REITs in 2025: Positioning for Growth in a Transforming Landscape

By: David Sullivan, Nareit

This article covers the factors driving REIT performance, their strategic value in institutional portfolios, and how they are positioned to capitalize on economic trends, valuation shifts, and sectoral innovations in 2025.

This is an excerpt from NCPERS Winter 2025 issue of PERSist.

In 2024, real estate investment trusts (REITs) demonstrated resilience amid challenging economic conditions, navigating higher interest rates with robust balance sheets, efficient capital market access, and sound operating performance. Year-over-year comparisons for the first three quarters of 2024 showed over 3% growth in aggregate net operating income and dividends. The FTSE Nareit All Equity REIT Index recorded a 14% total return through Nov. 30, 2024, outperforming private real estate by more than 17 percentage points as private valuations slowly adjusted to the rising rate environment.

Looking ahead, 2025 may bring moderating interest rates alongside steady economic growth -- a potential "soft landing." However, challenges such as sluggish property fundamentals in certain sectors, fiscal uncertainties, and disruptive trade policies pose risks. Against this backdrop, REITs are well-positioned to capitalize on emerging opportunities by driving accretive growth, embracing key real estate trends, and offering institutional investors an efficient pathway to diverse, scalable, and innovative commercial real estate exposure.

Three factors are expected to energize the commercial real estate market:

- Economic Soft Landing: Stabilizing growth and interest rates could catalyze broader investment activity.

- Public-Private Valuation Equilibrium: The convergence between public REIT and private real estate valuations continues, narrowing the cap rate spread from 212 basis points at the end of 2023 to 69 basis points by late 2024.

- Transaction Market Revival: Realignment in valuations should stimulate property deals, benefiting REITs' growth prospects.

REITs' agility in navigating market volatility, superior liquidity, and transparency makes them essential tools for institutional portfolio strategies.

