Promoting Retirement Stability Through Governance, Portfolio Allocation, and Plan Design

By: Zhikun Liu, MissionSquare Retirement

Promoting public sector retirement stability requires a holistic approach integrating the strengths of both defined benefit (DB) and defined contribution (DC) plans. DB plans provide the foundation of retirement security with guaranteed income and risk pooling, while well-designed DC plans offer flexibility and additional savings opportunities. Together, they create a comprehensive and resilient system. By prioritizing strong governance, responsible portfolio allocation, and thoughtful plan design, leaders can ensure long-term stability and meet the evolving needs of retirees.

This is an excerpt from NCPERS Spring 2025 issue of PERSist.

Public retirement systems are vital for the financial security of millions of workers. Defined benefit (DB) pension plans, with their guaranteed lifetime income, remain effective for ensuring retirement security. However, the rise of defined contribution (DC) plans has introduced new dynamics. While DC plans can complement DB plans, they are not substitutes. Together, these plans can create a more comprehensive and resilient retirement system. Achieving public sector retirement stability requires integrating the strengths of both plan types through good governance, responsible portfolio allocation, and thoughtful plan design.

The Role of Good Governance

Good governance is the foundation of a stable retirement system. For DB plans, governance ensures funding policies, actuarial assumptions, and investment strategies align with the plan's long-term obligations to retirees. These plans provide predictable, guaranteed income, making them uniquely effective in addressing retirement security challenges. Strong governance ensures DB plans remain well-funded and sustainable, even during economic uncertainties.

For DC plans, governance focuses on empowering participants to make sound investment decisions while providing safeguards, such as well-designed default options. While DC plans offer flexibility and portability, they shift investment risk and decision-making to participants, which can lead to suboptimal outcomes without proper oversight. Governance structures for both DB and DC plans should encourage collaboration among stakeholders, including pension boards, investment committees, and plan administrators, to ensure strategies are effectively implemented and communicated to participants.

Responsible Portfolio Allocation

Portfolio allocation is critical to retirement system stability. For DB plans, the focus is on managing a diversified portfolio that balances risk and returns to meet funding obligations. Liability-driven investment (LDI) strategies, which align asset allocation with plan liabilities, are particularly effective in reducing funding volatility and ensuring commitments to retirees are met.

In DC plans, portfolio allocation shifts responsibility to individual participants, making the design of default investment options crucial. A well-diversified default portfolio can help participants achieve long-term growth while managing risk. Together, DB and DC plans provide a more comprehensive retirement solution, with DB plans offering stability and DC plans adding flexibility.

Insights from Default Investment Research

Recent research highlights the importance of default investment design in public DC plans. A study1 analyzing the investment decisions of 340,000 newly enrolled public DC plans participants reveals:

