Non-Agency Securitization: Unlocking Opportunities in U.S. Mortgage Markets

By: Imperial Fund Asset Management

Securitization began in 1968 when Ginnie Mae was founded to keep housing affordable by insuring

certain loans. This innovation gave investors access to mortgage cash flows without owning or servicing loans directly, while enabling lenders to recycle capital. In 2025, securitization remains a cornerstone of modern finance, channeling capital efficiently, enhancing liquidity, and expanding credit access. And with issuance rising and institutional interest expanding, non-Agency RMBS are poised to remain a key pillar of U.S. fixed income.

Over time, securitization extended beyond mortgages to assets like credit card receivables, auto leases, royalties, and even athlete transfer fees.

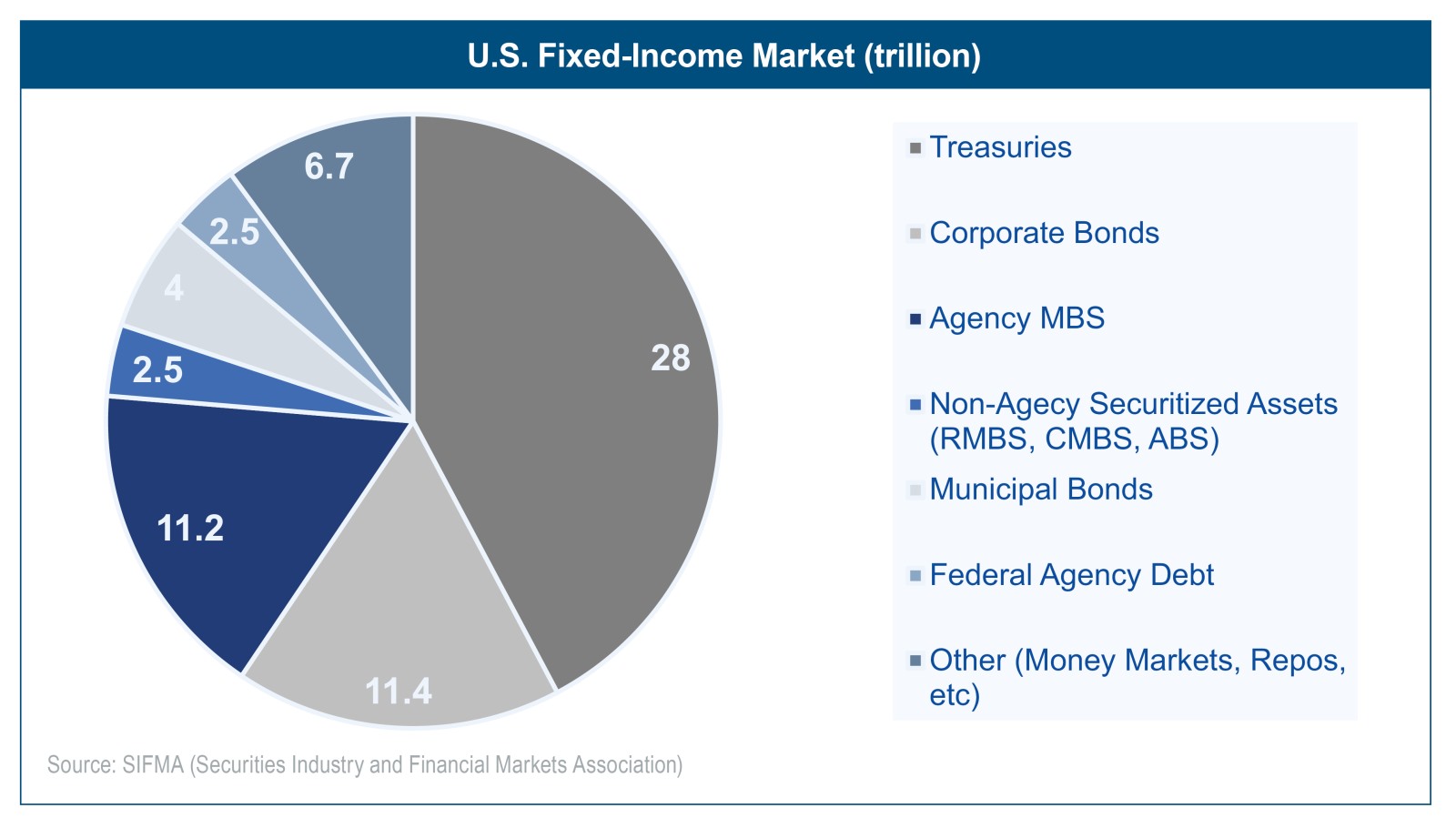

Today, the U.S. fixed-income market totals $62.3 trillion, dominated by Treasuries ($28.7T), corporate bonds ($11.4T), and agency MBS ($11.2T). Non-agency securitized assets (RMBS, CMBS, ABS) account for about $2.3T, or 4–5% of the market, while municipal bonds add $4T. Together, securitized credit (agency and non-agency combined) makes up close to a quarter of the total fixed-income universe, underscoring its systemic importance. Alongside Treasuries and corporate bonds, securitized debt is one of the three largest pillars of U.S. fixed income.

The high issuance of mortgage-backed-securities is facilitated by a process called securitization. In a securitization, assets with future cash flows are pooled. Then, legal claims on those future cash flows are converted into tradeable securities. This process simplifies investment through bonds, expands liquidity by broadening the investor base, and supports lending activity. However, risks remain: returns depend on loan performance (credit risk), bond values fluctuate with interest rates (interest rate risk), and early repayments can reduce expected returns (prepayment risk).

Risks in securitization are managed through structural features that make deals more attractive to investors. Subordination arranges securities into tranches, with junior tranches absorbing losses first to protect senior holders. Overcollateralization provides a cushion by backing securities with collateral exceeding their value. Step-up features increase coupon payments after a set period, helping offset interest rate risk and improving returns over time.

There are two types of RMBS:

- Agency RMBS: Guaranteed by U.S. government-sponsored enterprises (GSEs) such as Fannie Mae, Freddie Mac, or Ginnie Mae.

- Non-Agency (Private Label) RMBS: Not backed by GSEs and are issued by private institutions

