2026 Outlook for the Economy: It’s an AI World

By: Empower

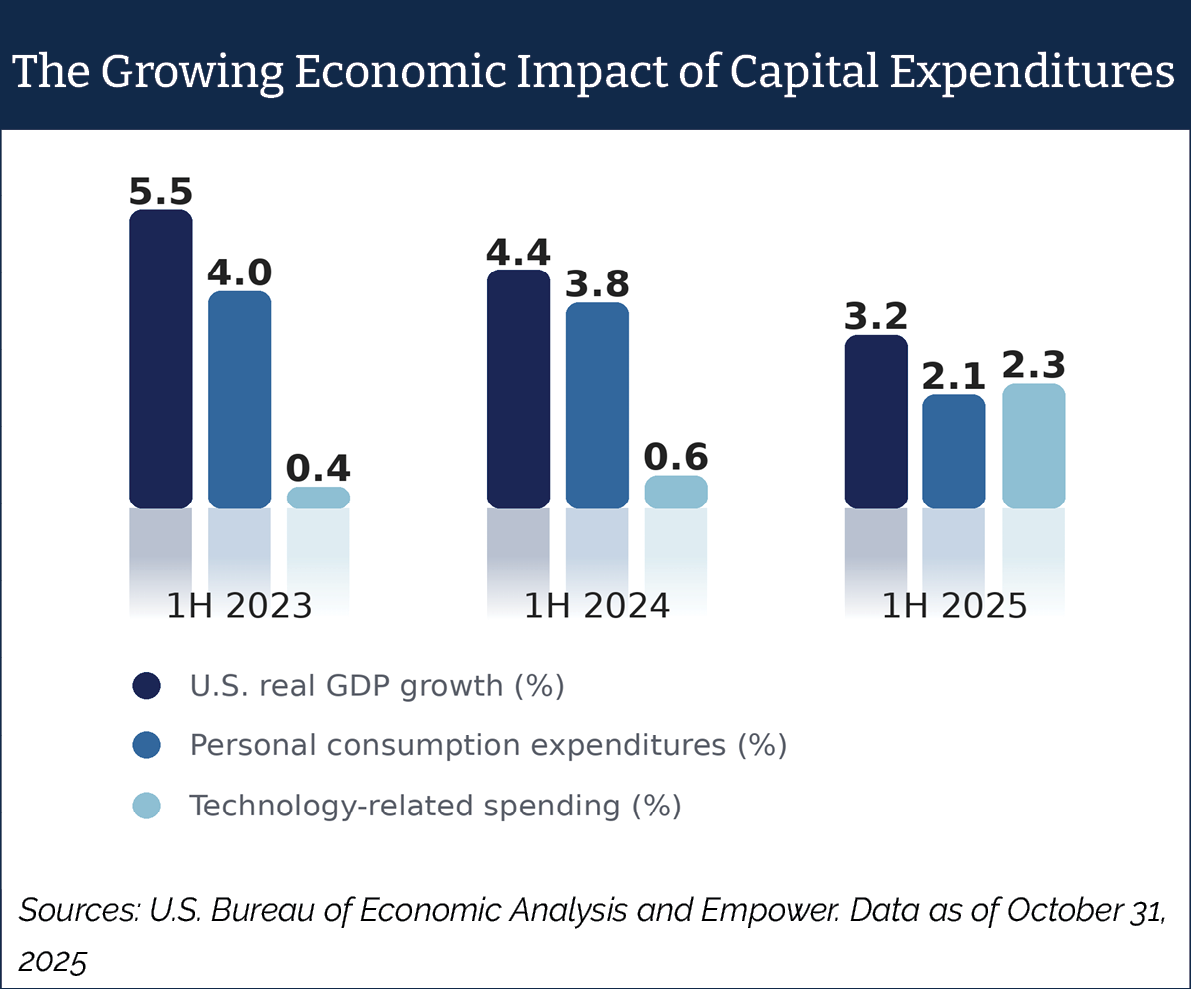

Despite all the tariff headlines and consumer-related fears, the 2025 economy boiled down to one dominant factor: AI. It’s a capex (capital expenditures) thing.

Tech firms are on an AI bender, with the AI investment cycle inflating their infrastructure building and spurring cloud revenue.

We evaluate real GDP growth in the first half of the year in 2025 against the first-half real GDP growth in 2023 and 2024. We also compare the contribution of consumer spending to the contribution of technology-related fixed investment. We find that technology-related fixed investment has increased markedly relative to prior years. Technology-related spending is defined as the combined total of Information Processing Equipment, Software, and Research & Development excluding Software within GDP components.

We Expect More of the Same in 2026

In fact, our AI research suggests that related capital expenditures by hyperscalers such as Alphabet, Microsoft, Oracle, and Amazon could reach $400 billion in 2026, which would make hyperscalers as much or more central to economic strength over the next year as they have been over the past year.

That’s Because AI Remains Capacity Constrained

For companies to harvest demand — and revenue — they have to train models, build data centers, and develop energy sources.

Thus, before we can look for the revenue, we have to see even greater investment.

