Taking Stock of USD Pessimism

The US dollar stands at a pivotal juncture. We examine the structural drivers behind dollar strength, review the factors behind its recent decline, and evaluate whether investor expectations of further weakness are justified.

This is an excerpt from NCPERS Summer 2025 issue of PERSist.

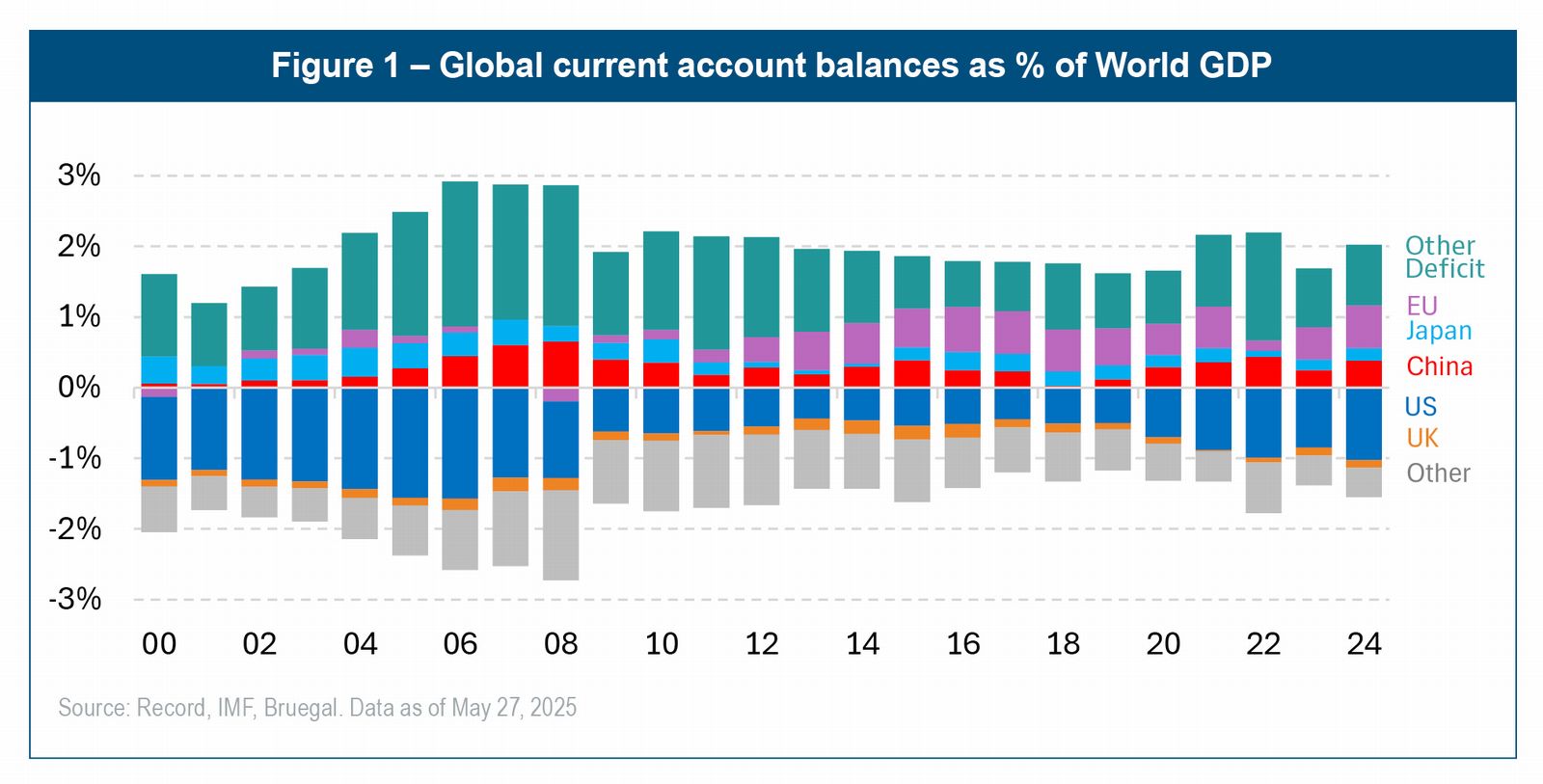

The US Dollar is at a pivotal juncture, with its real trade-weighted exchange rate recently exceeding the 1985 Plaza Accord peak The US now accounts for two-thirds of global current account deficits (Figure 1), raising concerns about imbalances and leading to speculation about a shift toward a weaker dollar policy.

US Exceptionalism – Too Much of a Good Thing?

