Safeguarding Your Financial Security: NCPERS Life Insurance Affinity Program

According to the most recent annual Insurance Barometer Study, more than 52% of Americans have some form of life insurance protection.

As the world evolves, so do the risks that we face – in response, more people are turning to comprehensive insurance as a means of helping to protect their financial security. Among the various options available, life insurance and identity & fraud insurance have emerged as critical tools to consider. In this two-part series, we'll discuss these products and the role they can play in safeguarding you and your family members' financial security.

First, let's talk life insurance.

According to the most recent annual Insurance Barometer Study, more than 52% of Americans have some form of life insurance protection. Life insurance has long been recognized as a safety net for families, providing stability in times of loss. It can help cover essential expenses when a loved one passes away such as, mortgage payments, funerals, everyday living costs, and more.

Life insurance is often offered as an employee benefit, although most group life insurance benefits stop or are reduced at retirement. But even after you stop working, it's important to protect your family from financial hardships, which is why NCPERS offers a decreasing voluntary term life insurance policy through Prudential that can be continued after retirement.

What is Decreasing Term Life Insurance?

There are different types of life insurance available on the market. Decreasing term life insurance is a type of insurance policy where the death benefit decreases over the life of the policy, meaning that if the insured person were to pass away, the payout to their beneficiaries would decrease over time according to a predetermined schedule. The benefit of this type of policy is that since payout decreases over time, the premiums are generally lower compared to other types of life insurance.

How does NCPERS Voluntary Term Life Insurance Program work?

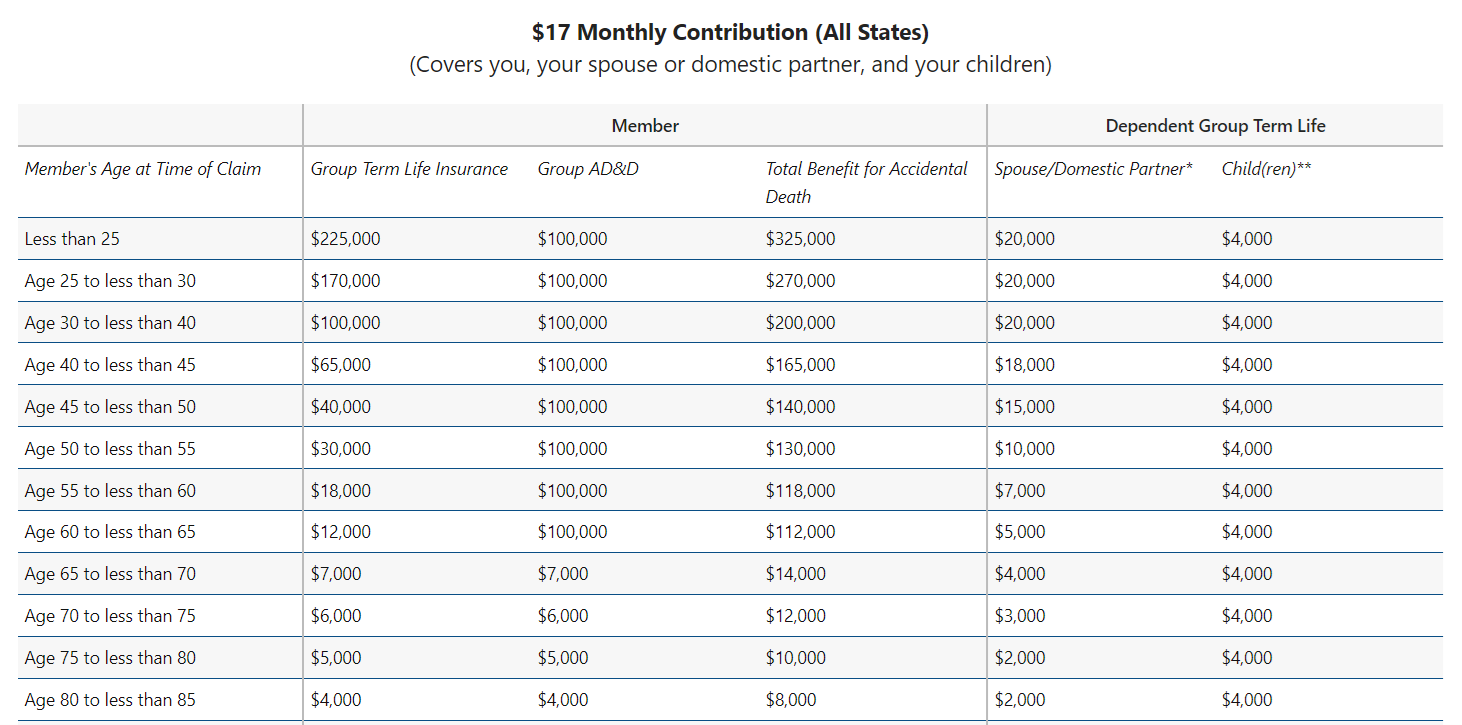

NCPERS' product is uniquely designed for public retirement systems, as it supplements your pension survivor benefits when your family needs it most. As your pension increases throughout your career, your term life insurance decreases--having both can help ensure your loved ones are protected.

There are a few special features of our product.

- The premium never increases, regardless of your age. The premium stays flat at $17 per month and NEVER increases. This is a highly competitive price.

- There is no medical underwriting and coverage is guaranteed. For many life insurance policies, enrollees must prove that they are a low health risk. However, with NCPERS' product, people can enroll regardless of any health conditions – no medical questions asked.

- Accidental, spouse, and child death benefits are automatically included. Again, with no medical questions asked.

- Built in student loan protection. If you are age 45 and under, approved for a waiver of premium due to total disability, and have an outstanding student loan balance, Prudential will reimburse the amount of student loans you owe up to a maximum of $50,000.

- Coverage can continue into retirement. For most employees, their life insurance ends when they age out of their job. This policy stays with you into retirement, as long as you retire within the public system.

In a world full of uncertainties, insurance can provide a sense of security and empowerment. NCPERS life insurance gives our members the confidence to tackle life's challenges head on by providing immediate support to beneficiaries and loved ones in their times of need. Look out for Part Two in this series to find out how identity and fraud insurance can add another layer to your financial security.

To learn more about the life insurance offering, please ask your public employee retirement system administrator for details on enrollment or to find out if they're offering this unique benefit. Additionally, visit our website or click the link below:

Group Insurance coverage is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500

1081023-00001-00