Spring 2024 White Paper: Compelling Market Dynamics Within U.S. Private Credit

By: Turning Rock Partners

Private credit plays a vital role in pension portfolios due to its income profile and lower correlation to broader markets. Lower mid-market private credit focused on founder owned and led companies plays a vital role in driving U.S. growth, argues Turning Rock Partners in this new white paper.

This is an excerpt from NCPERS Spring 2024 issue of PERSist, originally published April 25, 2024.

Market Dynamics:

Global economic growth outlook is muted, geopolitical conflicts abound, and recessionary fears remain. It is a challenging time to allocate capital.

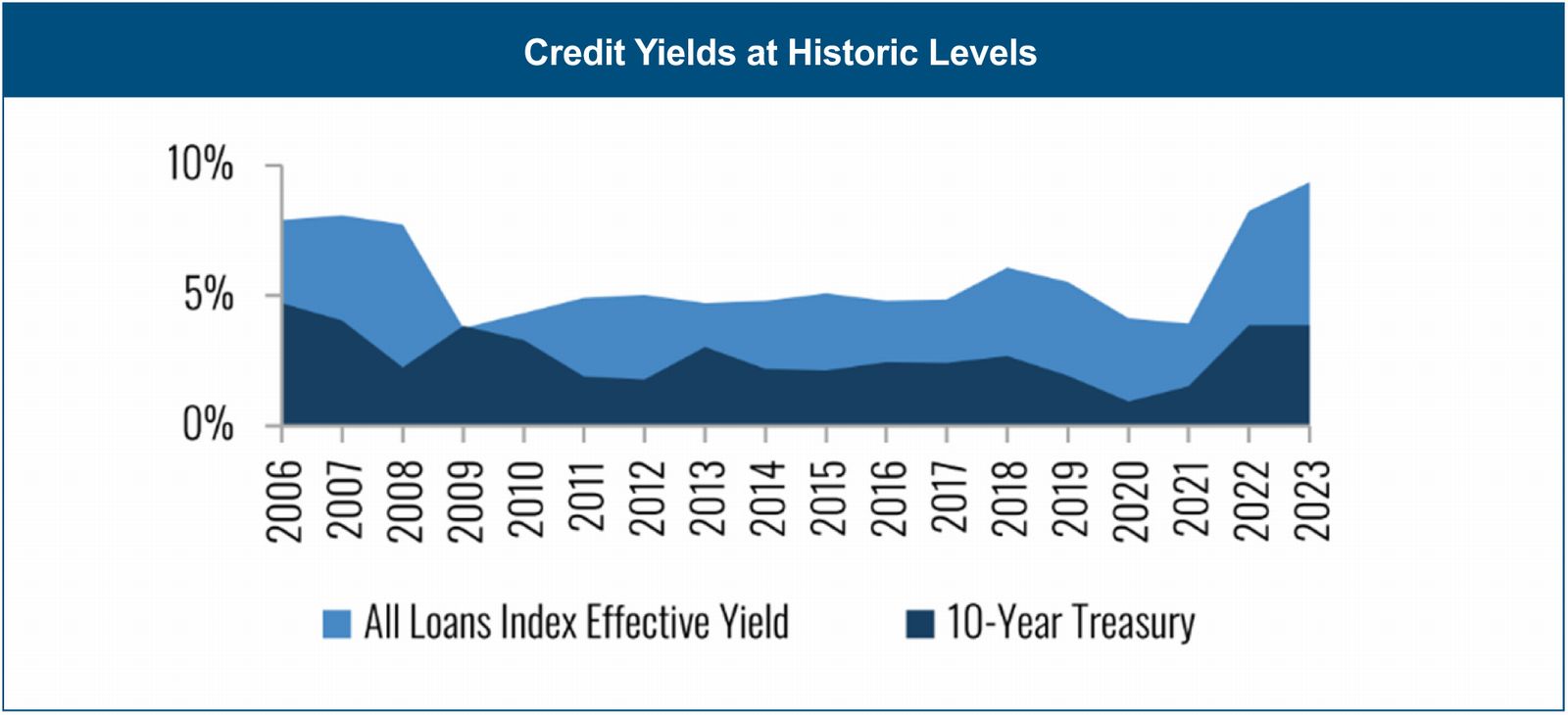

Effective yields in the loan market are at 15-year highs as spreads over nominal base rates have widened out and investor demand has picked up.1

