Measuring Returns in Alternatives

By: Pulkit Sharma, Jason DeSena, and Richard Wang, J.P. Morgan Asset Management

When investing in alternative funds, it's crucial to understand the differences in return calculation methodologies, such as TWR and IRR, and the benefits of a diversified multi-vintage closed-end fund program, which can enhance capital efficiency and potentially deliver higher net MOICs through reinvestment and compounding returns over time.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

When investing in alternatives, it is important that investors take into consideration the return calculation methodology used across different fund structures. Open-end funds typically utilize time-weighted returns (TWRs) whereas closed-end funds typically use an internal rate of return (IRR). TWR and IRR are not directly comparable and can signal very different outcomes for investors. TWR is a compound rate of growth which excludes the impact of cash flows in calculating performance and is more appropriate for open-end funds where GPs have less control over timing and magnitude of capital commitments made to their fund. IRRs are more relevant for closed-end funds where GPs control the pacing and sizing of capital calls and distributions.

The differences in convention mean that comparing performance between funds using different approaches is less meaningful and instead, investors should compare net MOICs over comparable periods, as highlighted below.

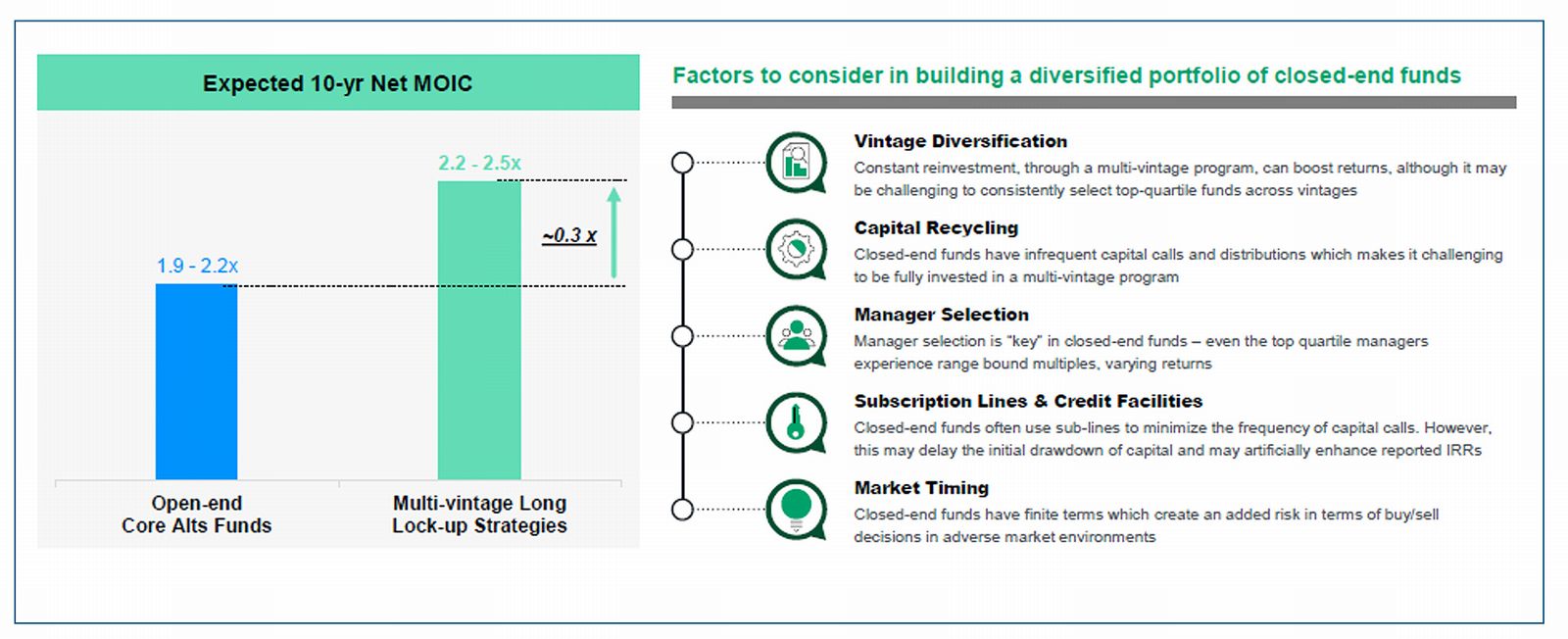

