A Case for Risk Budgeting

Savvy investors take an intentional approach to balancing portfolio risk with desired returns. What are the benefits of active risk budgeting and the consequences of unintended risks? In this article, we discuss how to address actionable risk in a portfolio.

Though markets shift, institutional investors’ main goal remains: Deliver strong risk-adjusted returns that meet or exceed set targets. The amount of risk taken depends on factors like funding status, contribution rates, governance, and liquidity needs. Assessing performance requires managing this risk, not just meeting return targets. Risk budgeting is a tool used to manage total portfolio risk.

What is Risk Budgeting?

Risk budgeting allocates investments based on their risk characteristics, seeking to efficiently deploy “active risk” (fund tracking error vs. policy benchmark) across the total portfolio. An effective risk budget factors in the organization’s risk tolerance and identifies acceptable and unacceptable risks. Staff can then define how much and what types of active risk are desirable and implement strategies with the goal of generating excess returns (alpha) efficiently. Metrics like the information ratio and Sharpe Ratio help evaluate the efficiency of alpha generation.

Benefits

Risk budgeting provides: a framework for using risk to potentially enhance returns, accountability for strategy implementation, and clearer attribution of performance drivers. This approach helps reduce unintended exposures and focuses efforts on areas with higher chances of achieving alpha, though it does not guarantee improved outcomes.