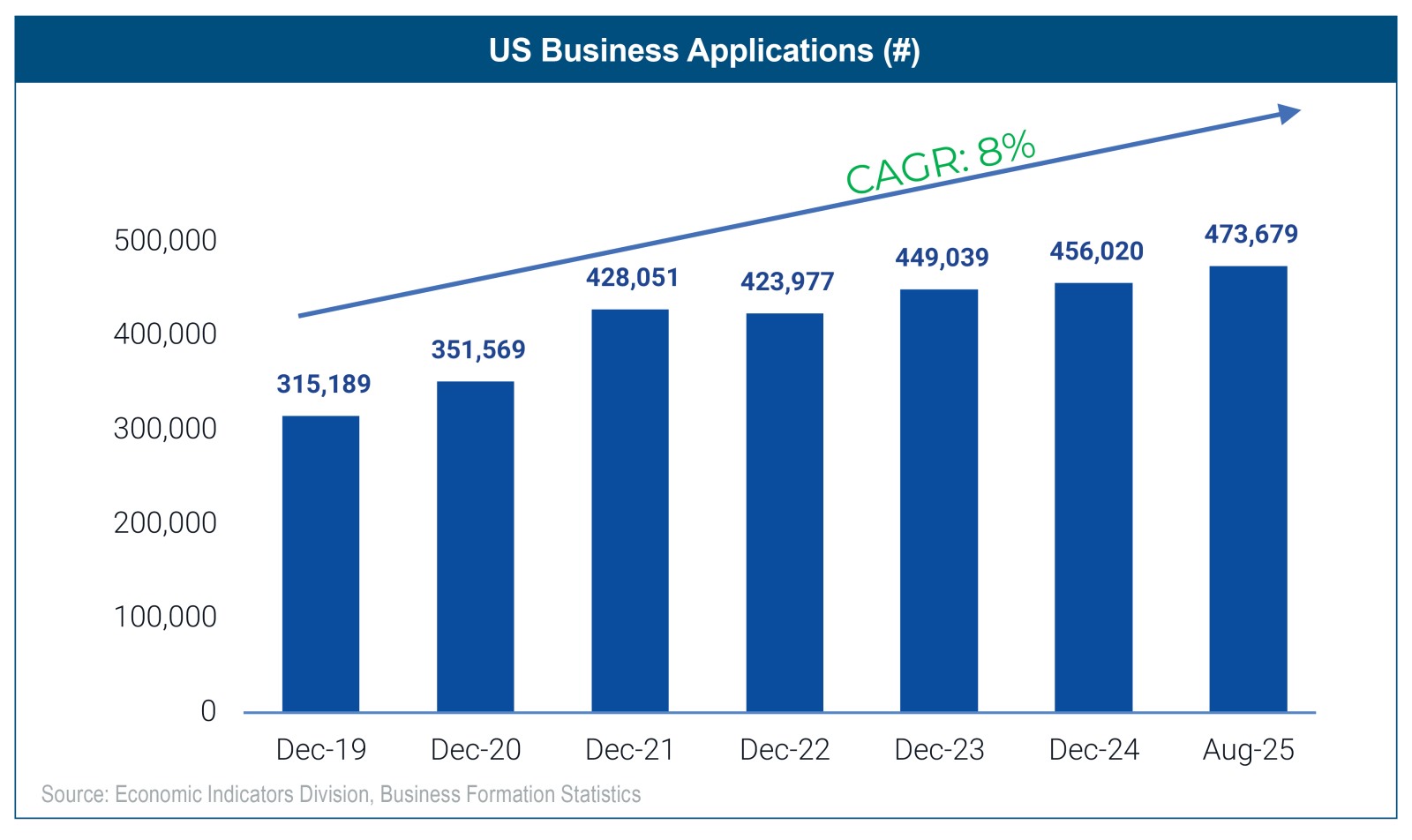

The non-Agency market emerged in response to regulatory reforms which followed the 2008 financial crisis. Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. Among its provisions was the creation of the Qualified Mortgage (QM) framework and Ability-to-Repay (ATR) rules—aimed at ensuring responsible underwriting and preventing the types of risky loans that fueled the collapse. New rules frequently excluded creditworthy borrowers who didn’t fit the “traditional” profile—for example, self-employed individuals, real estate investors, or home buyers who might not have a W-2. To assist these home purchasers, lenders started originating non-Agency loans: mortgage products that fall outside of GSE provisions but still require responsible underwriting and ability-to-repay verification.