However, what is not captured above is the optionality of reinvesting income/distributions private funds into other investments as investors may benefit from returns generated from other components of their portfolio. Investors should therefore compare open-end funds with multi-vintage closed-end fund programs which include returns on idle/uninvested capital.1 Through a multi-vintage program, capital efficiency can be enhanced through recycling, achieving a more fully invested profile over the long-term. Execution is critical and dependent on the accuracy of assumptions (inherently challenging given the uncertain nature of private markets). A diversified multi-vintage program has the potential to deliver a net MOIC that is slightly higher than core/core+ multi-alts fund, but several key requirements must be satisfied in order to effectively achieve these outcomes.

A Simple Rule of Thumb to Follow in Multi-Vintage Private Allocations:

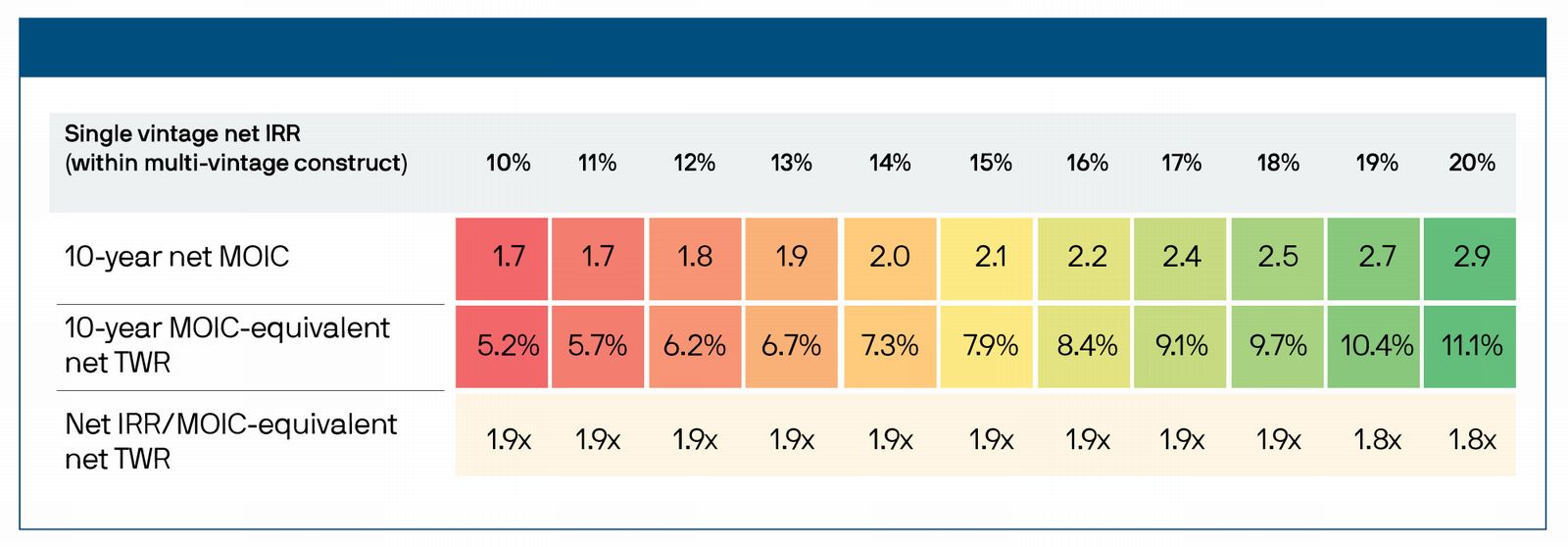

The IRR metric is sensitive to timing and magnitude of cash flows, which aren't factors for time-weighted return metrics. Using a relatively standard portfolio model over a 10-year period, we can construct a rule of thumb with which to utilize in comparing IRRs and TWRs: “IRR = 2 * TWR”. The reason for this differential is largely attributed to the importance of the timing of cash flows in closed-end funds and the “j-curve effect” where performance in early years as fund management fees and expenses outweigh valuation uplift which typically occurs later in the fund life as operational improvements are reflected in asset values and/or asset sales are crystalized.