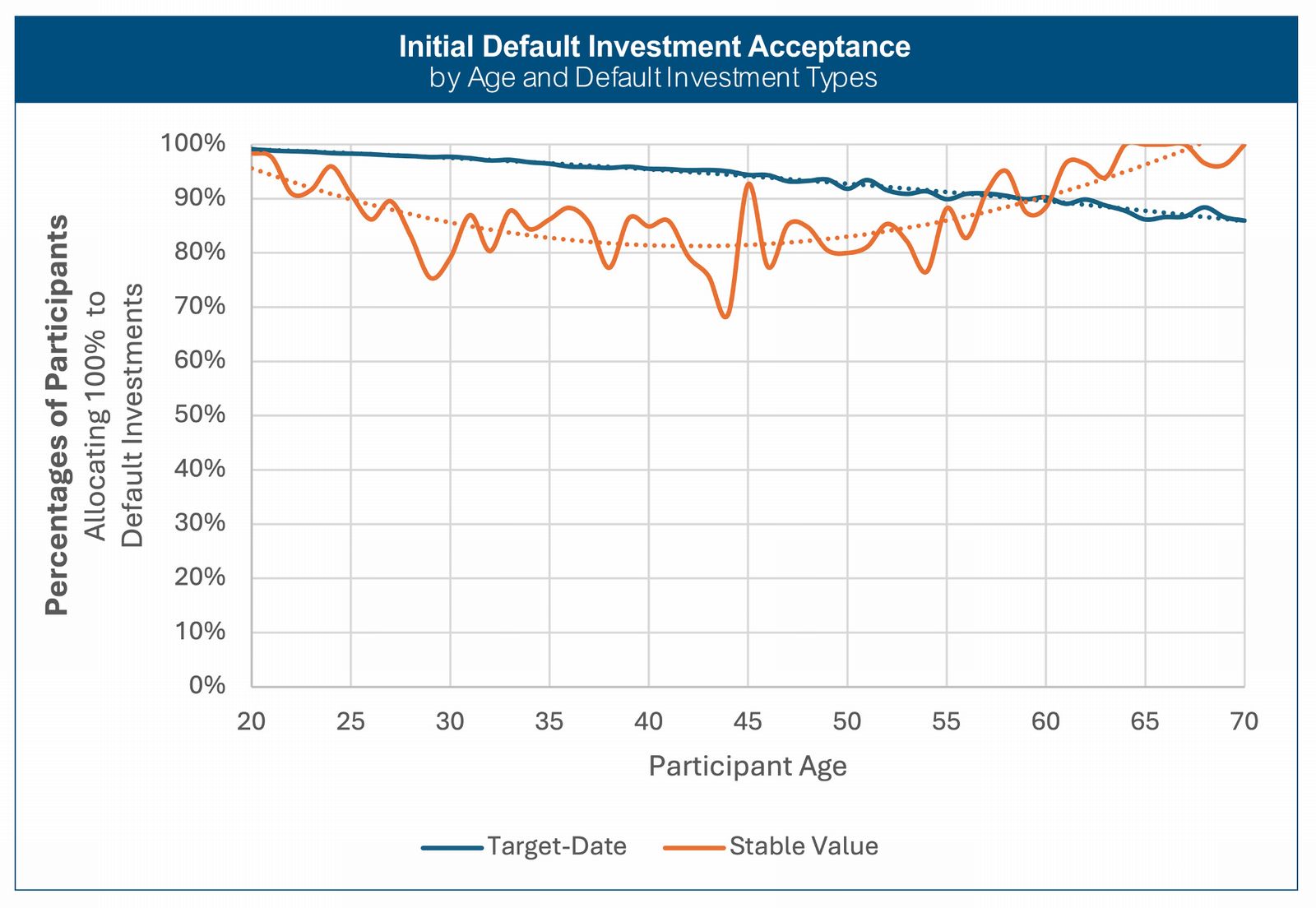

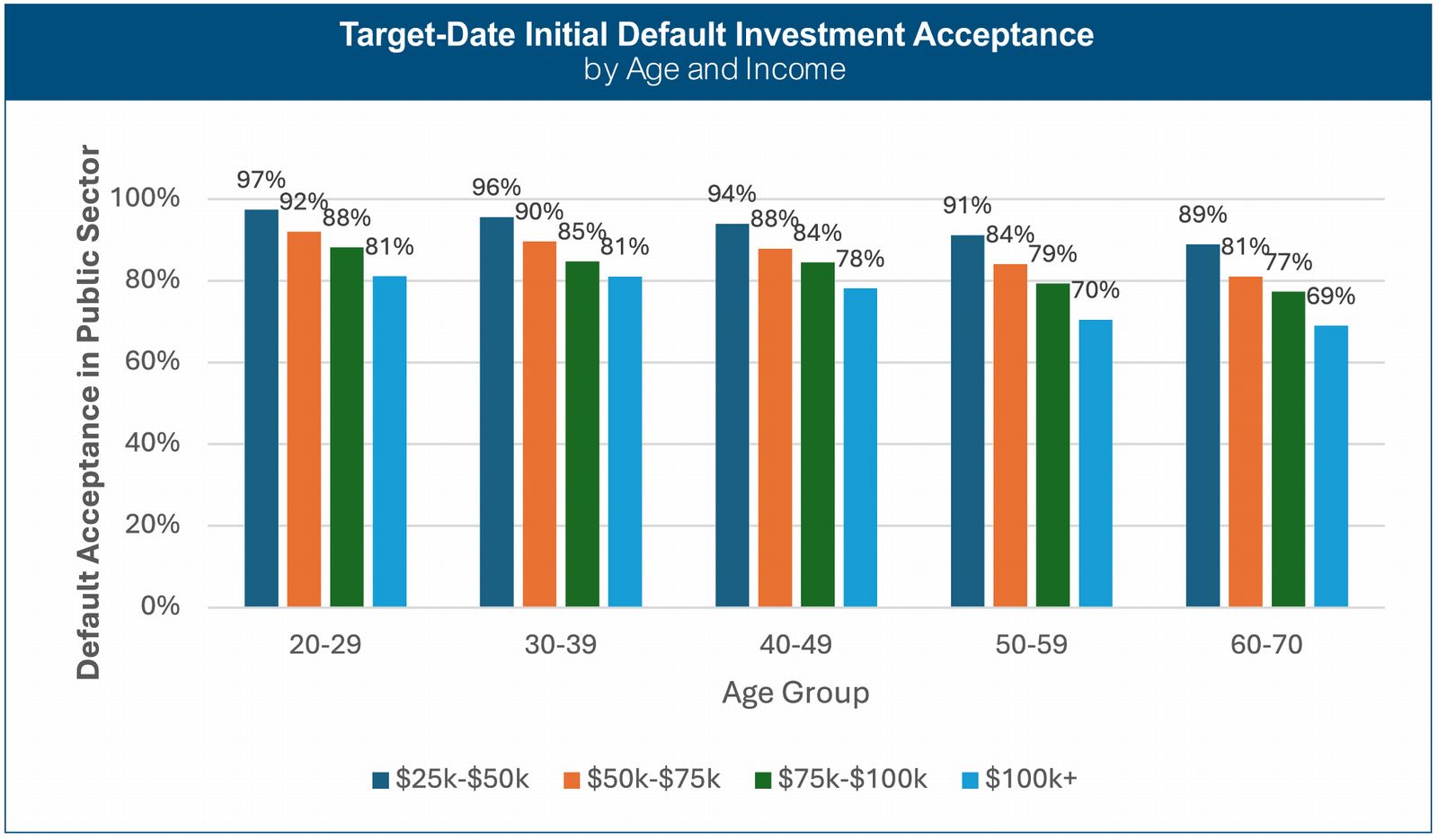

- High Default Acceptance Rates: Over 80% of participants across all age groups accept default investment options, a rate higher than in private sector 401(k) plans.

- Demographic Influences: Default acceptance rates decline with age and income but are higher among female participants.

