What a Maturing Private Credit Market Means for Investors

By: Michael Massarano, Laura Parrott, and Randy Schwimmer, Nuveen

This article explores how the maturation of private credit is shaping opportunities in this dynamic, multifaceted asset class and discusses the benefits of private credit in portfolios.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

This is an excerpt from NCPERS Fall 2025 issue of PERSist.

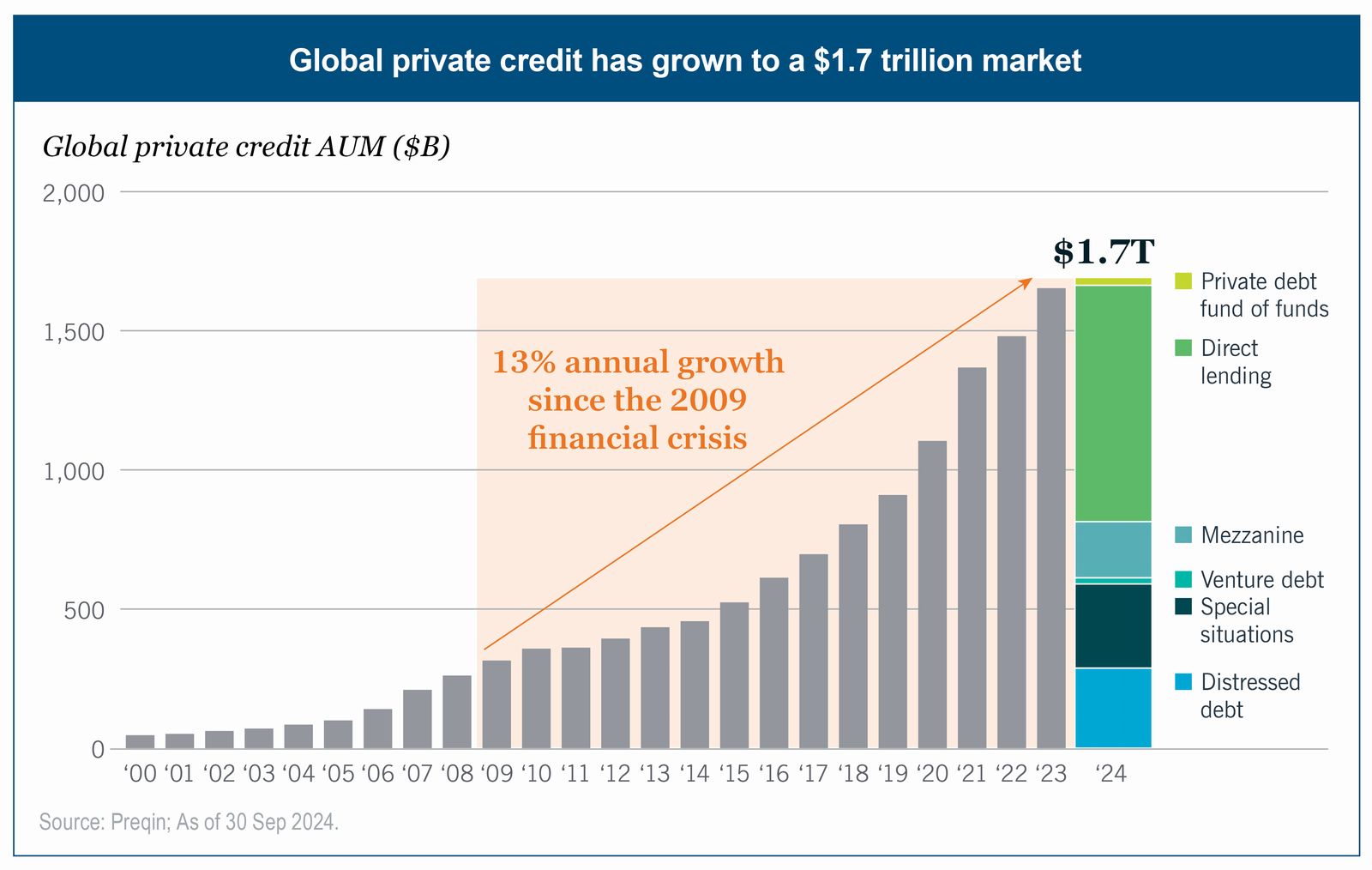

The private credit sector has experienced significant expansion over the past decade, with global assets under management reaching $1.7 trillion. This growth has inevitably attracted scrutiny and raised questions among market participants and observers. Some analysts have posited whether such rapid capital inflows might indicate the formation of a market bubble.

