiscal slippage in the United States, weakening demand for Treasurys, a softer U.S. dollar, and diverging inflation trends between the United States and Europe are reshaping the relative appeal of U.S. versus non-U.S. assets.

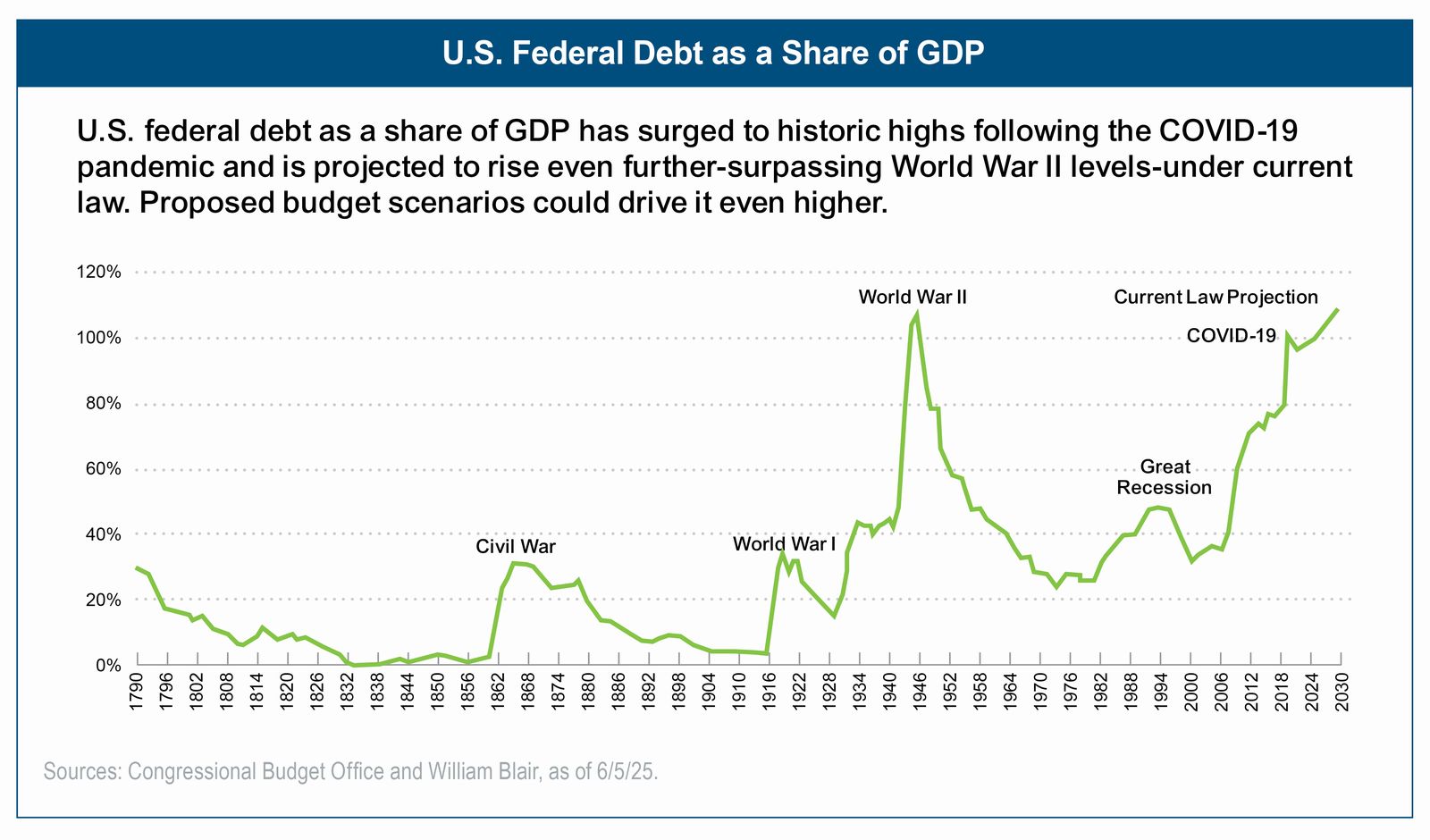

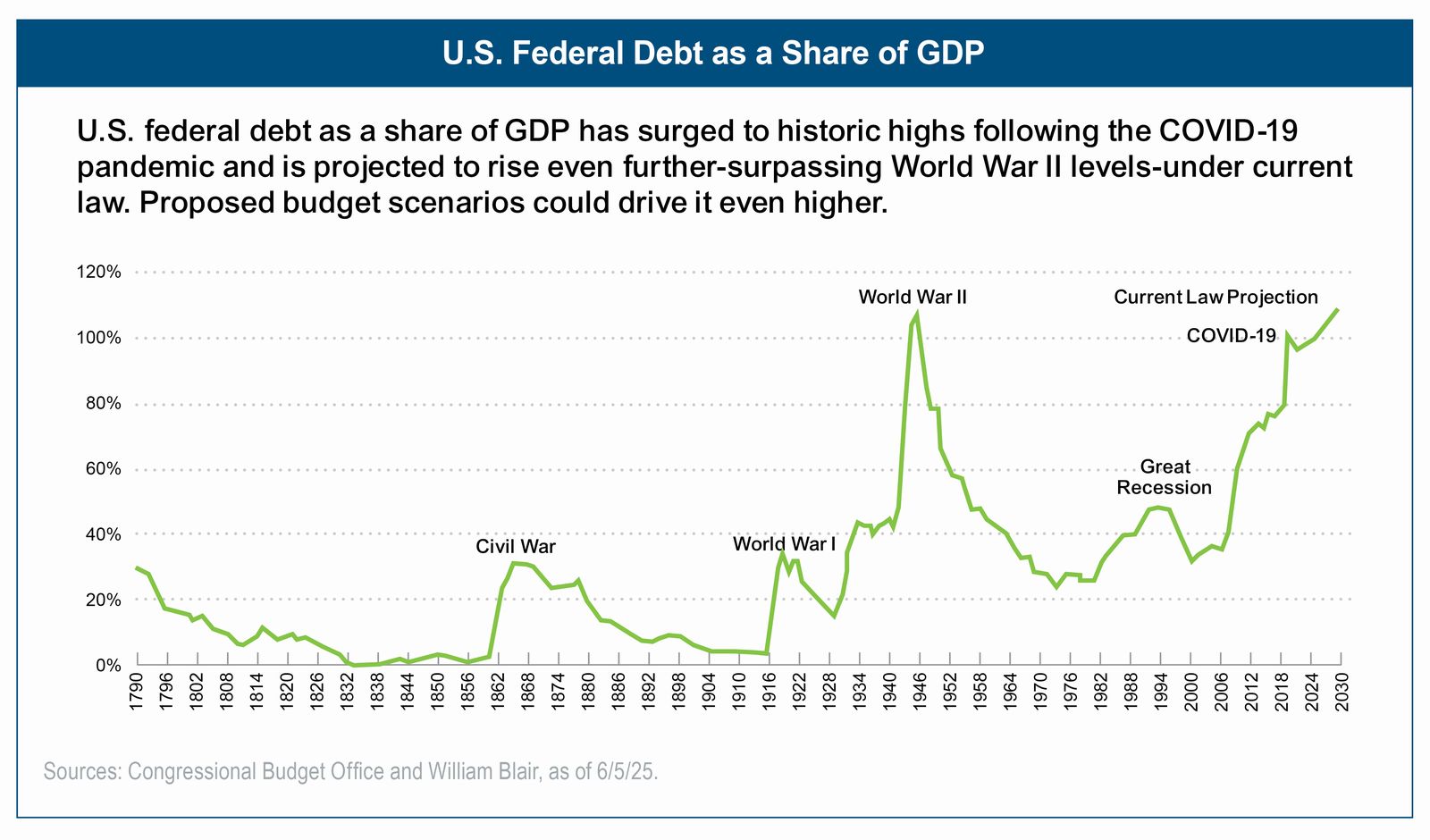

Combined with softening U.S. growth, a deteriorating fiscal outlook has eroded foreign investor confidence in U.S. assets, which is increasingly visible in the behavior of U.S. Treasurys and the U.S. dollar. As shown in the chart below, federal debt as a share of GDP is already at historic highs and is projected to climb further—surpassing World War II levels.

The steepening of the yield curve reflects not only fiscal worries but also waning demand for long-dated Treasurys and the recent Moody's downgrade. These dynamics suggest Treasurys may be losing their traditional safe-haven status, raising the likelihood of higher U.S. borrowing costs.

At the same time, America's sharp post-COVID fiscal deterioration and unpredictable trade policies point to a U.S. dollar that may have peaked. For U.S. investors, dollar weakness could provide a tailwind to non-U.S. equity returns.

Inflation adds another layer of divergence. Eurozone inflation has eased, while U.S. inflation remains sticky and could be aggravated by tariffs. This dynamic complicates the Federal Reserve's policy stance, while the European Central Bank may be positioned to remain more accommodative. Purchasing manager index (PMI) input prices reinforce this picture: euro-area costs fell sharply after the 2021–2022 shocks and have stayed subdued, whereas U.S. input prices have been climbing since late 2024.

As a result of these forces, we believe the valuation per unit of growth equation looks increasingly favorable for markets outside the United States, potentially supporting greater capital flows into non-U.S. equities.

This article is excerpted and condensed from a William Blair blog.

Bio: Alaina Anderson, CFA, partner, is a portfolio manager on William Blair's global equity team.