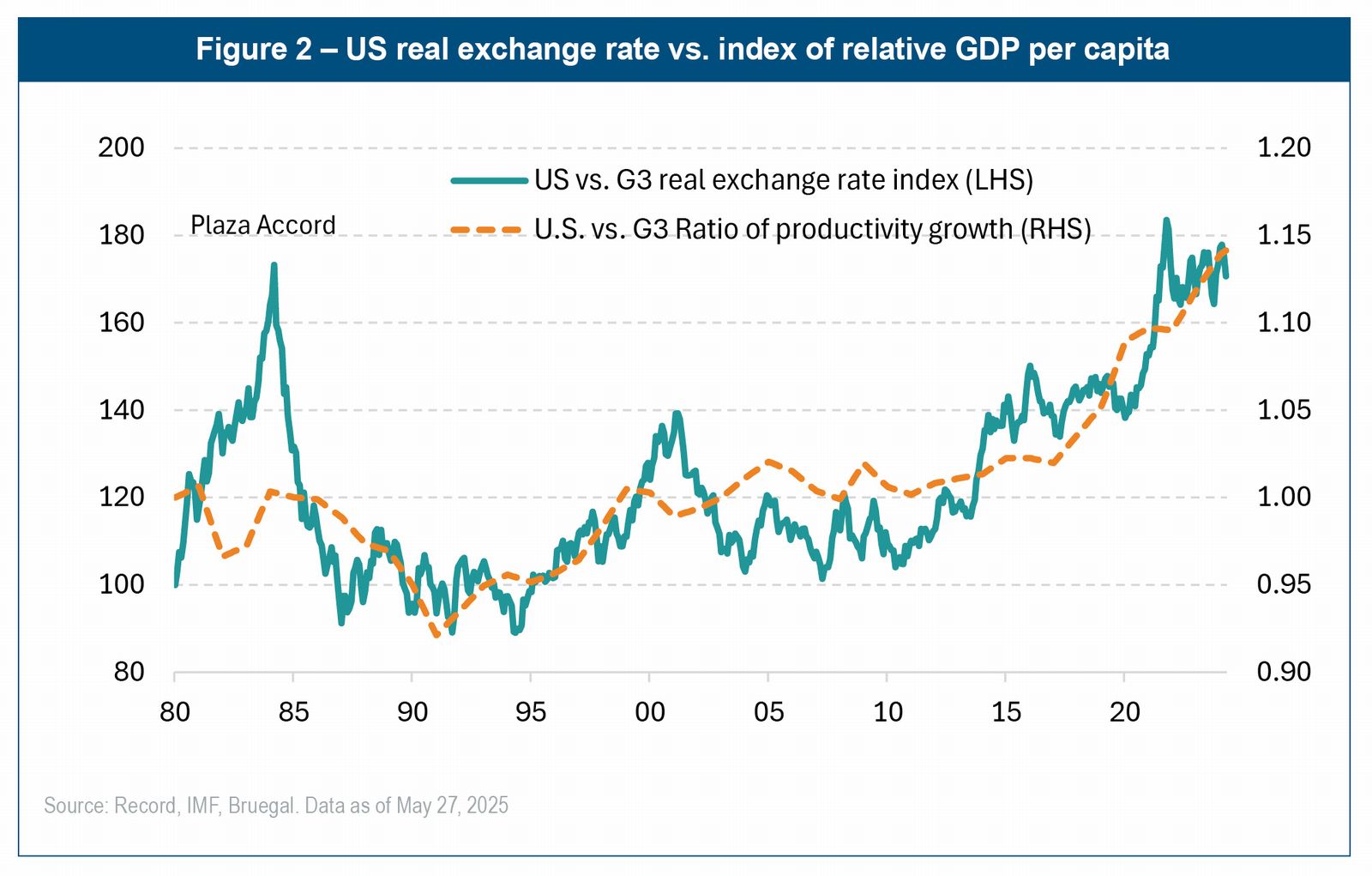

Persistent twin fiscal and trade deficits have long characterized the US economy. Yet, the dollar's “exceptionalism” has persisted through strong relative productivity growth which generates value misalignments, and geopolitical insulation with strong demand for US assets during risk-off periods.

However, vulnerabilities do exist. Expansionary fiscal policies that attract capital also grow current account deficits unless offset by private savings. That capital must be retained to support the dollar, and if growth fails to meet investors' expectations, capital outflows often follow. Yet, the trade war has exacerbated both of these issues by creating a supply shock and suppressing earnings growth. Other regions, notably Europe, are emerging as investment alternatives.

