Are Public Pensions Affordable for Taxpayers?

Reducing benefits or closing pension plans may appear to save money in the short term, but the long-term costs could include reduced economic activity and public services, higher taxpayer burdens, and diminished retirement security for public servants.

By: Hank Kim, Executive Director & Counsel, NCPERS

At a time when the vast majority of states are seeing tax revenues fall below long-term trends, and many are grappling with budget shortfalls and structural deficits, leaders may be tempted to consider making changes to public pensions to balance their books in the short term.

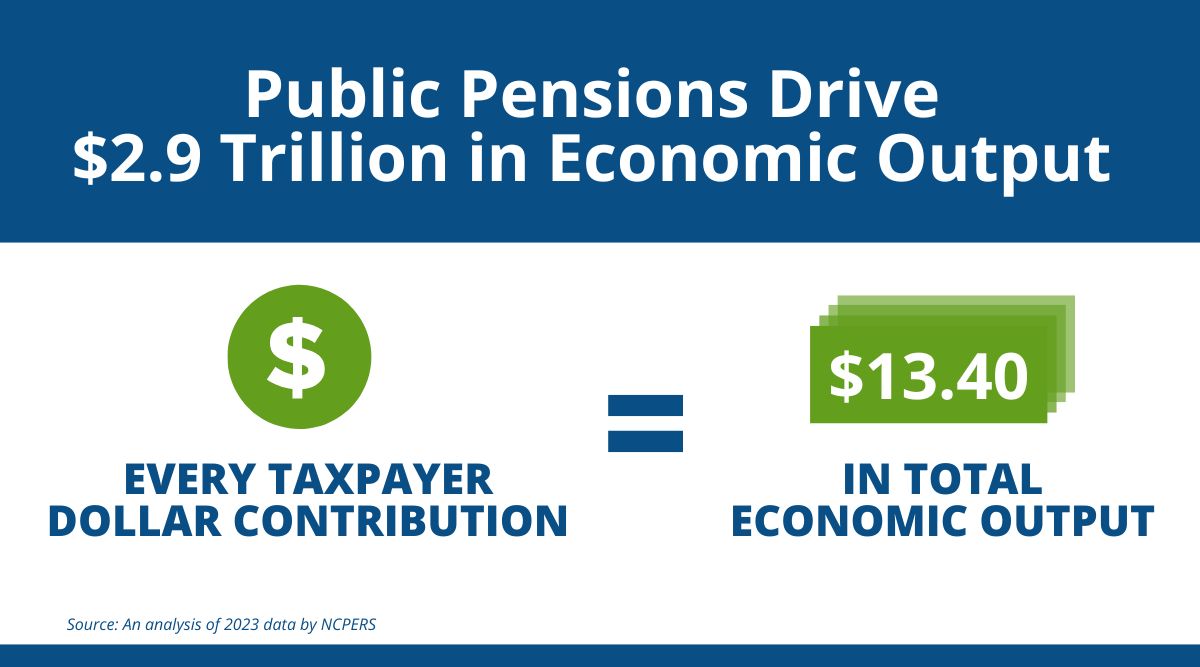

But a new study from NCPERS finds that scaling back public pensions could have negative economic effects: Public retirement systems generated nearly $662 billion in state and local tax revenues and contributed $2.9 trillion to the U.S. economy in 2023 alone.

Public pensions contribute to state and local tax revenues and economies in two primary ways: Retirees spend their pension checks each month, and pension funds invest capital to support economic development. By quantifying the economic impact of public pensions and comparing this to the relative contributions by taxpayers, we gain a clearer understanding of whether or not pensions are fiscally sustainable.

NCPERS' 2025 research update of Unintended Consequences: How Scaling Back Public Pensions Puts Government Revenues at Risk offers compelling evidence that public pensions are not a burden for taxpayers, but are instead a revenue generator that should not be overlooked.

The data reveals that in 2023:

- Public pensions contributed $2.9 trillion to the U.S. economy: $1.9 trillion from the investment of pension fund assets and $980.7 billion from retiree spending of pension checks.

- Public pensions generated $661.9 billion in state and local tax revenues—$445.2 billion morethan the $216.7 billion contributed by taxpayers.

- Forty-three states saw a net revenue gain from public pensions, highlighting their widespread fiscal benefits. This trend has grown steadily since 2016.

- For every dollar taxpayers contributed to public pensions, they generated $13.41 in economic activity.

These are not abstract numbers. They represent real economic activity—retirees spending in their communities, pension funds investing in infrastructure and businesses, and governments collecting the revenues needed to fund essential services.

Reducing benefits or closing pension plans may appear to save money in the short term, but the long-term costs could include reduced economic activity and public services, higher taxpayer burdens, and diminished retirement security for public servants.

To learn more:

- We encourage you to download the report here and to view our interactive map to find the tax revenue generated by public pensions in your state.

- Watch our on-demand webinar for key takeaways from the study's lead author.

- Explore the NCPERS' research library to learn more.

- For insights into public pension funding practices and research into fiscal sustainability, head to Chicago on Aug. 17-19 for NCPERS Public Pension Funding Forum. View the agenda and register now to join us.