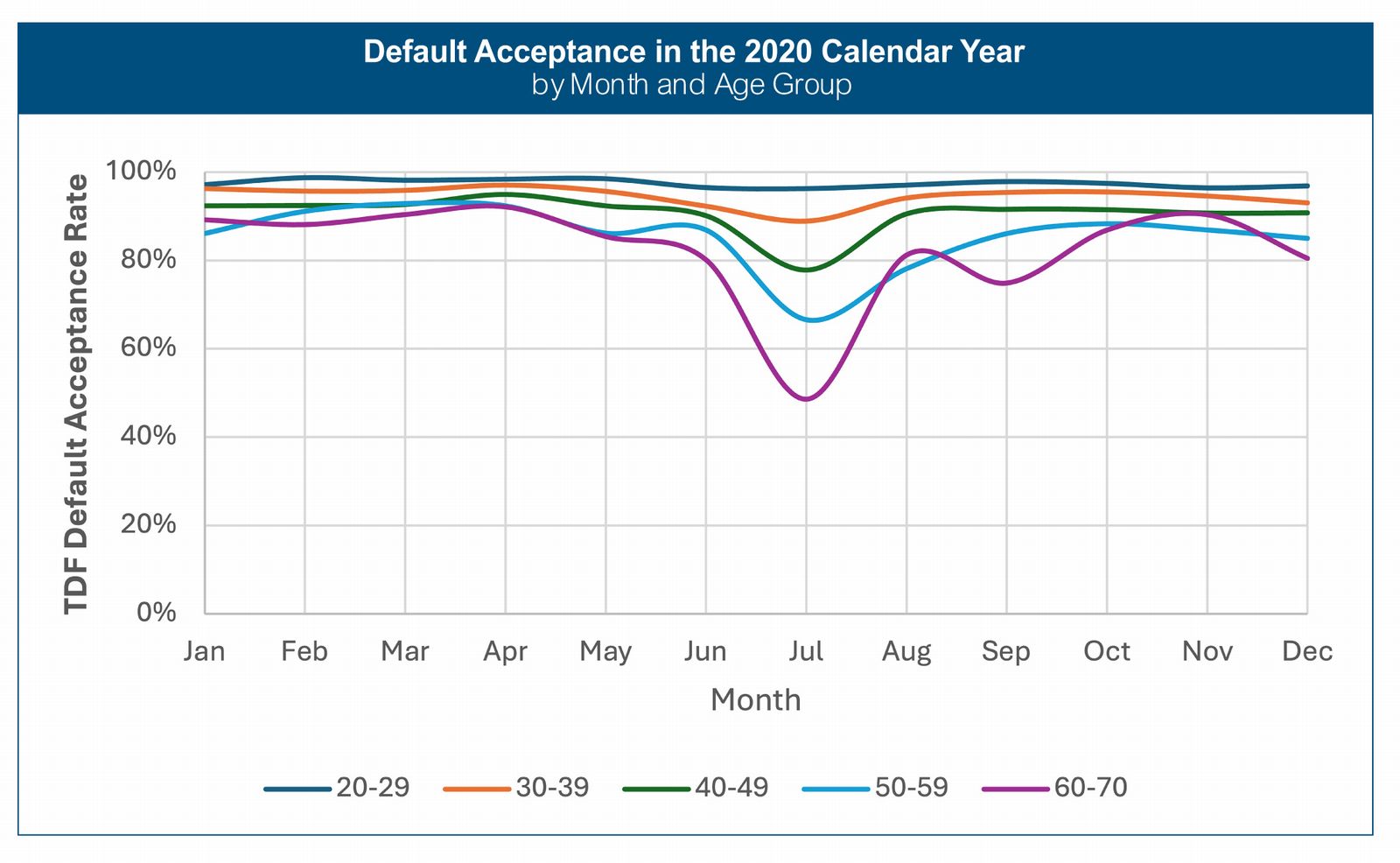

- Market Volatility Impact: Market conditions significantly influence default investment decisions. Reassessing default investment decisions during economic uncertainty remains important.