Given elevated base rates, uncertain growth expectations, and volatile equity markets, fixed income and credit strategies play a vital role in portfolios to provide ballast and income production. Credit investors in the U.S. can clearly see advantages on a risk-adjusted yield basis, but must also consider the systemic driver which is supporting overall demand – the secular retrenchment of bank lending and the recent regional banking market dislocation. Not only has there been a secular decline in bank lending, but the U.S. banking market experienced substantial volatility in 2023, with the total amount of assets involved in bank failures exceeding even the GFC.2

Most lower middle market companies (“LMM”) (defined herein as <$1bn in Enterprise Value) are too small to tap public credit markets for financing. These companies in the U.S. are frequent customers of smaller and regional banks and rely on these counterparties for working capital, revolving credit capacity, inventory financing, equipment purchases, real estate loans, and other needs. There are more than 200,000 middle market companies in the U.S. alone; with banks trimming lending, pursuing asset sales, and reducing risk, these corporates must turn to alternative credit financing to meet their needs.

Quantifying the Opportunity:

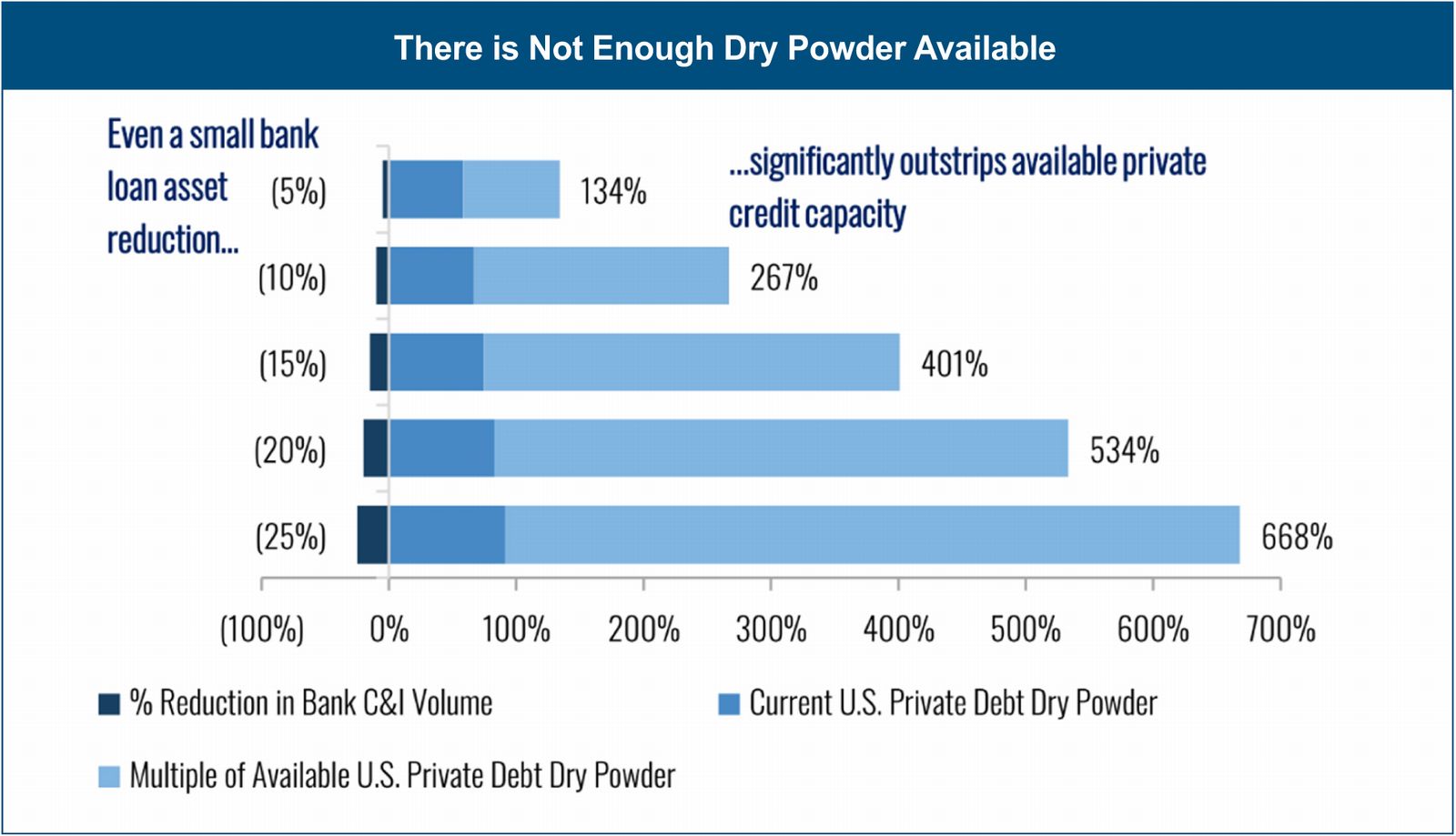

A sensitivity analysis reveals that even a 5% reduction in loan assets from small U.S. banks (a primary source of financing for LMM businesses) would exceed the current dry powder available in U.S. direct lending private credit3. Given the heightened volatility and disruption in smaller and regional banks, the pullback could in instances be much greater than 5%, in which case the effect cascades.

The Rise of Non-Sponsor Lending:

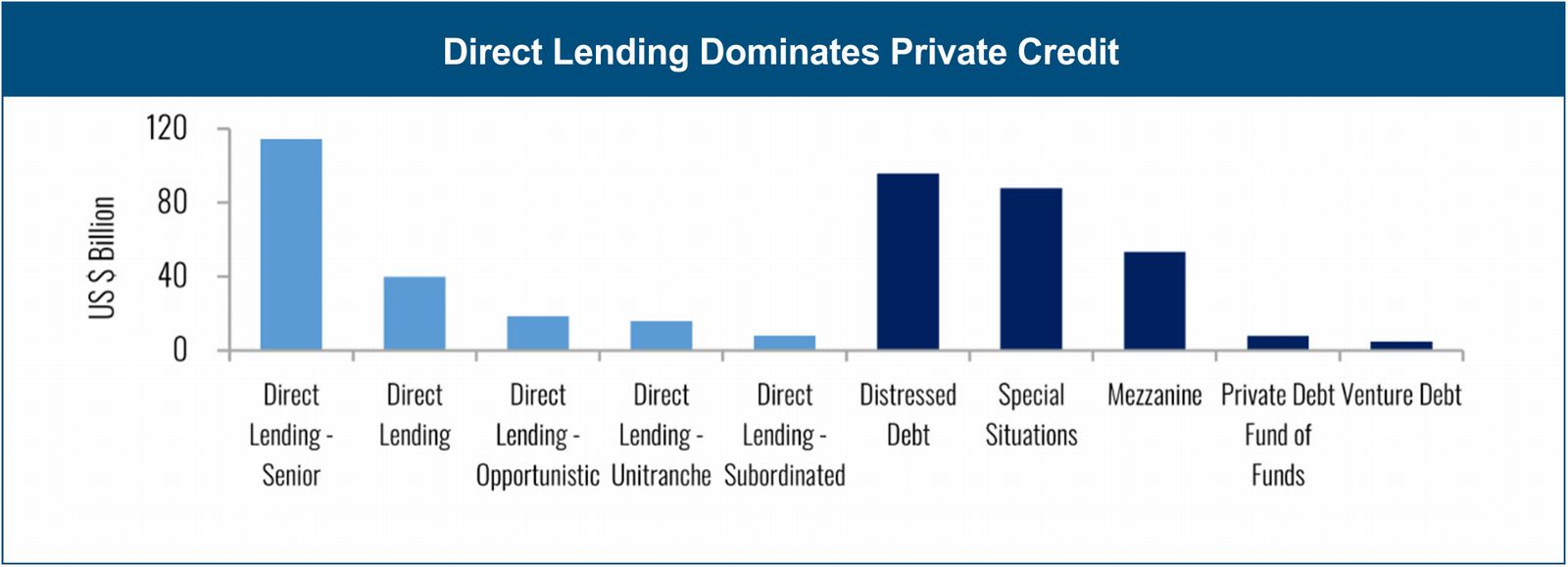

Traditionally, private credit was dominated by sponsor-backed lending, focusing on dividend recapitalizations or traditional leveraged buyouts. This market tends to be more competitive, with 44% of all private credit AUM in direct lending strategies4. The non-sponsor lending market has emerged as a dynamic and attractive alternative. Non-sponsor lenders provide capital directly to companies, bypassing sponsors and supporting founder or family-owned/ led businesses seeking capital. Beneficial characteristics can include:

- Lower competition: Fewer participants compared to the sponsor-backed market (based on amount of dry powder available), potentially leading to more attractive deal terms.

- Unique deal flow: Founder-led businesses can offer strong fundamentals and compelling growth trajectories, and they may be tapping institutional capital for the first time.

- Favorable alignment of interests: Direct relationships with borrowers who typically have substantial equity and cash at risk.

Conclusion:

The middle market is a deep, broad, and growing segment of the U.S. economy. There are over 200,000 middle market companies in the U.S., employing more than 48 million people. Of that segment, roughly 28,000 have revenues of $50-$250 million. At an assumption of $20-50 million in capital need per company, the market demand over the next three years could easily exceed $3 trillion.

In an environment of economic uncertainty, lower middle market private credit, particularly non-sponsor lending, presents a compelling investment opportunity. This market offers investors superior returns, lower volatility, diversification benefits, and access to a dynamic segment of the economy. With its unique characteristics and untapped potential, the LMM private credit market stands poised to deliver compelling returns for discerning investors seeking all-weather absolute returns in a challenging economic landscape.