Note that this approach is an illustrative comparison which assumes a fully invested open-end fund and a multi-vintage closed-end fund program (to be more representative of an investor's experience in having an allocation diversified across closed-end funds). Diversifying across multiple vintage years mitigates the impact of single vintage j-curves; however, it's important to reiterate the challenges in executing according to plan given the uncertainties which exist (cash flow timing, manager selection, etc.).

It is also worth highlighting that in this example we have assumed that return on idle capital committed but not yet deployed and/or capital returned but not yet reinvested is 0%. While this portion of capital is lower in a multi-vintage program versus a standalone vintage analysis, it is not negligible. If we were to assume a 2.5% rate of return for this, the Net IRR / TWR equivalency metric would decline to 1.5-1.6x for the range of returns shown below.

Another important consideration in analyzing different investments in alternatives is the potential for compounding of returns over time. Being more fully invested for longer and actively reinvesting income distributions can meaningfully impact long-term outcomes. We demonstrate this in showing the impact on net MOICs over time, assuming income is taken as a distribution versus reinvested back into the portfolio. Reinvesting income will increase net MOIC by an increasingly greater margin as the time period invested lengthens; this illustrates the importance of compounded returns and being fully invested over the long-term.

Endnotes:

1 This is an important consideration in accurately comparing performance between the two fund structures. While investors in open-end funds benefit from faster capital deployment and being more fully invested for longer, investors in closed-end funds experience a more prolonged capital drawdown timeline and shorter period of full investment (if at all). Because of this it is only prudent to assume a rate of return for the idle/uninvested capital in comparing performance with open-end funds. In our analysis we have assumed a 2.5% return for idle/uninvested capital which is in line with JPMAM Long-Term Capital Market assumptions for core fixed income.

Bios:

Pulkit Sharma, CFA, CAIA, Managing Director, is the Head of Alternatives Investment Strategy and Solutions (AISS) business, which is part of J.P. Morgan Asset Management, and accesses its Private Markets and Alternative Solutions groups, that collectively manage $300B+ in alternative assets. Pulkit serves as the Portfolio Manager for the Alternatives Access Fund, which is an actively managed Insurance Dedicated Fund that invests across private and public markets. Pulkit founded the private real assets portfolio strategy and solutions business for the firm's institutional clients. Pulkit and the AISS team have helped global clients invest USD 10B+ across a diversified suite of multi-alternatives solutions across the private and public continuum. He is a CFA and CAIA charterholder. Pulkit holds a B.E. in Civil Engineering from the Delhi College of Engineering and an M.S. in Real Estate Development from the Massachusetts Institute of Technology (MIT).

Jason DeSena, CFA, Executive Director, is the Head of Research & Analytics and a Portfolio Manager for the Alternatives Investment Strategy & Solutions team at J.P. Morgan Asset Management. Jason is responsible for portfolio design and management of multi-alternatives investment solutions that span global alternatives such as private real estate, infrastructure, transport, alternative credit, private equity, liquid alternatives. He is a member of the Alternatives Investment Strategy & Solutions – Investment Committee. Jason holds a B.S. in Finance from Lehigh University. He is a CFA charterholder and holds Series 7 and 63 licenses.

Richard Wang, CFA, FRM, Vice President, is a member of the J.P. Morgan Asset Management Alternatives Investment Strategy & Solutions. Richard specializes in multi-alternative portfolio construction & management, and in-depth quantitative research & analytics. He obtained a B.S. in Applied Mathematics from Peking University and an M.S. in Financial Mathematics from the University of Chicago. Richard is a CFA charter holder, a CAIA charter holder, and holds FINRA Series 7 and 63 licenses.