Expanding REIT Adoption Among Institutional Investors

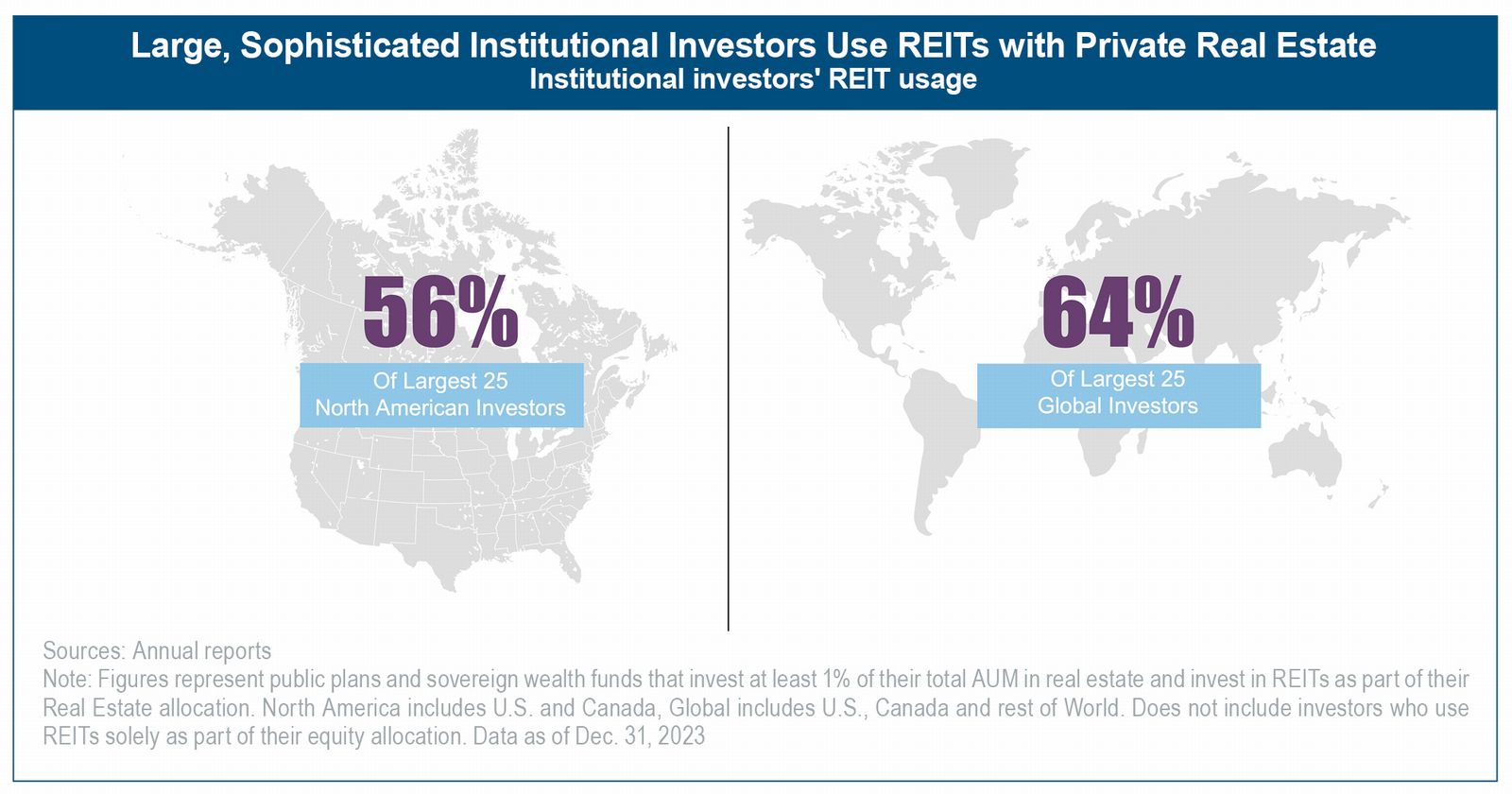

Institutional use of REITs has grown significantly, driven by their ability to meet evolving investment objectives. REITs are utilized in the real estate allocations of close to 60% of the 25 largest North American institutional investors.

Institutional investors value REITs for:

- Geographic and Sector Diversification: REITs offer exposure to sectors like data centers, health care, telecommunications, and logistics.

- Tactical Allocation Opportunities: REITs' liquidity and short-term valuation dynamics enhance flexibility.

- Portfolio Completion Strategies: By filling gaps in property types or regions, REITs complement private real estate holdings effectively.

Innovative Use Cases of REITs

During 2024, Nareit released a series of case studies illustrating how institutional investors are strategically incorporating REITs to achieve their real estate portfolio objectives, including enhancing diversification and driving returns. These examples offer valuable real-world insights for other institutional investors:

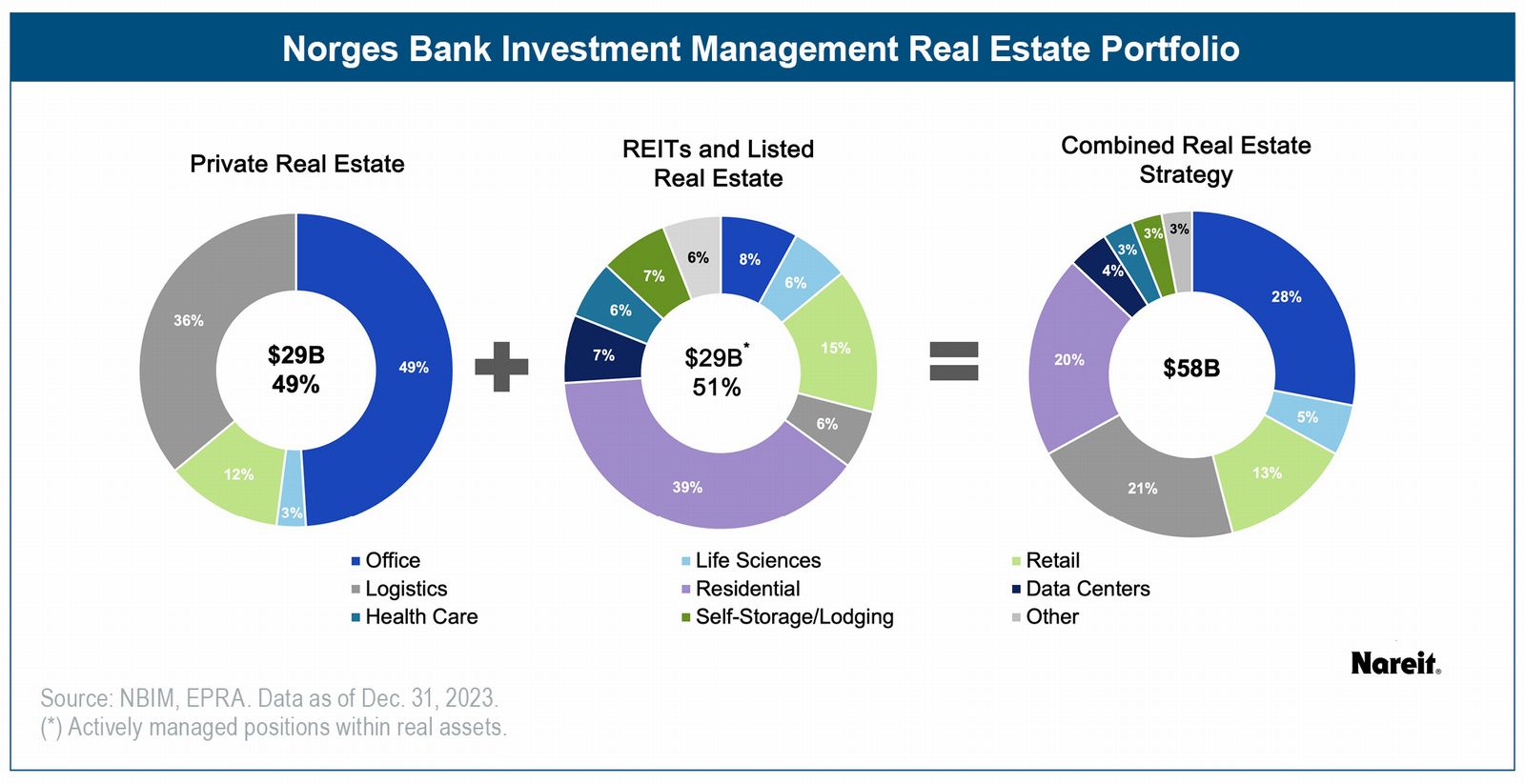

- Norges Bank Investment Management (NBIM): NBIM manages Norway's sovereign wealth fund and oversees $1.7 trillion in AUM, including approximately $58 billion in real estate. It invests 51% in REITs and 49% in private real estate to enhance diversification, access new and emerging property sectors, and optimize cost management.

The chart above shows how Norges uses public and private real estate in one portfolio. The REIT strategy gives Norges access to sectors like residential, data centers, health care, self-storage, and lodging, which private funds or direct investing may not be able to efficiently access. Office properties make up nearly half of Norges' private portfolio, but this exposure drops to 28% of the total portfolio when REITs are included. Norges' strategy shows how REITs play a crucial role in improving and “completing” sector diversification and the overall risk-return profile of the fund.