Benchmark Mismatch

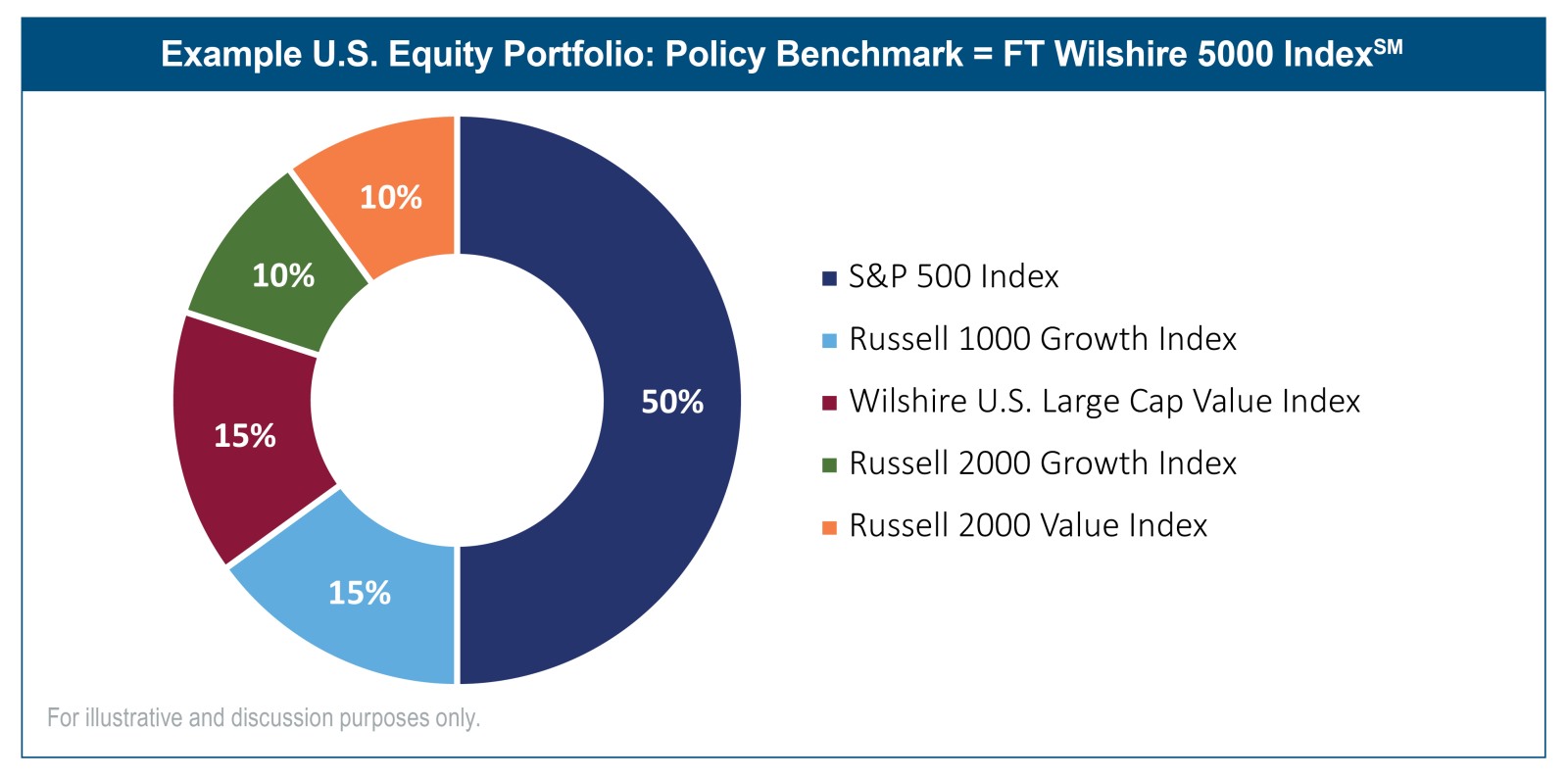

A common portfolio risk is benchmark mismatch, which arises when the policy benchmark and the benchmarks for underlying strategies differ. This mismatch can create tracking error and unintended risks. For instance, as is the case within the below example, using one index as the policy benchmark while allocating assets differently among large- and small-cap managers can generate active risk.

While benchmark mismatch is often viewed as unintentional risk, investors may use structural tilts purposefully. For example, investors may choose to take directional tilts toward specific sectors or regions.