A Capex-Driven Market Changes the Economic Calculus a Bit

The consumer still matters — of course — and we’ll want to keep a close eye on all the traditional consumer measures: inflation, labor, housing, and retail spending.

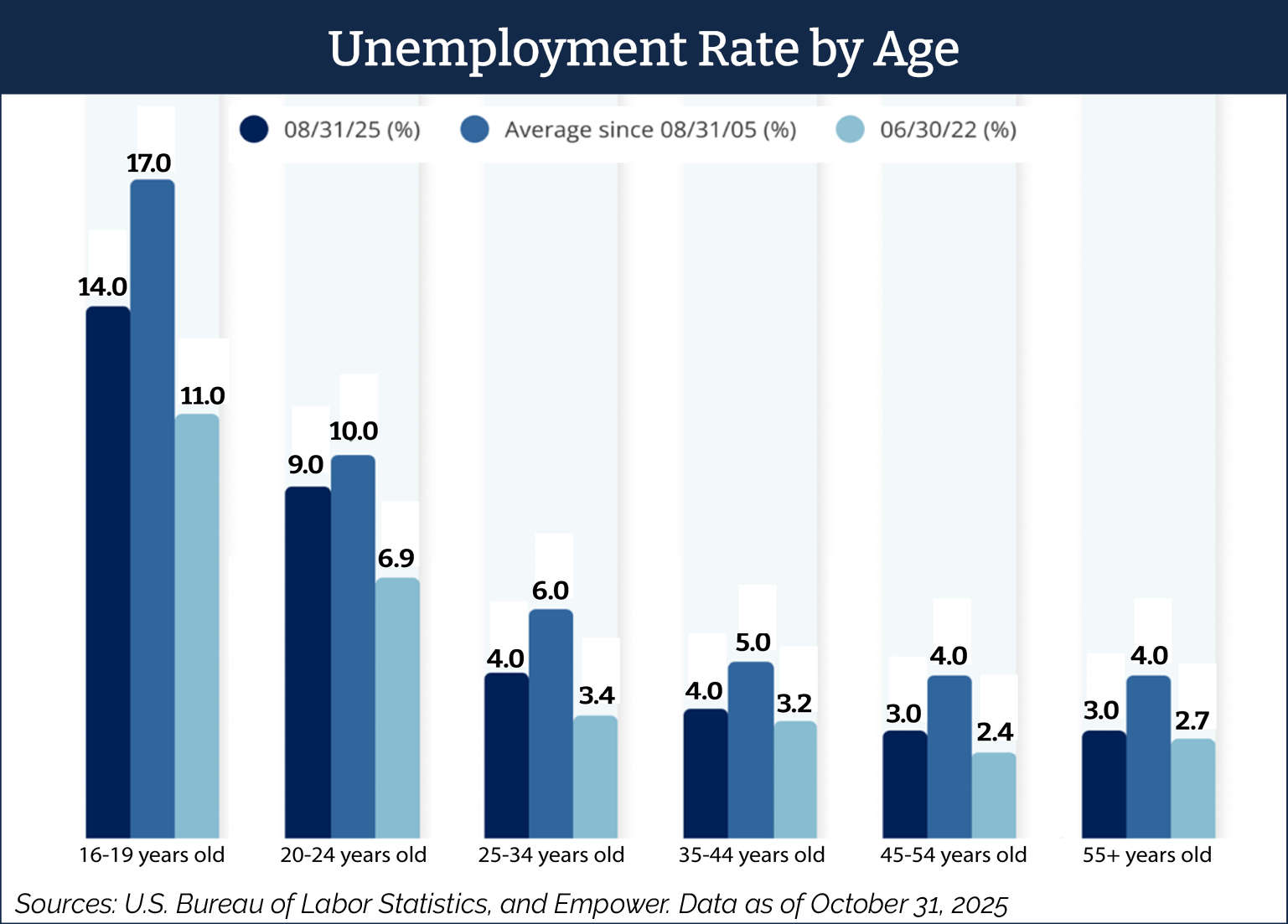

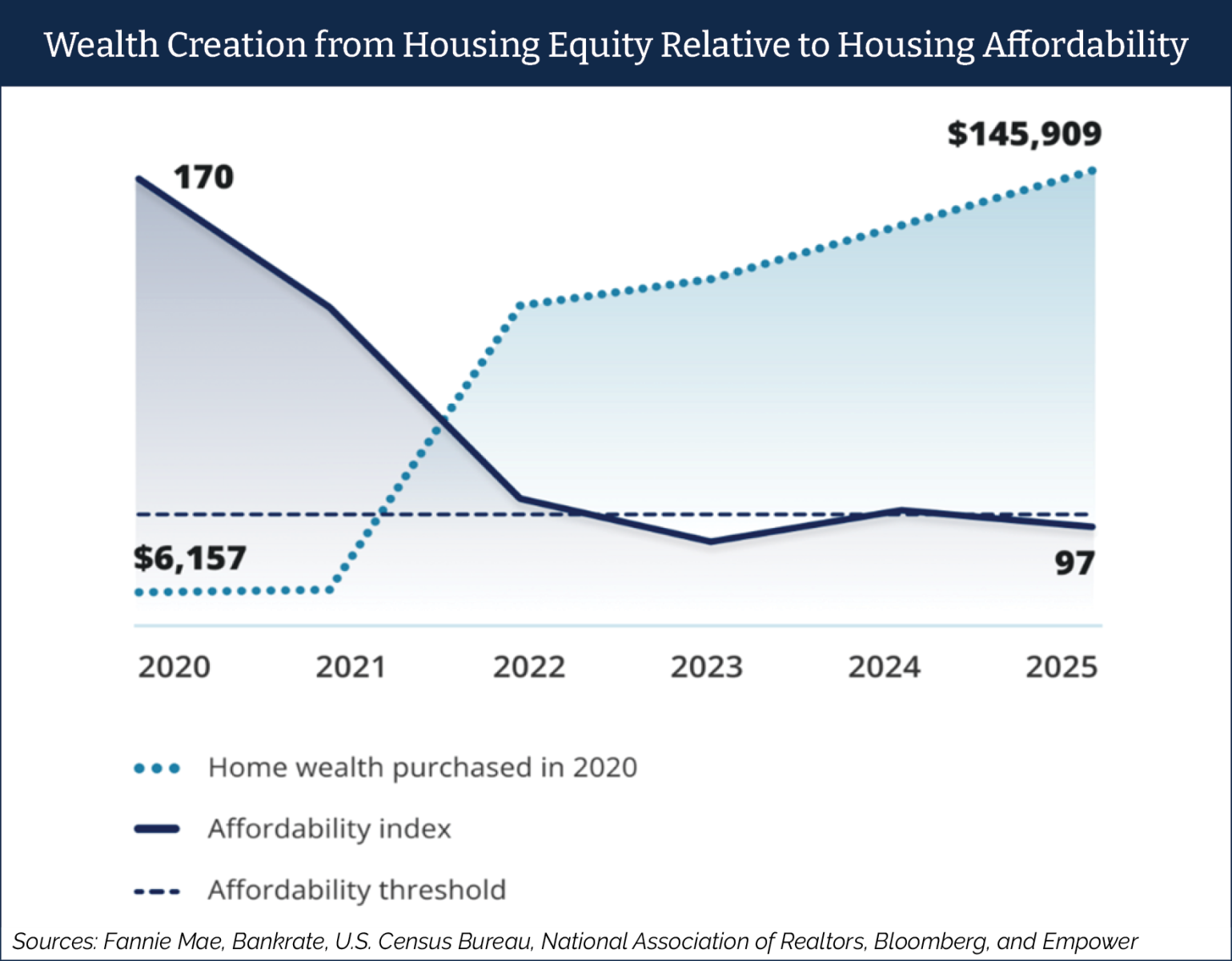

In particular, we’re worried by the economic splintering we’re seeing across different cuts of the economy. Consider the wealth gains since the pandemic by those who own homes, which has essentially shut out new homebuyers. Or the higher unemployment rate for younger demographics relative to the still-healthy broader labor market.

We review the unemployment rate by age. We find that while unemployment is below the 10-year average across all age categories, it has worsened meaningfully over the past three years, particularly for younger job seekers.

We compare the wealth creation from rising home price equity for homes purchased in 2020 relative to an index measuring affordability over the same period. The contrast is stark: Due largely to rising home prices, homeowners have seen a remarkable gain in wealth over this stretch. However, those looking to enter the market are looking at extremely low levels of affordability. A Housing Affordability Index of 100 indicates that a median-income household earns exactly enough to afford a median-priced home under standard mortgage terms. Values above 100 imply greater affordability, while values below 100 indicate that the median-income family lacks sufficient income to purchase the median-priced home.

Housing Matters to the Economy. A Lot.