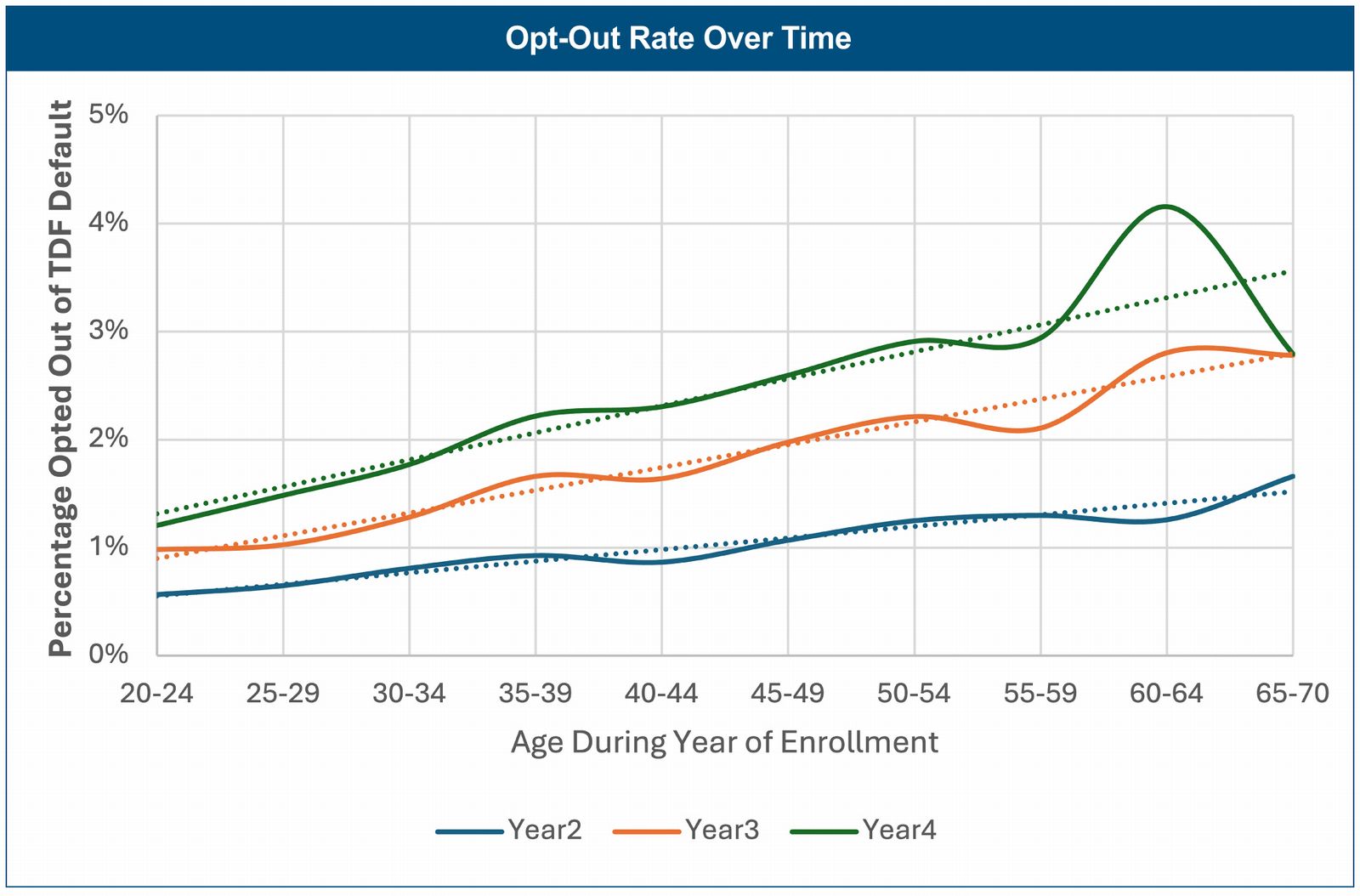

- Opt-Out Trends: While public plan participants' default opt-out rates are relatively lower, they increase with age and income.

These findings emphasize the importance of designing default options that align with participants' demographics and retirement goals.

DB and DC Plans: A Complementary Approach

DB and DC plans can complement each other to create a robust and sustainable retirement system. DB plans provide the stability and predictability of guaranteed income, while DC plans offer additional savings opportunities and flexibility. Together, they address the diverse needs of public sector employees, ensuring both short-term and long-term retirement goals are met.

For example, DB plans can serve as the foundation of retirement security, providing a stable income floor throughout retirement. DC plans, on the other hand, allow participants to save for additional expenses, invest for growth, and tailor their strategies to individual circumstances. By integrating the strengths of both plan types, public retirement systems can better withstand economic challenges and meet the evolving needs of participants.

Recommendations for Public Retirement System Leaders

To promote public retirement system stability, leaders should focus on the following:

- Preserving and Strengthening DB Plans: Policymakers and plan sponsors should prioritize the sustainability of DB plans, which provide the most reliable and efficient retirement income. Ensuring adequate funding and adopting sound investment strategies are critical to maintaining these plans for future generations.

- Enhancing DC Plan Design: Plan sponsors should ensure default investments are well-suited to participants' demographics and retirement goals. Strategies like re-enrollment campaigns can encourage participants to periodically revisit their investment choices.

- Integrating DB and DC Plans: Public retirement systems should leverage the strengths of both DB and DC plans. DB plans provide a stable income floor, while DC plans offer additional savings opportunities and flexibility. Together, they create a more comprehensive and resilient retirement system.

Endnotes:

1 Default Investment Acceptance among Public Defined Contribution Plan Participants MissionSquare Research Institute, February 2025

Bio: Zhikun Liu, Ph.D., CFP®, is an experienced financial planning research director, specializing in retirement planning, behavioral economics, and wealth management. He currently serves as Vice President and Head of the MissionSquare Research Institute at MissionSquare Retirement. Dr. Liu's prior career includes research director roles at Empower Retirement and Employee Benefit Research Institute, where he made significant contributions to the retirement and financial planning industry. Zhikun received his Ph.D. in Personal Financial Planning from Texas Tech University and holds multiple advanced degrees in fields including Mathematics, Economics, and Finance.