The Risk Exhaustion Regime Continues

Date postedNovember 18, 2025

By: Paul Moghtader and Jason Williams, Lazard Asset Management

We believe ongoing macroeconomic and geopolitical uncertainty is driving significant changes in investor sentiment — particularly in the United States, where performance patterns that once seemed unbreakable are being called into question.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

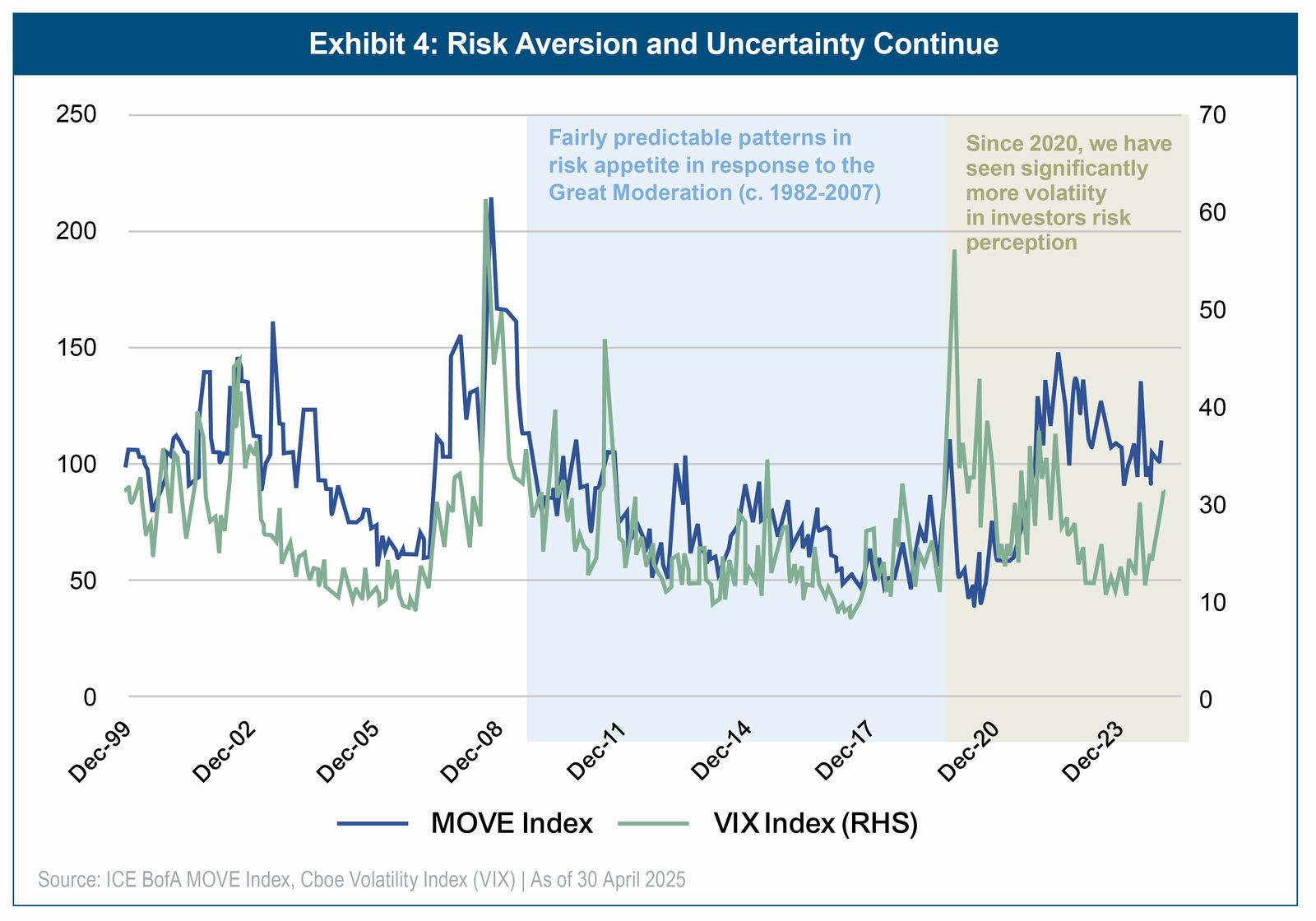

More than five years ago, the global pandemic ushered in a new era of risk exhaustion:1 an environment in which heightened macroeconomic uncertainty, volatile inflation, and fluctuating interest rates combined to make risk assessment significantly more challenging. 2025 marked a continuation of this regime, particularly in the United States, where a series of macroeconomic and geopolitical shocks called well-established, seemingly unbreakable performance patterns into question.