The Trump administration's desire to rebalance trade is understandable. However, its approach undermines economic credibility, lacking acknowledgement of the investment-savings gap as a driver of imbalances. Early signs of stress in the bond market have checked the administration, yet erratic policymaking has cast doubt on the US dollar's safe haven status.

A Plaza Accord 2.0 Seems Less Likely

The apparent goal of the Trump administration is to use tariffs to pressure foreign countries to shift investment to the US or appreciate their currencies. However, Treasury market weakness exposed the fragility of the US negotiating position, and export-oriented countries like China and Europe are unlikely to support coordinated dollar devaluation.

East Asian export economies are more open to bilateral trade talks. However, any currency policy must align with economic fundamentals to be effective as continued productivity growth in the US could complicate coordinated depreciation efforts (Figure 2). A more gradual dollar depreciation could help to advance US competitiveness and improve external sustainability through a revaluation of foreign assets priced in dollars relative to local currency foreign liabilities.

Policy Credibility a Greater Risk to Safe-Haven Status

The greater risk to the US dollar lies in policy credibility where the dollar's reserve currency status depends on sustained confidence from foreign creditors. Cooling of trade tensions suggest some intent to preserve the dollar's reserve status, however the dollar remains weak compared to its fundamental anchors including interest rates, highlighting the need for credible policy. The key risks to credibility include:

-

Fiscal policy where further budget deficits exacerbate external imbalances and hamper demand for US treasuries.

-

Monetary policy where undermining the Federal Reserve's price mandate (e.g. through a Shadow Fed Chair) could erode confidence.

-

Institutional policy where disregarding constitutional checks and balances may weaken investor confidence.

If these risks unwind the dollar's natural diversification, institutional investors may be forced to mechanically increase hedge ratios on US dollar holdings in order to maintain optimality of equity and fixed income portfolios.

Looking through the USD pessimism

The market has adopted a predominantly negative view of the US dollar. However, strong positioning for dollar weakness combined with dislocated market fundamentals increases the risk of a sharp dollar rebound should more market-friendly policies materialize.

“Liberation Day” events suggests the Trump administration often pushes boundaries before moderating. If external market pressure forces politicians to adopt more orthodox trade and fiscal policies, a recovery in the dollar is possible. Furthermore, structural US dollar downside would be bounded if the US can limit productivity declines to match those of other developed markets.

Alternatively, a prolonged or deep US slowdown could spill over globally as the US remains the world's largest economy and consumer. The US dollar also remains the world's primary funding currency and a financial crisis beyond US borders would likely lead to risk-off demand for dollars. We are recently reminded as well that the US dollar responds well to geopolitical crises that threaten energy supply where there is no shortage of risks.

Conclusion

US exceptionalism and demand for US assets have supported the dollar, but recent weakness has exposed policy vulnerabilities. While rebalancing trade is reasonable, the current approach has undermined US economic credibility, and both fiscal and monetary policy actions further threaten investor sentiment towards the US.

A multilateral currency deal seems unlikely, yet a careful, gradual depreciation could enhance US competitiveness. Despite current vulnerabilities outlined, a rebound in policy credibility could lead to a rapid dollar recovery, and geopolitical tensions risk sudden bouts of US dollar appreciation.

Disclaimer:Any opinion expressed is based on Record's views as of the date of publication stated and may have changed since then. The views expressed do not represent financial or legal advice. Record accepts no liability should future events not match these views and strongly recommends you seek your own advice to take account of your specific circumstances. The views expressed are provided for informational purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, Record products or investment services. Any reference toRecord products or service is purely incidental and acts as a reference point only. The views about the methodology, investment strategy and its benefits are those held by Record.

Regulated by the Financial Conduct Authority in the UK, registered Investment Adviser, Commodity Trading Adviser in the US.

Bios: Andrew Bloomfield, Director, Head of Macro Research and Portfolio Manager, joined Record in 2013 and oversees all thematic and macroeconomic research. He is also the lead Portfolio Manager of Record's FX Alpha product. He sits on Record's Investment Committee and the Investment Management Group. He has 14 years' industry experience, having previously worked at J.P. Morgan. Andrew holds a BSc in Economics from the University of Surrey and is a CFA Charterholder.

Patrick Barley, Senior Analyst, Macro Research, joined Record in 2024 and is a macro research analyst covering the US, G10 and major EM markets. He provides commentary on global macroeconomic developments and FX markets through periodical and ad-hoc publications, as well as supporting Record's FX Alpha product. Previously, he worked for Wells Fargo Economics. Patrick holds a B.A. in Economics and Global Studies from the University of North Carolina at Chapel Hill.