We contend that the market's evolution is indicative of the natural maturation process of an emerging asset class. The sector's growth has led to a broadening of the opportunity set and an increase in market complexity, necessitating more sophisticated analytical approaches and a heightened emphasis on manager selection.

In our view, the primary consideration should not be whether the private credit market has become oversaturated, but rather how to effectively identify high-quality opportunities and optimize allocations within the current nuanced market environment. This approach requires a thorough understanding of market dynamics, rigorous due diligence processes, and a strategic long-term investment perspective.

Institutional investors' confidence in private credit remains strong. Nearly half (49%) of institutional investors in Nuveen's 2025 EQuilibrium survey plan to increase allocations to private credit over the next two years. For wealth investors, this conviction underscores that private credit is evolving, continuing to offer durable opportunities for income and portfolio stability.

A diverse and dynamic market

A common misconception is that private credit is one large, monolithic asset class. It has matured into a diverse ecosystem encompassing a wide range of strategies, each with its own risk profile, borrower base, position in the capital structure and regional dynamics. This diversity is one of the reasons the asset class has proven durable through changing market conditions.

Private credit strategies can be segmented in several important ways:

- Geography. The U.S. maintains its position as the world's most developed and liquid private credit market, supported by a diverse set of direct lending platforms. Europe, by contrast, is more fragmented, with significant differences in laws, regulations and business practices across countries.

- Position in the capital structure. Private credit spans the debt spectrum, from senior secured loans to junior capital and net asset value (NAV)-based lending. Senior secured loans, which sit at the top of the capital structure, are often backed by strong collateral and protective covenants.

- Borrower type. A distinguishing feature of the middle market and upper middle market is private equity sponsorship. While sponsor-backed entities represent a small fraction of the market — less than 5% of the U.S. middle market1, for example — they tend to be recurring-revenue businesses with strong management teams and ambitious growth strategies. Relationships with sponsors are a critical conduit for differentiated deal flow within the private credit ecosystem. In contrast, non-sponsored transactions may offer potential yield enhancement but frequently involve smaller-scale borrowers that may be characterized by less sophisticated governance frameworks and limited financial reporting capabilities.

- Competitive dynamics. Not all areas of the market are equally crowded. At the top end of the U.S. middle market, for example, competition for jumbo deals has intensified, often eroding investor protections. At the lower end, smaller non-sponsored borrowers can carry more credit risk. By contrast, the core U.S. middle market has become less crowded in recent years as capital flows shifted toward the extremes.

For investors, the key takeaway is that private credit is not a monolith. It is a broad and dynamic market where risk and return can vary significantly depending on geography, structure, sponsorship, and competition.

Keys to success in a maturing market

As private credit expands and evolves, success depends more on choosing the right partners who can deliver targeted exposures that align with investor needs. Top managers share several defining strengths:

- Proprietary sourcing. Long-standing relationships with private equity sponsors and repeat borrowers provide consistent access to attractive deals that are not widely marketed.

- Scale and execution. Larger, well-established lenders can anchor transactions, shape terms, and secure stronger covenant protections.

- Portfolio construction discipline. Leading managers build diversified portfolios across sectors, geographies, and capital structures, with a focus on senior secured loans and resilient industries.

- Active portfolio management. Much of the real work in capturing value in private credit begins after a loan is made. Effective managers continuously monitor performance, engage directly with borrowers and sponsors, and intervene early when issues arise in order to protect capital and sustain performance.