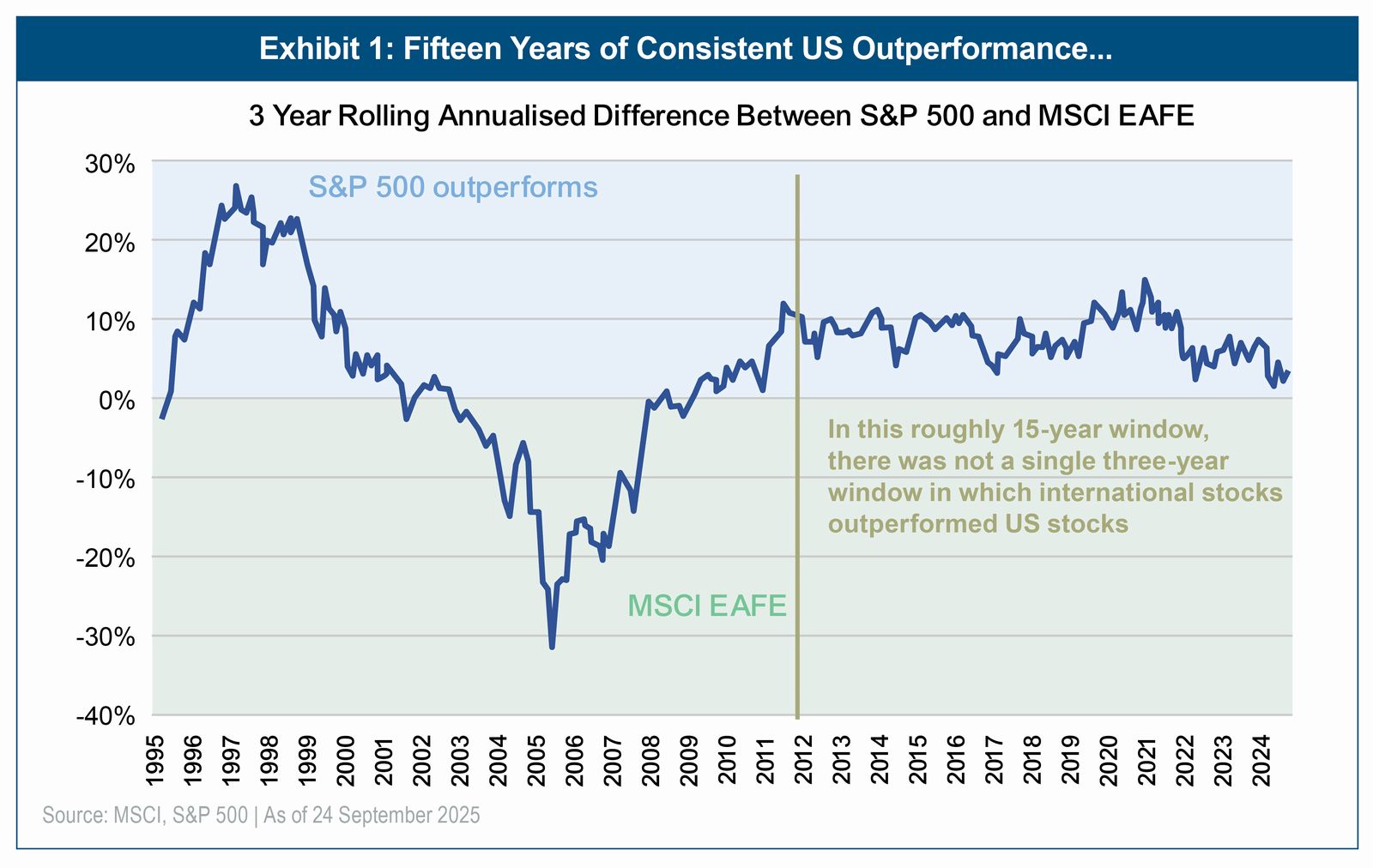

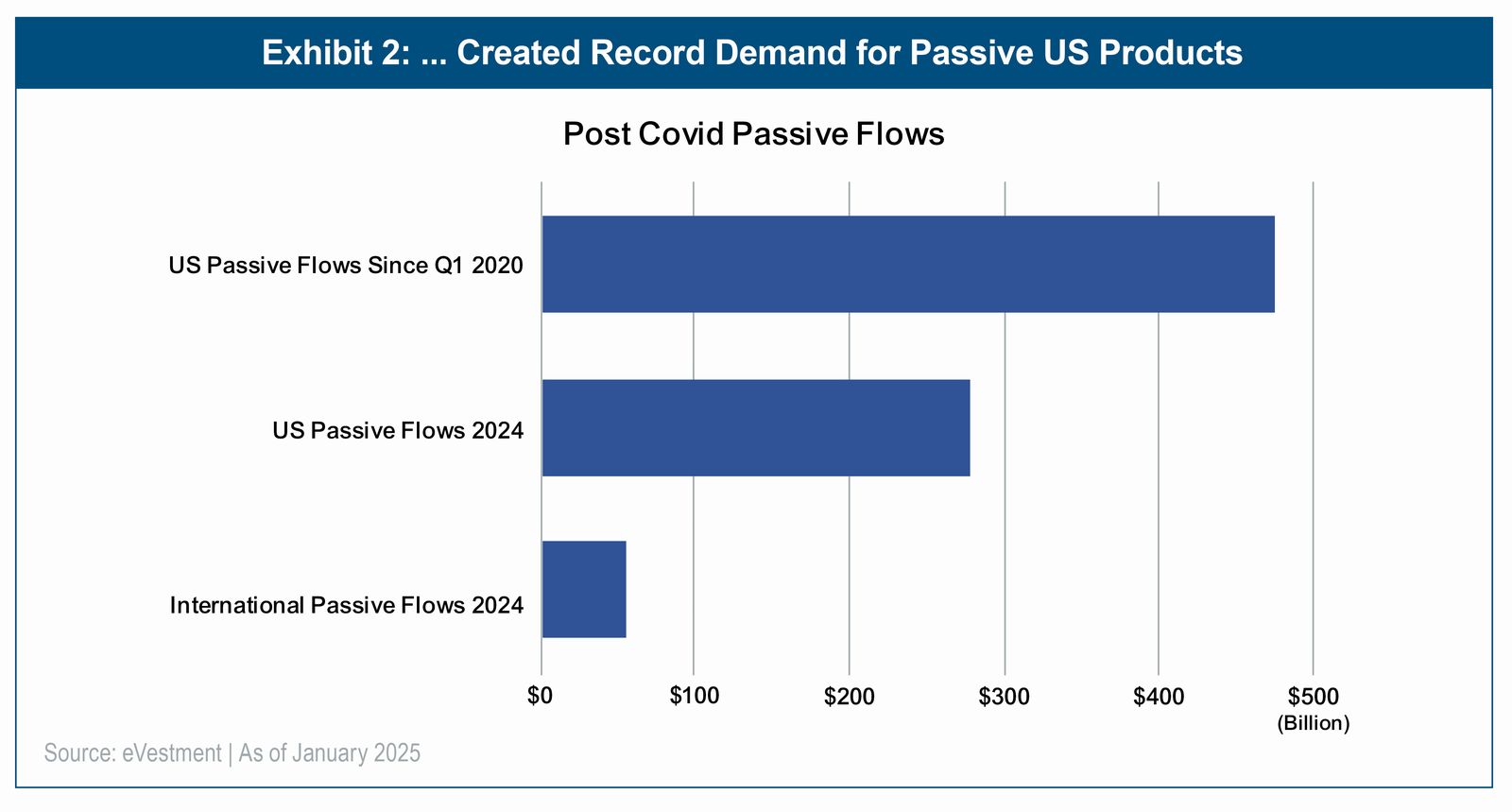

For the better part of two decades, US outperformance was the defining theme of developed markets. From 2009 to 2024, the S&P 500 outperformed EAFE by 8.1% on average each year—a notable departure from prior decades where the two regions delivered comparable annualized returns of approximately 9%. Even more remarkable was the consistency over time: from 2009 to 2024, there were only three years where US stocks underperformed international stocks (2015, 2017, 