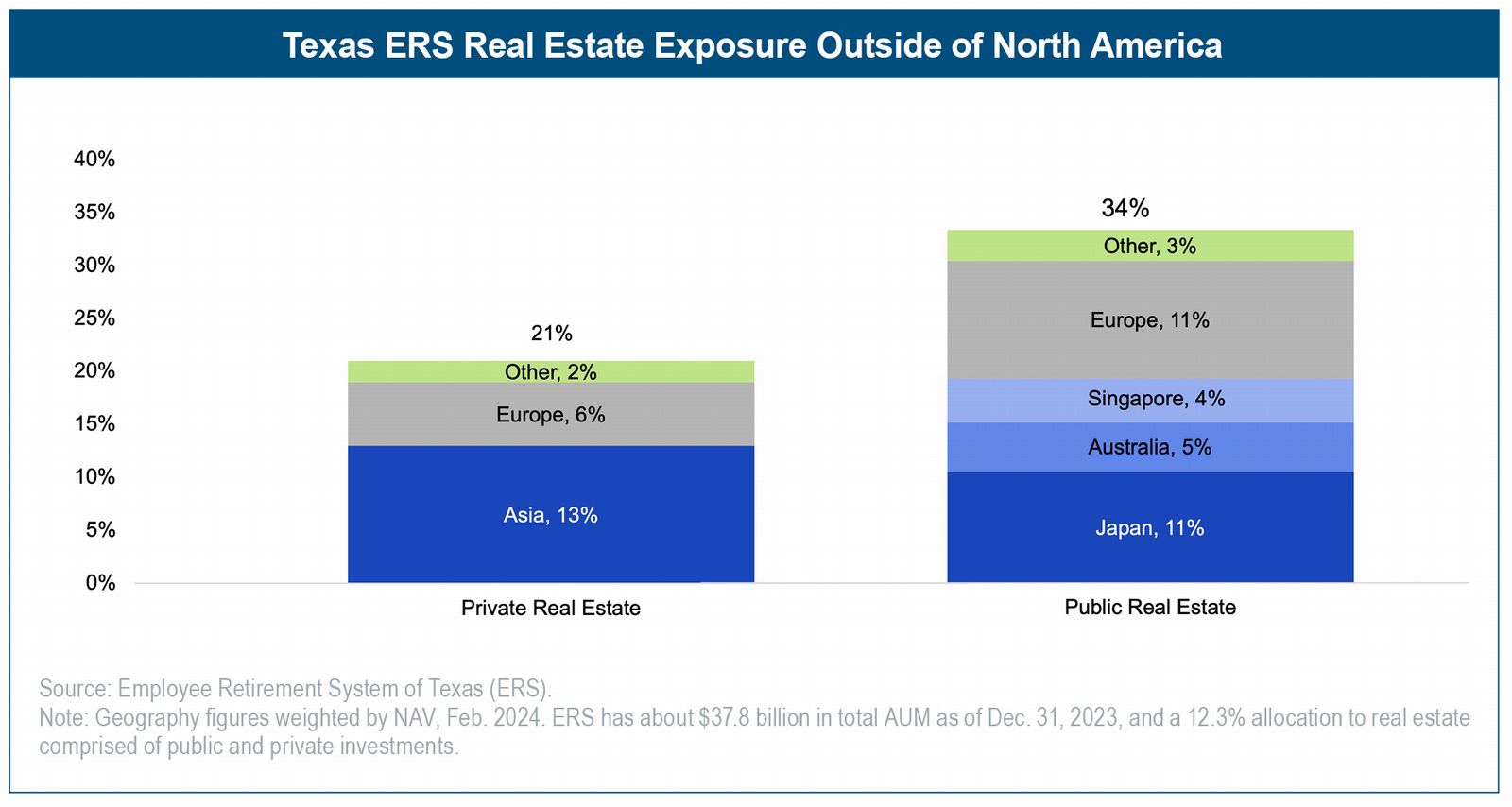

- Employee Retirement System (ERS) of Texas: Texas ERS manages approximately $38.2 billion in AUM and allocates 12% of it to real estate. Within that real estate allocation, ERS has a 25% target for REITs. ERS uses REITs to gain geographic and property sector diversification.

Global listed real estate, especially in Asia, is a key growth area for ERS, offering unique access to high-quality assets in foreign markets. The chart above shows how the public real estate portfolio with REITs has 37% exposure to foreign real estate, compared with just 21% in the private real estate portfolio. By using REITs, ERS achieves geographic and property sector diversification otherwise unachievable in a private real estate portfolio.

Sector Evolution and Future Prospects

As the global economy evolves, institutional interest is gravitating toward modern real estate sectors like technology infrastructure and specialized health care that REITs operate in. Offering transparency, liquidity, and operational efficiency, REITs meet core institutional needs while providing access to high-growth property markets. Increasingly central to institutional strategies, REITs deliver diversified, scalable, and innovative real estate investments. Their ability to bridge valuation cycles, respond to emerging trends, and optimize portfolios ensures their enduring relevance in a dynamic landscape.

Bio: David Sullivan leads institutional pension plan, foundation and endowment outreach for Nareit, the trade association for U.S. listed real estate. Nareit's mission is to actively advocate for REIT-based real estate investment with policymakers in the US and abroad as well as the global investment community. As part of this, Mr. Sullivan promotes and facilitates real estate investment through REITs to institutional investors and their consultants worldwide. This includes organizing roadshows, hosting meetings and other marketing outreach targeted to institutional real estate investment officers around the world.