The lesson is clear: private credit can deliver income, return potential, market resilience, and diversification, but outcomes are largely determined by the quality of the manager.

Take a deeper dive in the full article: Private credit's next phase: finding opportunity in a maturing market.

Disclosures: This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Financial professionals should independently evaluate the risks associated with products or services and exercise independent judgment with respect to their clients.

Investors should be aware that alternative investments including private equity and private debt are speculative, subject to substantial risks including the risks associated with limited liquidity, the potential use of leverage, potential short sales and concentrated investments and may involve complex tax structures and investment strategies. Alternative investments may be illiquid, there may be no liquid secondary market or ready purchasers for such securities, and they may be subject to high fees and expenses, which will reduce profits. Real estate investments are subject to various risks associated with ownership of real estate-related assets, including fluctuations in property values, higher expenses or lower income than expected, potential environmental problems and liability, and risks related to leasing of properties.

Nuveen, LLC provides investment solutions through its investment specialists.

4855406

Endnotes:

1PitchBook 2024 US PE Middle Market Report and the National Center for the Middle Market.

Bios: Michael Massarano is a Partner and Co-Head of Human Capital at Arcmont Asset Management, an investment specialist of Nuveen. Michael was previously a Principal at BlueBay's Private Debt group where he worked from 2017.

Prior to BlueBay, Michael worked as an Investment Associate at Avenue Capital Group for three years focusing on a wide range of credit investments within the Private Debt team. Prior to Avenue Capital, Michael worked for three years within the leveraged finance team of Deutsche Bank with a focus on leveraged loans, high yield and restructuring transactions.

Michael graduated with First-Class Honours from Manchester University (MBS) and holds a Bachelor's degree in International Business, Finance and Economics.

Laura Parrott is a senior managing director and Head of Private Fixed Income at Nuveen where she leads Private Placements and oversees Nuveen Green Capital and the Energy Infrastructure Credit investment team.

As Head of Private Fixed Income, Laura is responsible for the growth and commercialization of the Private Placements platform, which has grown to over $60 billion in AUM, and includes corporate credit, infrastructure debt, credit tenant loans, and private ABS. Laura oversees Nuveen Green Capital, which was acquired in 2021 and is the leading provider of C-PACE financing in the nation. She also oversees the Energy Infrastructure Credit investment team that was launched in 2022 to further assist companies' efforts to reduce carbon emissions, advance the electrification of industry, and ensure energy supply and reliability. She joined the company in 2005 in the private placement originations and portfolio management group. Prior to joining Nuveen, Laura worked at JPMorgan in various market-related roles in Equities and Corporate Strategy.

Laura graduated with a B.S. in Business Administration from Wake Forest University's Calloway School of Business and an M.B.A. from Duke University's Fuqua School of Business.

Randy Schwimmer is Vice Chairman and Chief Investment Strategist at Churchill. In his role, he leads the firm's investment outlook and is dedicated to educating clients and audiences on private capital markets and portfolio strategy. Randy is the Founder and Publisher of The Lead Left, Churchill's weekly newsletter reviewing deals and trends in the capital markets, and he also produces Private Capital Call, a monthly podcast. Additionally, Randy serves on Churchill's Executive Committee and Senior Lending Investment Committee.

Previously, Randy oversaw Churchill's Investor Solutions Group, focused on deepening and expanding the firm's relationships with investors, and prior to that, he served as Co-Head of Senior Lending, responsible for senior lending origination and capital markets.

Randy graduated, cum laude, from Trinity College with a B.A. in English, where he currently serves on its Board of Fellows, and received a M.A. in English Literature from the University of Chicago, where he is a member of the Humanities Advisory Council. Randy was named the 2023 “Thought Leader of the Year” by the Alliance of Mergers & Acquisitions Advisors (AM&AA). He is also Treasurer and member of the Vestry of Christ Church Greenwich, where he served as Senior Warden. Finally, Randy is a member of the Prisoner Visitation and Support (PVS) volunteer program for people incarcerated in U.S. federal and military prisons.