2022) and in each case, that underperformance was less than 3%.2 The three-year rolling difference between the S&P 500 and MSCI EAFE shows that at any given month-end in that fifteen-year window, a three-year buy-and-hold of overweighting US stocks and underweighting international stocks would have resulted in three years of mostly-significant outperformance (Exhibit 1). By 2024, the term “American Exceptionalism” had become common shorthand for the seemingly unstoppable rise in US stock indices3 and the lure of steady double-digit market returns created an extraordinary appetite for passive US products (Exhibit 2). Complacent faith in US growth had become so mainstream that t-shirts sporting the phrase “VOO and Chill”—meaning invest in Vanguard's S&P 500 ETF and sit back while steady, reliable returns accumulate4—could be found at Amazon and Walmart.5

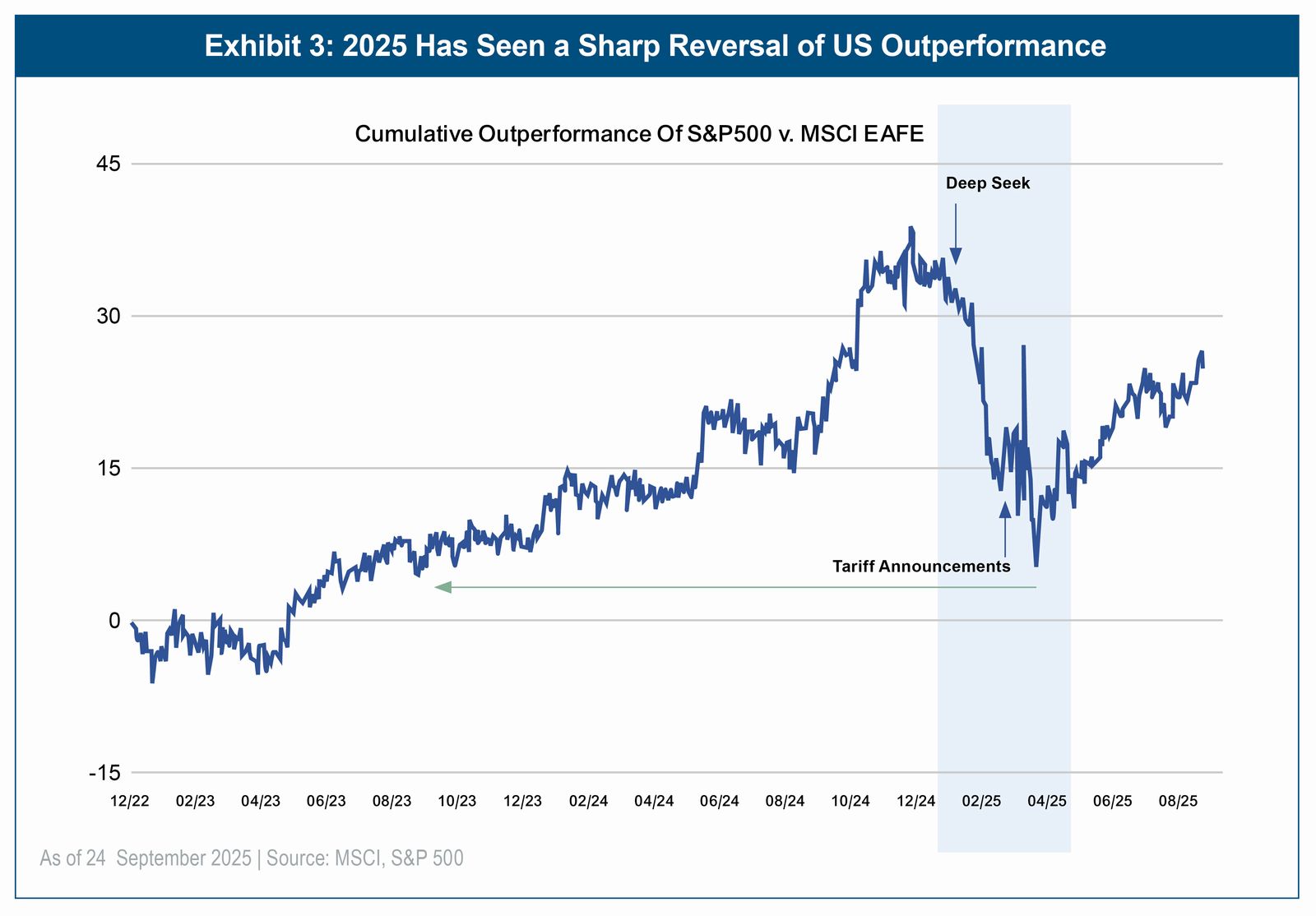

But in early 2025, the DeepSeek announcement and US tariff uncertainty caused sudden and sharp market movements that we believe represent an important shift in investor sentiment (Exhibit 3).