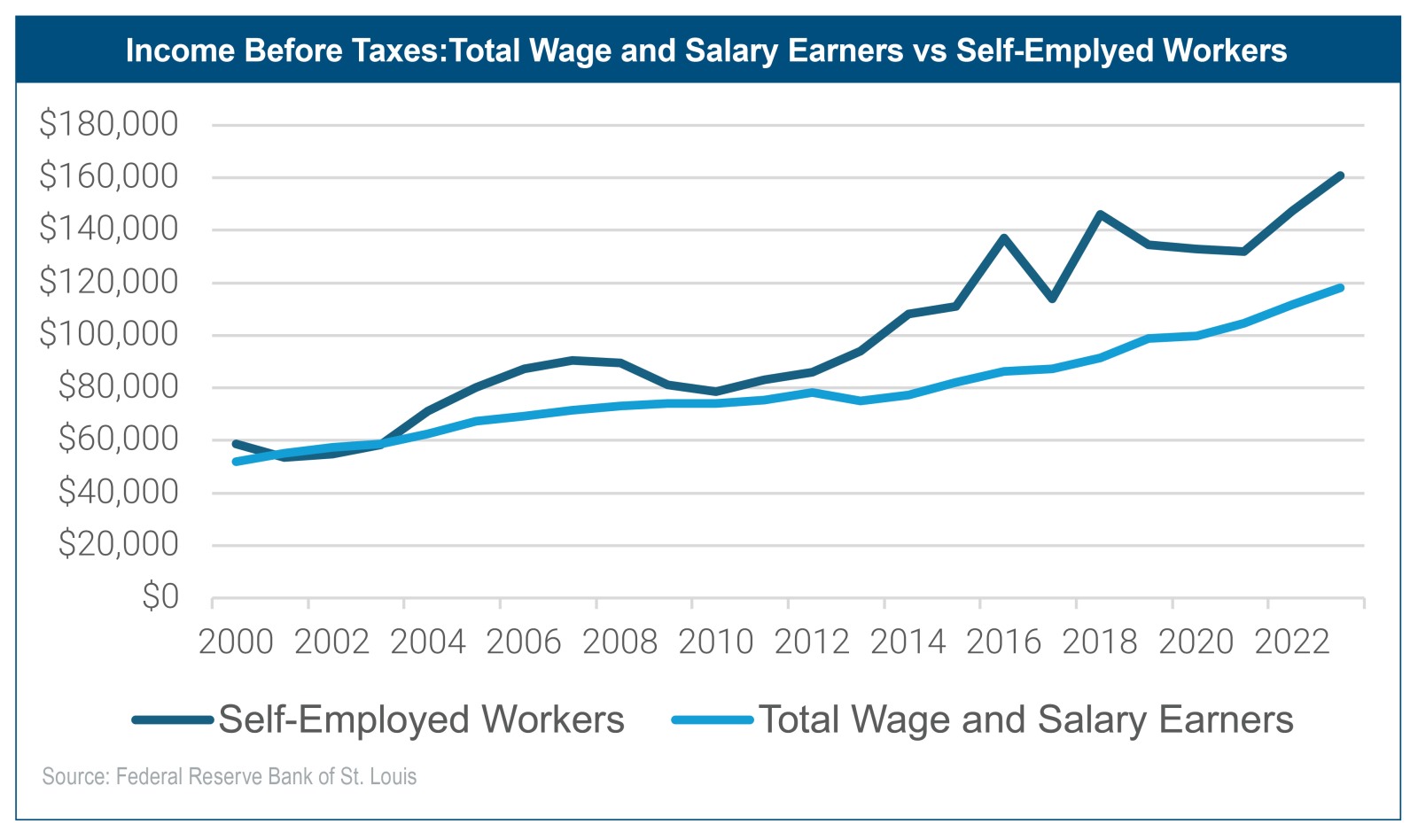

Non-agency mortgages cater to the U.S.’s growing population of entrepreneurial, credit-worthy borrowers who are self-employed. As of February 2024, there were 16 million self-employed individuals in the U.S. And their incomes have grown substantially. Indeed, in 2010, the average self-employed worker made approximately $4,300 more in salary-before-taxes than the average employee. In 2023, that difference had risen to $42,519. These borrowers typically pay a higher mortgage rate than agency borrowers, but this premium has narrowed over time.