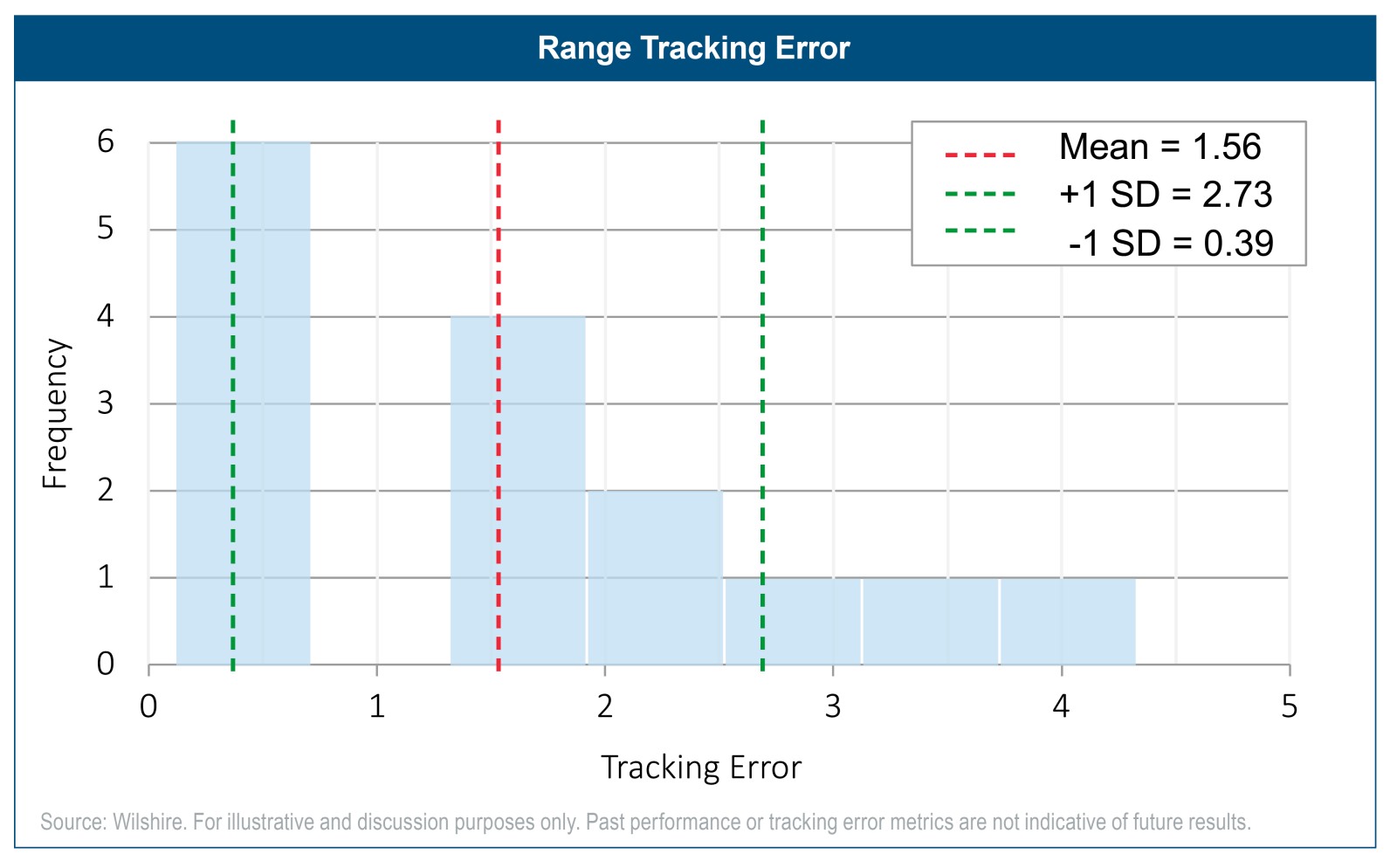

In a recent analysis of 15 plans (as of 3Q24), average tracking error from benchmark mismatch was 1.5%, with size, style, and industry as the primary drivers. Sector exposures, especially information technology, also contributed.

Conclusion

Ultimately, risk is an inherent part of investing. Managing, rather than avoiding, risk enables investors to pursue their objectives. Risk budgeting offers a structured framework to align portfolio risk with organizational goals and tolerance, helping investors make more informed, disciplined decisions.

You can find the full paper (long version) here at the Wilshire website).

Bio: Lauren Gellhaus, CAIA, Vice President, serves on Wilshire’s Client Solutions Team and is the chair of the Firm’s ESG and Diversity Committee. She is a senior consultant, working primarily with public pension plans and she specializes in sustainability.

Disclosures: Wilshire is a global financial services firm providing diverse services to various types of investors and intermediaries. Wilshire’s products, services, investment approach and advice may differ between clients and all of Wilshire’s products and services may not be available to all clients. For more information regarding Wilshire’s services, please see Wilshire’s ADV Part 2 available at www.wilshire.com/ADV.

Wilshire believes that the information obtained from third party sources contained herein is reliable, but has not undertaken to verify such information. Wilshire gives no representations or warranties as to the accuracy of such information, and accepts no responsibility or liability (including for indirect, consequential or incidental damages) for any error, omission or inaccuracy in such information and for results obtained from its use.

This material is intended for informational purposes only and should not be construed as legal, accounting, tax, investment, or other professional advice. Final terms set forth in a written agreement will prevail. Any charts, graphics, projections, and forecasts included in this Presentation are presented for illustrative purposes only, in order to provide information and context. None of the statements or information contained in this Presentation constitute investment performance, nor should the inclusion of any information be treated as indicative of, or a proxy for, the investment performance of Wilshire.

Wilshire Advisors LLC (Wilshire) is an investment advisor registered with the SEC. Wilshire® is a registered service mark.

M802848 E0926