In January, the dominance of big US tech—which had driven much of the S&P 500's outperformance up to that point—was called into question when Chinese startup DeepSeek announced it was making significant strides in AI at a fraction of the cost to US competitors. In a single day, the share price of NVIDIA, one of the largest Magnificent Seven tech stocks, declined 17% and the Nasdaq lost 3%; in a week, the S&P 500 declined 1.5%. Within a month, the Philadelphia Semiconductor Index (SOX), which tracks the 30 largest American semiconductor companies, unwound almost all of the outperformance it had enjoyed since the end of 2022. More volatility followed in the second quarter, when the 2 April announcement of sweeping tariffs on US trading partners raised concerns about the impact on particular trading partners, companies, and sectors. Within two days, the S&P 500 declined 10%—and though markets recovered in the weeks that followed (due in part to a temporary tariff pause), the sharp drop shows the dislocation that can occur when the impacts of government decisions are unclear.

Much of this volatility has subsided since. But we believe the DeepSeek sell-off marked one of the most meaningful changes in investor appetite for US assets in roughly 15 years. Similarly, macro-driven volatility is not new—but in our view, geopolitical uncertainty is a more recent feature behind the rocky performance of the 2020s.

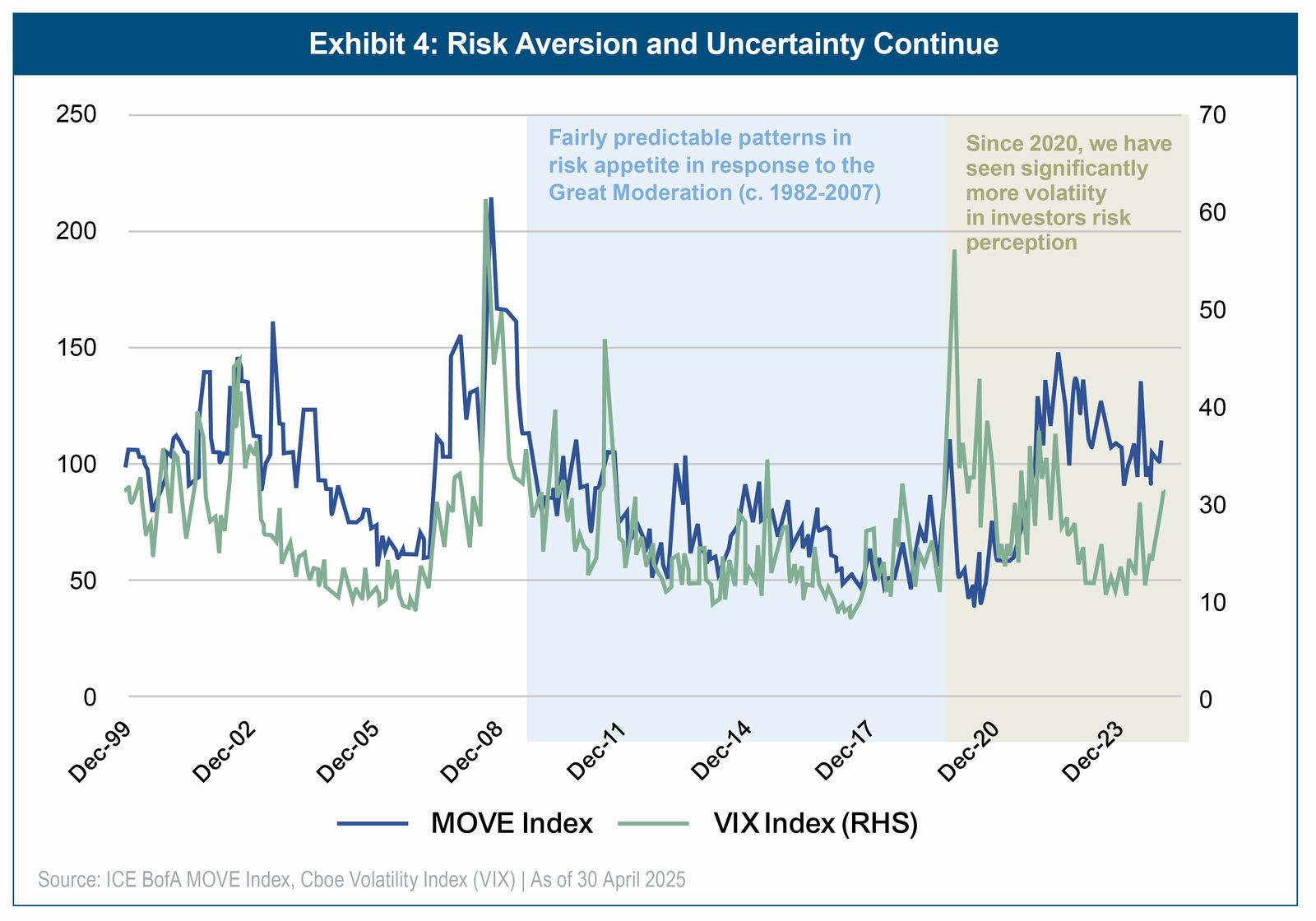

We also believe the speed and scale of this volatility compounded the sense of uncertainty reflected in two key measures of investor sentiment: the ICE BofA MOVE Index (a measure of expected volatility in government bond yields) and the VIX Index (a measure of expected volatility of the S&P 500, often called the “fear index), both of which have spent most of the risk exhaustion period at higher levels than in the 2010s—a period defined by falling interest rates, stable inflation, and low macroeconomic uncertainty (Exhibit 4).

Looking ahead to 2026, we believe previously established performance drivers will be reevaluated as macroeconomic and geopolitical uncertainty become the new normal.

Disclosures: Important Information

Published on 25 September 2025

Provided for the sole use of NCPERS. Not for further distribution.