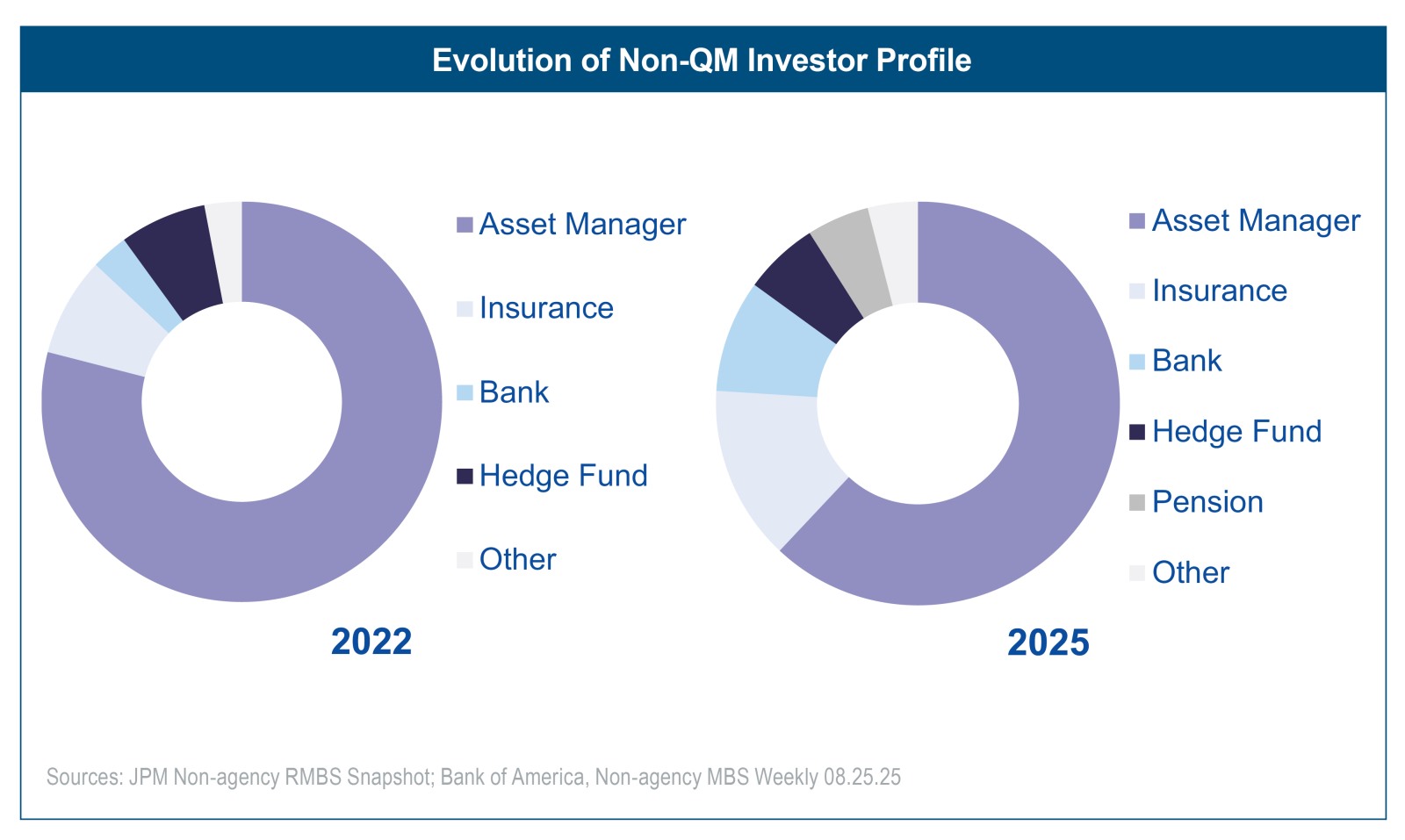

This has resulted in increasing interest in non-agency RMBS from pension funds who now maintain a 5% market share of the space. This increased involvement reflects the search for yield as interest rates come down in global markets. Indeed, one of the flagship non-agency products, non-QM AAA, has traded at 15-30bp premium over agency RMBS as the market continues to develop.

This has resulted in increasing interest in non-agency RMBS from pension funds who now maintain a 5% market share of the space. This increased involvement reflects the search for yield as interest rates come down in global markets. Indeed, one of the flagship non-agency products, non-QM AAA, has traded at 15-30bp premium over agency RMBS as the market continues to develop.

Evolution of Non-QM Investor Profile

Securitization remains a cornerstone of modern finance, channeling capital efficiently, enhancing liquidity, and expanding credit access. While success depends on careful structuring and risk management, the growth of the non-Agency sector shows how the market adapts to changing regulations, borrower needs, and investor demand. With issuance rising and institutional interest expanding, non-Agency RMBS are poised to remain a key pillar of U.S. fixed income.

Securitization remains a cornerstone of modern finance, channeling capital efficiently, enhancing liquidity, and expanding credit access. While success depends on careful structuring and risk management, the growth of the non-Agency sector shows how the market adapts to changing regulations, borrower needs, and investor demand. With issuance rising and institutional interest expanding, non-Agency RMBS are poised to remain a key pillar of U.S. fixed income.

To read the full article, please visit Imperial Fund Asset Management’s website at www.imperialfund.com or contact us at info@imperialfund.com.

Disclosures: This content is for informational purposes only and should not be construed as investment or legal advice. Neither the author of this content nor Imperial Fund assumes any liability for actions taken or not taken based on information contained herein. Investments involve risk, including potential loss of principal. You should consult a qualified professional before making financial decisions.