Not only does a strong housing market generate demand all on its own (think construction activity, home furnishings, and spending for services), but gains in home equity can also generate a powerful “wealth effect” that encourages homeowners to spend on other things, too.

We’re hopeful that lower rates and slower price growth will improve affordability and allow more would-be homeowners to join the party.

The outside risk? Should demand not materialize, severe price declines could occur, which might cause that wealth effect to run in reverse. But with AI spending undergirding the economy, the implications of economic splintering may be more political than economic.

Approaching midterms may give a sense for who people hold accountable for the economic disparity. But while we think it’s possible weaker segments of the consumer base may drag on the economy on the margin, we expect AI spending to dictate the overall health of the economy.

This is Both Risk and Opportunity

Our research suggests capex cycles are sensitive to the business cycle and stock-market drawdowns. And should the AI supercycle stall or — worst-case scenario — collapse, it’s hard to imagine the U.S. economy won’t feel the effects. On the flipside, should it continue apace, it’s hard to imagine a recession on the horizon.

We take a guardedly optimistic view on the buildout. The big spenders are generally well capitalized, spending from cash flow rather than taking out debt. However, this is changing (for example, in October Bloomberg reported that Meta had received orders of $125 billion for a jumbo bond sale) and is something worth watching over the course of 2026.

Further explore Empower’s outlook for 2026 through the links below:

Overview I Economy I Equity market I Bond market I AI I Housing market I Global debt