Information and opinions presented have been obtained or derived from sources believed by Lazard Asset Management LLC or its affiliates (“Lazard”) to be reliable. Lazard makes no representation as to their accuracy or completeness. All opinions expressed herein are as of the published date and are subject to change. Nothing herein constitutes investment advice or a recommendation relating to any security, commodity, derivative, investment management service, or investment product. Investments in securities, derivatives, and commodities involve risk, will fluctuate in price, and may result in losses.

Endnotes:

1Risk Exhaustion: Navigating the New Regime (Lazard, 2023)

2FactSet as of 30 June 2025.

3Has the Era of "American Exceptionalism" Ended? (Haver Analytics, March 2025) and How the Reversal of the ‘American Exceptionalism' Trade Is Rippling Around the Globe (Wall Street Journal, March 2025)

4‘VOO and Chill': Should Investors Rely on Just the S&P 500? (US News, May 2025)

5VOO and Chill T-Shirt (Amazon); VOO and Chill T-Shirt (Walmart)

Bios: Paul Moghtader, CFA, is a Managing Director and Portfolio Manager/Analyst, leading Lazard's Equity Advantage team. He began working in the investment field in 1992. Prior to joining Lazard in 2007, Paul was Head of the Global Active Equity Group and a Senior Portfolio Manager at State Street Global Advisors (SSgA). At SSgA Paul was the senior manager responsible for the research and portfolio management of all multi-regional active quantitative equity strategies. Previously, Paul was an analyst at State Street Bank. He began his career at Dain Bosworth as a research assistant. Paul has a Master of Management (MM) from Northwestern University and a BA in Economics from Macalester College. Paul is a CFA® charterholder.

Jason Williams, CFA, is an Investment Strategist on Lazard's Equity Advantage team. In this role, he focuses on delivering quantitative macro and factor based analytical insights for the investment team to facilitate performance evaluation and client communications. He began working in the investment field in 2001. Prior to his current role, Jason served 17 years as a portfolio manager of quantitative UK, European and Small cap portfolios, first at State Street Global Advisors and then, from 2008, at Lazard. He has an MA in Finance and Investment from the University of Exeter and a BSc Honours in Mathematics from Coventry University. Jason is a member of the CFA Institute and the UK Society of Investment Professionals (UKSIP).