Safeguarding Your Financial Security: NCPERS Identity and Fraud Insurance Affinity Program

The 2023 Internet Crime Report by the Federal Bureau of Investigations reported a record number of complaints from the public: 880,418 complaints with potential losses exceeding $12.5 billion. Identity theft and fraud insurance is not yet widely offered by employers, which is why NCPERS offers Identity and Fraud Protection through MetLife.

As the world evolves, so do the risks that we face – in response, more people are turning to comprehensive insurance as a means of protecting their financial security. Among the various options available, life insurance and identity & fraud insurance have emerged as critical tools to consider. In this two-part series, we'll discuss these products and the role they can play in safeguarding you and your family members' financial security.

In the second installment of this series, we're talking identity and fraud insurance.

Considering our increasingly digital society, the risk of identity theft and fraudulent activity is a growing concern. According to the National Council on Identity Theft Protection, nearly 33% of Americans have faced some kind of identity theft attempt in their lives, and experts indicate that this number could increase significantly in the next several years. The 2023 Internet Crime Report by the Federal Bureau of Investigations reported a record number of complaints from the public: 880,418 complaints with potential losses exceeding $12.5 billion. Identity theft and fraud insurance is not yet widely offered by employers, which is why NCPERS offers Identity and Fraud Protection through MetLife.

What is identity and fraud insurance?

Identity theft insurance provides coverage for expenses incurred as a result of identity theft. It may cover costs related to legal fees, lost wages, document replacement costs, credit monitoring, and fraudulent charges. Fraud insurance goes beyond identity theft and may cover losses resulting from various types of fraud, including cyber fraud, investment fraud, insurance fraud, and credit card fraud. When fraud protection is combined with identity protection, they are powerful tools in helping individuals recover from the financial and emotional toll of these threats.

What are some components of NCPERS Identity and Fraud Insurance Program?

NCPERS identity theft and fraud program is an all-in-one digital security solution that helps members to navigate the digital landscape with peace of mind. MetLife Identity & Fraud Insurance powered by Aura protects identity, money & assets, family & reputation, and privacy.

- Identity Theft Protection. Get alerts if Aura detects threats to your identity, Social Security Number, and online accounts. Aura offers personalized support and up to $1M in identity theft insurance.

- Financial Fraud Protection. Aura closely watches your finances and assets, providing alerts for credit & debit cards, bank & 401(k) accounts, student loans, home & car titles, and any new inquiries to your credit.

- Privacy & Device Protection. Shop, bank, and work online safely and privately with safety tools, including VPN/Wi-Fi security, safe browsing, and password management. Aura also requests removal of your personal information from data broker lists to help reduce spam like robocalls and texts.

- Customer Service. Aura plans include 24/7/365 customer support to answer account, technical, or billing questions. Additionally, resolution specialists provide white glove case management services to victims of fraud.

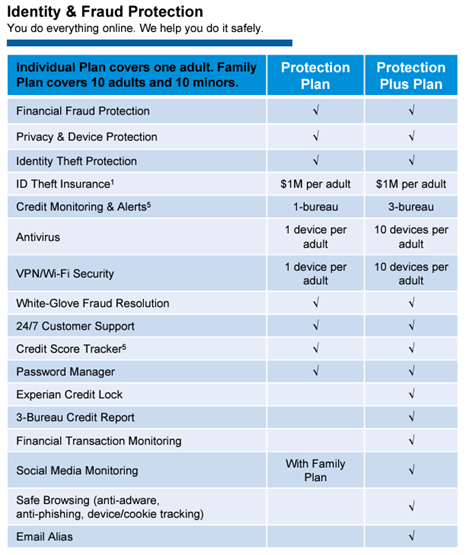

There are two Aura protection plans offered by NCPERS, the Protection Plan and the Protection Plus Plan. Starting at just $7.95/month, both are available to purchase as individual or family plans. The table below illustrates the specific components of each plan:

In a world full of uncertainties, insurance can provide a sense of security and empowerment. NCPERS Identity and Fraud Insurance serves as a proactive measure to safeguard your financial wellbeing and mitigate any potential fallout from cyberattacks. When you start participating in this program, you are taking meaningful action to protect the futures of yourself and your loved ones.

For more information or questions regarding NCPERS Identity and Fraud Program, visit https://offer.aura.com/ncpers.