The Rise of Private Credit Secondaries: A Differentiated Strategy Offering Investors a Diversified

This is an educational introduction for plan sponsors on private credit secondaries market, which evolved from private equity secondaries, offering opportunities to buy and sell illiquid private credit fund positions. The article explains how this growing market, driven by increased demand and limited buyers, provides a diversified, low market-correlated entry point, helping investors understand how it can enhance their portfolio diversification and deliver attractive risk-adjusted returns.

This is an excerpt from NCPERS Spring 2025 issue of PERSist.

As fnancial markets evolve, new asset classes are formed, and innovative solutions are identifed. Following the growth of the private equity market in the 1990s, some investors found themselves holding long-term, illiquid fund investments at a time when they needed liquidity for various reasons. Naturally, this gave rise to a private equity secondaries market where other investors were able to provide liquidity by purchasing these illiquid fund positions, often at a discount, in volumes great enough to form an asset class of its own, now known as secondaries.

Following in the footsteps of the boom in the private equity market, the Global Financial Crisis accelerated the growth of a fourishing private credit market. Inherently, like we saw in private equity, this growing pool of illiquid private credit fund investments creates opportunities for investors to buy and sell existing investments in private credit funds in the same way, creating what we now call the private credit secondaries market. Just as there are differences in the private equity secondaries market based on the underlying fund strategies across geographies, company sizes, or type of equity investments, there are also numerous focus areas within private credit secondaries and the competitiveness and attractiveness for investors can vary based on simple supply demand dynamics. Limited buyers exist with the origination capability, due diligence skills, and strategic focus to acquire smaller credit-oriented secondary assets, creating high barriers to entry and opportunities for specialized lower middle-market private credit secondaries managers to benefit from this supply-demand imbalance.