About the Author

Turning Rock Partners seeks to make long-term investments in debt and equity securities of North American small and mid-capitalization businesses. Turning Rock Partners has over $1.2B of committed capital and structures capital solutions for growing companies in need of flexible financing. The firm is based in New York, NY.

Disclosures: The Presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any security or interest in any current or future Turning Rock fund and may not be relied upon in connection with the purchase or sale of any security. Any such offer or solicitation shall be made only pursuant to the confidential private placement memorandum. You may not rely on the Presentation as the basis upon which to make an investment decision. Turning Rock does not represent, warrant or guarantee that the information contained in this presentation is accurate, complete or suitable for any purpose. No assurance can be given that the Funds will meet their investment objectives or avoid losses. Investment in a Fund is speculative and involves varying degrees of risk. Turning Rock expressly prohibits any redistribution of this document without its prior written consent.

Endnotes

- Pitchbook LCD Data – Represents the effective yield of the All Loans Index as of Q4 for each year from 2006-2023.

- FDIC: Bank Failures in Brief – 2023

- Source: Federal Reserve – Assets and Liabilities of Commercial Banks in the United States – H.8 as of March 31 2023. Dry powder represented as Preqin's North America Direct Lending dry powder estimate (US$29bn; funds <US$1bn;) as of May 25, 2023.

- Blackrock, Preqin, as of June 2022