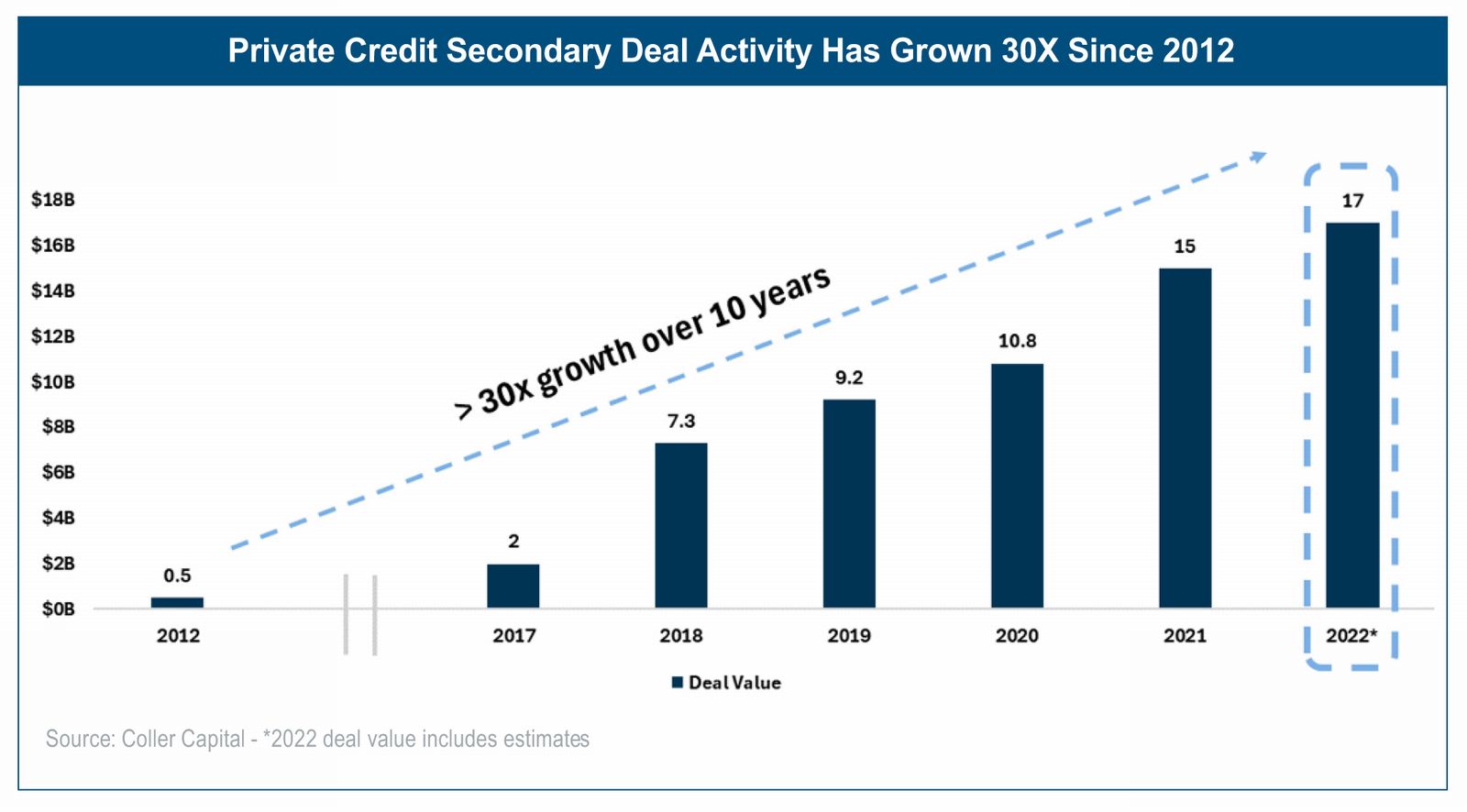

The private credit secondary market has grown 30x since 2012,1 which has led to the current supply-demand imbalance as there are not enough capital providers to satisfy the deal flow in this space. Therefore, experienced buyers can be extremely selective in this market; however, new entrants will need to pay close attention to the quality and terms of their purchases, as risk tolerances and rates fluctuate.

According to Private Debt Investor's LP Perspectives 2024 Study, investors are more interested than ever in capitalizing on the opportunities available in private credit secondaries. In all, 21% of LPs now plan to commit capital to secondaries funds in private credit over the next 12 months, the highest proportion ever seen in the survey and up from 7% as recently as 20222. Investors are now taking notice of private credit secondaries as a method of achieving immediate diversification, reducing dispersion in returns, yield enhancement, and j-curve mitigation, while capitalizing on the market dislocation.

Private credit secondaries transactions can take various forms, including the purchase of individual loans or debt portfolios, the acquisition of LP interests in private credit funds as well as fund solutions like Net Asset Value (NAV) lending and continuation vehicles. These transactions often occur in a bilateral or negotiated manner between buyers and sellers, with pricing and terms reflecting factors such as credit quality, collateral characteristics, and prevailing market conditions.

MARKET OPPORTUNITY

Market Ineffciencies and Information Asymmetry:

The private credit secondaries market is characterized by information asymmetry and limited liquidity, creating opportunities for skilled investors to capitalize on market ineffciencies and mispricing. Active management, rigorous due diligence, and specialized expertise are critical for identifying and unlocking value in private credit secondaries transactions.

Structural Tailwinds:

Favorable macroeconomic trends, such as rising corporate indebtedness, credit market dislocations, and regulatory changes impacting traditional banks, can create structural tailwinds for private credit secondaries. Additionally, demographic shifts, technological innovation, and evolving capital market dynamics are driving demand for alternative credit solutions and financing alternatives.

Liquidity Needs and Portfolio Optimization:

Institutional investors, including pension funds, endowments, and insurance companies, often face liquidity needs and portfolio rebalancing requirements. Private credit secondaries offer a solution by providing liquidity for existing investments, enabling investors to optimize their portfolios and redeploy capital into new opportunities or other asset classes.

Diverse Investment Opportunities:

The private credit secondaries market encompasses a wide range of investment opportunities, including the purchase of individual loans, distressed debt portfolios, structured credit products, and private credit fund interests. Investors can gain exposure to various credit sectors, geographies, and risk profiles, allowing for customized portfolio construction and risk management.

Potentially Attractive Risk-Adjusted Returns:

Private credit secondaries, especially in the lower middle-market, have the potential to generate attractive risk-adjusted returns similar to the returns in Private Equity Secondaries, and higher returns than traditional fixed income and public market alternatives.

Endnotes and Disclosures:

1 https://pitchbook.com/news/articles/private-debt-secondaries-market-2023

2 https://www.privatedebtinvestor.com/the-growing-appeal-of-credit-secondaries/

Investing in the Growth Engine of America ® – Star Mountain is a $4+ billion (as of 5/31/24 inclusive of debt facilities) specialized lower middle-market investor providing: (i) Strategic Debt & Equity Capital to private businesses that have at least $15 million of revenue or under $50 million of EBITDA and (ii) Liquidity Solutions to investors and fund managers ("Secondaries") including purchasing LP interests and direct investments in lower middle-market private credit and private equity funds in addition to providing fund managers with NAV loans.

Bio: Ravi Ugale is Managing Director and Investment Committee Member at Star Mountain Capital. Mr. Ugale has 30+ years of private credit, secondaries, private equity, venture capital, investment banking and business operations experience. Expertise spans direct and fund investments, investment and operational due diligence, implementation, manager selection, portfolio allocation and construction for the benefit of clients in the UHNW Private Wealth Management, Foundations & Endowments market segments. He was a Young Presidents' Organization (YPO) member for 10 years and has substantial board and c-level executive operating experience. He was also an active member of the governance and thought leadership Institutional Limited Partners Association (ILPA). Mr. Ugale leveraged a proven track record in principal investing, portfolio management, finance, M&A, executive leadership, marketing and business development to shepherd early, expansion and growth stage companies in bottom-line growth, recruit world-class talent, create win-win strategic partnerships as well as exit planning and execution.